Welcome to the inaugural post of the Please Haul My Freight newsletter. If you have any thoughts or comments, please email at ari.ashe@ihsmarkit.com. Here are some of the items in my reporter’s notebook.

A CASE IN POINT: Trucking companies have told me in recent weeks about containers stuck in Lot W in BNSF Logistics Park Chicago for more than two months. While frustrating, it should be noted that BNSF is not charging rail storage (demurrage) in the inaccessible Lot W. BNSF Railway shared a letter CEO Katie Farmer sent in response to one customer. This quote caught my attention:

“We believe that there is enough physical capacity present across the national supply chain to handle the current volumes. The amount of chassis, port and rail terminal capacity, rail equipment, and employee resources are sufficient to handle the current volumes, but only if all parts of the supply chain do their part.”

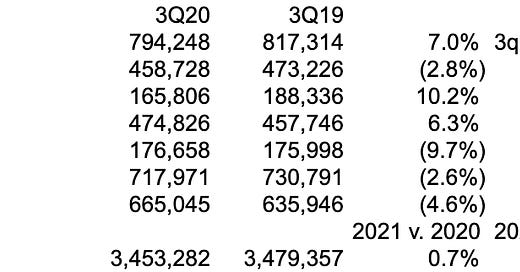

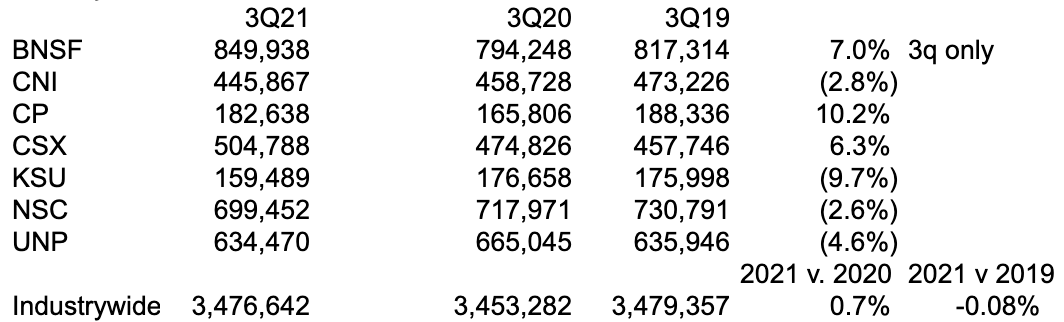

Do you agree with Katie Farmer? Is there enough physical capacity and equipment to handle current volumes? Is everyone doing their part? BNSF’s intermodal volume is up 7% year over year in 3Q so far, while UP’s has declined 4.6%, according to the Association of American Railroads (AAR).

LONGER HOURS: Gene Seroka and Griff Lynch, executive directors at the ports of Los Angeles and Savannah, respectively, have said BCOs need to remove their imports faster. If not, terminal operators may slow the pace at which they discharge vessels to prevent gridlock.1

What is the solution? Scott Weiss of Whiplash believe ports should be open longer.

“Ocean containers are not received as live loads into a warehouse so the hours of operation for the warehouse are irrelevant.

How it works is the containers are delivered to the yard and repositioned at the warehouse door when a door becomes available and/or when the warehouse is ready to start unloading the inbound container.

What matters is if the drayage provider has drivers that are willing to work all hours and that they can deliver to a warehouse that has a gated, secured yard that drivers can drop the containers off 24/7.”

He told Bill Mongelluzzo and me that “any warehouse of size has 24/7 security due to the value of the containers sitting in the yard,” and such a person is empowered to sign paperwork to complete a drop off.

Do you agree with Scott? How many of your BCOs have a distribution centers that fit Scott’s description?

LABOR SHORTAGE: I read an interesting LinkedIn post from Chris Guillebeau, author of The Money Tree:

“We should stop using the phrase ‘labor shortage.’ There’s not a shortage, there’s a gap between what employers are willing to pay and what employees are willing to accept. Companies that have adjusted to changing conditions are doing just fine.”

I wonder how much of this is true. Is "labor shortage” corporate speak? When demand exceeds supply, prices go up. Is that happening here? Or is it that people are uneasy about leaving unvaccinated children in daycare with the Delta and Mu variants? I’m a father. I get that.

JOC INTERMODAL SAVINGS INDEX: Our Index measures how much shippers save using domestic intermodal compared with longhaul trucking. Spot intermodal rates shot up to $2.19 per mile in August, up 16 cents compared with July. Spot truckload rates will be up about 3 cents on the same 117 lanes, although I’m still crunching data. Spot intermodal savings may fall below 15% nationally while contract intermodal savings will remain around 30%-35% nationally.

Contract intermodal rates are significantly cheaper than truckload contracts out of Los Angeles, but spot intermodal rates are more expensive than spot truckload. If you have a last-minute load, trucking is the way to go in Southern California.

AAR DATA: Remember these numbers when you hear about overwhelming volume.

Do you have an opinion on anything I wrote? Or do you have a subject you’d like me to include in my next newsletter? Email me ari.ashe@ihsmarkit.com to send me your thoughts.

Keep an eye on the Port of Philadelphia.

I would suggest that Katie's statement would make a lot more sense to outsiders if she replaced the word "physical" with "theoretical."

Great inaugural newsletter, Ari. Is there enough physical capacity in the supply chain to meet current demand? Perhaps on paper. But chassis, trucks, and employees don't work on paper. Getting all parts of the supply chain to "do their part" requires all that equipment and personnel and freight be in the right place at the right time -- and has that ever happened?