Welcome to Edition 3 of the Please Haul My Freight newsletter. Here are some of the items in my reporter’s notebook this week:

SOUL SEARCHING: With many vessels anchored in California and Georgia, do importers need to do some soul searching about their distribution networks? If current import levels of 2 million+ TEU per month in the US is the new normal, then examining distribution center capacity is critical, said Jim Newsome, CEO of the South Carolina Ports Authority. Shippers may need to examine if they have enough distribution centers, or whether their existing distribution centers are too small for their current needs. But developers cannot build 1 million square-foot warehouses overnight. Newsome also said cargo owners must stop relying on a small number of ports, saying “you just can't keep putting things through the same mousetrap.”

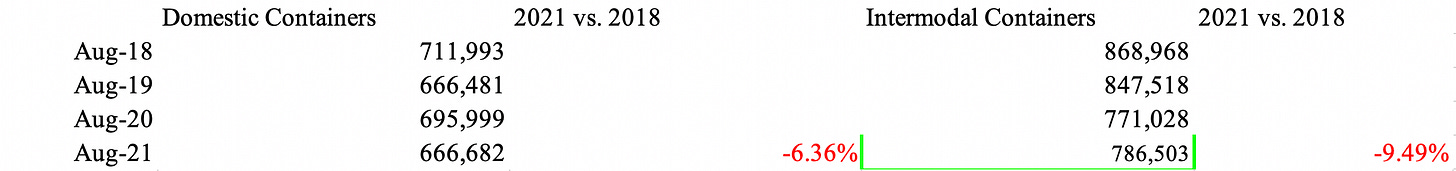

IS PSR REALLY TO BLAME?: Why are intermodal terminals so congested? One common answer is overwhelming volume. Data from the Intermodal Association of North America suggests this is not entirely true. The number of containers on rail was actually lower in August 2021 compared with August 2018.

So why are railroads struggling? US Surface Transportation Board Chairman Martin Oberman argues railroads cut too much in the name of operating ratios. But the problems are eerily similar between the ports and railroads. Read what Georgia Ports Authority CEO Griff Lynch told me:

“Imports are choking out exports. When you take up more space for imports, you take away space from someone else. We’re doing everything we can to find balance, but the reason we dropped down the days [ERDs] is because we have less space.”

Compare that with what I wrote this spring about railroads. The root causes of supply chain congestion are complex. There is no single cause, nor a single solution.

EXPANDED HOURS: The ports of Los Angeles and Long Beach announced expanded night and weekend truck gate hours to combat the deluge of cargo, but we must wait for further details from the marine terminal operators. A group of more than two dozen ocean carriers, MTOs, and stevedores have already came out against a 24-hour operation in a rebuttal of the Ocean Shipping Reform Act of 2021.

“Extending working hours to increase capacity at terminals has been discussed but is ill-advised. For a 24/7 operation model to be effective, other transport groups, including truckers and warehouse operators, would also need to commit to working those hours.”

I encourage you, however, to click on my first Please Haul My Freight notebook in which Scott Weiss of Whiplash explains why he supports a 24/7 operation:

“Their argument is false. Ocean containers are not received as live loads into a warehouse so the hours of operation for the warehouse are irrelevant.”

Who do you agree with? Scott Weiss or the ocean carriers and MTOs?

JOC INTERMODAL SAVINGS INDEX: This index tracks how much an average shipper should expect to save using domestic intermodal compared with long-haul trucking across the US. The index base is 100. Here are August totals:

JOC’s Contract ISI: 139.1 (39.1% intermodal savings). JOC’s Spot ISI: 114.7 (14.7% intermodal savings). Truckload rates on the our 117 indexed lanes were 36 cents higher on the spot market and 93 cents higher on the contract market.

If you want more details, please e-mail me about a data sharing agreement.

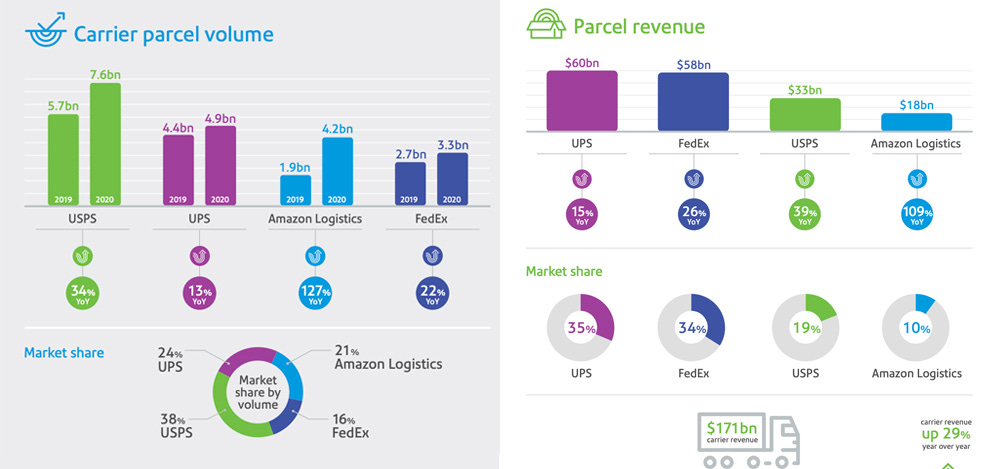

PARCEL DEMAND: According to the Pitney Bowes U.S. Parcel Shipping Index, parcel volume grew 37% year-over-year. In 2020, around 640 parcels were shipped per second. Between 2015 and 2020, parcel volume doubled from 10 billion to 20 billion.

TRAC INTERMODAL: TRAC said it has invested more than $1 billion in expanding and modernizing its marine chassis fleet since 2011. Since 2015, TRAC has added new or upgraded chassis to 65% of the Metro Pool, 60% of the Gulf Regional Pool, 45% of the Pacific Southwest Pool, according to a press release. Are there chassis problems? For sure. Could there be more chassis? Of course. But it’s not from a lack of cash.

Do you have an opinion on anything I wrote? Or do you have a subject you’d like me to include in my next newsletter? Email me ari.ashe@ihsmarkit.com to send me your thoughts and please consider a JOC subscription.1

Correction: A Norfolk Southern executive clarified an error in last week’s notebook. According to the executive, the Baltimore and Potomac Tunnel is unrelated to NS’s inability to double stack containers out of the Port of Baltimore. The primary impediment is that Amtrak’s overhead catenary wires are too low to fit double-stacked containers. The wires, which power Amtrak trains, would have to be reconfigured between Baltimore and Perryville. I appreciate the clarification from this NS executive.

The issue of driver shortages in drayage industry (with HOS impacts) makes 24/7 port terminal gates currently not viable. The money would be better spent for double flex gates to open at 0600 vs 0800 (West Coast).

The underlying issues in LA/LGB causing the backlog are limited terminal space and a failed empty appointment system. Terminals restrict the return of empty equipment (no space), which pushes the equipment onto the street, tying up a critically short supply of chassis. This has caused the detention/per diem expenses to skyrocket for the BCOs, to the point the FMC and Congress are now engaged.