Welcome Please Haul My Freight: Edition 26. Here are items in my notebook this week:

MR. PRESIDENT: A group of 157 trade associations signed a letter to President Biden on July 1 about the ILWU port labor unrest on the West Coast:

As we enter the all-important peak shipping season, we continue to expect cargo flows to remain at all-time highs, putting further stress on the supply chain and increasing inflation. Many expect these challenges to continue through the rest of the year.

Even with the recent joint statement, supply chain stakeholders remain concerned about the potential for disruption, especially without a contract or an extension in place…

The administration should work with the parties to:

1) Extend the current contract until a final contract is reached;

2) Commit to remain at the negotiating table and negotiate in good faith; and

3) Agree to not engage in any kind of activity that leads to further disruption at the ports.

The National Retail Federation also sent a letter to the President on July 6 to intercede to avert a rail labor strike:

Intermodal rail shipments have been the largest source of rail traffic over the past few years, and an overwhelming portion of those movements are tied to consumer goods. In the first part of 2021, railroads moved the most intermodal goods ever, and while such movements are down this year, they remain at a high level.

If the parties will not come back to the table, we urge the administration to do everything it can to avoid rail service disruption. We believe that White House leadership in appointing respected, experienced and impartial arbitrators to a Presidential Emergency Board (PEB) is critical to avoiding a strike and ensuring the fluidity our nation’s retailers deserve and expect.

More on the background of the dispute.

THE HEAD OF THE TABLE: Peter Tirschwell, the boss man, the guy who runs all things Journal of Commerce, wrote an op-ed for the Wall Street Journal last week on the labor situation at the West Coast ports:

An actual strike isn’t probable. More than half a century has passed since the last dockworker strike on the West Coast. Much more likely are local labor disruptions. There was no strike at West Coast ports in 2014 and 2015, when the contract was last up for negotiation (it was extended in 2019). But there were nearly six months of labor disruption, leading to billions of dollars in losses for agricultural exporters.

Local units of the ILWU disrupted individual ports over local grievances they felt weren’t being addressed in the negotiations. Port employees’ main tactic—which they’ve employed since the 1990s—was to work “to the letter of the contract,” loading and moving containers very slowly. It’s not possible to stop a dockworker from driving equipment at a snail’s pace, and it can severely disrupt cargo flow.

It’s the possibility of this sort of protest that most worries officials. The ILWU and PMA said in a June 14 update on negotiations that “neither party is preparing for a strike or lockout.” But they made no mention of slow-rolling tasks.

Because such disruptions originate at a local level, it’s hard for the union’s leadership to maintain control.

Another Peter Tirschwell editorial on the Journal of Commerce website focuses on inland distribution and inventory.

CLIFFHANGERS: There is zero evidence of imports will plunge this month. Journalists cannot rely only on data but also pick up a phone, call sources, and talk to people on the ground. Building a rapport with sources is critical to sound journalism.

Bethann Rooney, executive director of the Port of New York and New Jersey says the East Coast is seeing an import surge:

“We’re handling a full 33% more containers through our terminals than we were in the same period in 2019. That staggering increase in overall volume gives a picture of what all of the various nodes and links in the supply chain are trying to absorb.”

Griff Lynch, executive director of the Georgia Ports Authority:

“Pre-pandemic, we had usually 100,000 to 120,000 containers on the water. In January of 2021, we had 170,000 containers on the water. Last fall when when we went up to 30 ships, we had 210,000 containers. Today we have 255,000 on the water en route to Savannah. So we never could have envisioned the kind of volume that is tracking to us now, even when we spoke a couple months ago. It looks like it's plateaued and is holding in 250,000 to 255,000 range.”

As for July in Savannah:

“We have 155 containerships due to arrive in July, 39 of which are some form of unplanned vessel whether it's an extra loader or a an ad-hoc vessel. At 39, it’s 25% unplanned and on top of the norm.”

Laden imports are -3.6% into Los Angeles and -2.8% into Long Beach from January-May YoY. Even in L.A. and Long Beach, one NVOCC sees volume going up this month:

STUCK IN THE MIDDLE: I spoke with three NVOCCs recently to get their views on imports. None said there is an imminent cliff. While there are the tea leaves of a retail recession, the NVOCCs brought up several points to me:

There are many BCOs that are not big box retailers.

If there is a volume recession, it’ll be a Q4 or Q1 phenomenon, not July 2022.

Markets tend to move in hills rather than cliffs (outside of major events). Hills go up, hills go down, and hills are gradual. Cliffs are sudden and very rare, and then quickly recover. Even the COVID-19 pandemic was a 45-day event for the truckload market, and a 90-day event for the ports before the huge rebound.

From the National Retail Federation:

Even with retailers stuck with too much inventory, there is data from Bank of America to show consumer spending is up.

INTERMODAL VOLUME: Through the mid-point of the year, here is the intermodal volume scorecard based on the Association of American Railroads:

On the East Coast, CSX is outperforming on volume vs. Norfolk Southern.

On the West Coast, UP is outperforming on volume compared with BNSF Railway.

Total industrywide intermodal volume has been down 25 out of 26 weeks compared with a year ago, but up in 23 out of 26 weeks compared with the pandemic year of 2020.

INTERMODAL SPEED: Here is the report card on intermodal train speeds.

For Weeks 1-26:

And Weeks 13-26:

Union Pacific Railroad is targeting an 80% intermodal trip-plan compliance by the and was at 67% last week, according to its filing to the US Surface Transportation Board. BNSF Railway is targeting a 70% (they don’t use the term “trip plan compliance”) and was on time 57.2% of the time last week.

As we wrote in Numbers, Mrs. Landingham, those numbers fall far short of what our shippers consider a “truck-like” service in terms of reliability.

CSX’s trip-plan compliance is above 90%, much closer to the truck-like experience, although it has a much shorter length of haul than BNSF and UP.

I would guess that if the data were split between domestic and international intermodal, the domestic number would be far higher than the international.

COWEN CALL: Jason Seidl hosts a private trucking and 3PL call each quarter. While it’s closed to the outside press, he sends highlights out of the session:

All panelists on our call stated that customers are busy, and capacity has stayed relatively tight through 2Q. While there has been a modest return to normalization (rejected loads declining), volumes still remain somewhat strong and panelists have not seen any radical freight falloffs that would indicate a correction is imminent. In fact panelists indicated they remained confident that the demand would remain strong through the remainder of 2022…

Truckload contract rates have not come down according to our panelists, and this is largely in line with our FMIC data. Many customers are waiting to see what happens in the marketplace (one anecdote of a customer waiting three rounds of 30 days to negotiate, only to sign a price increase) and still signing price increases. One panelist stated they believe spot rates will remain relatively flat from where they currently are, and contract rates should remain strong.

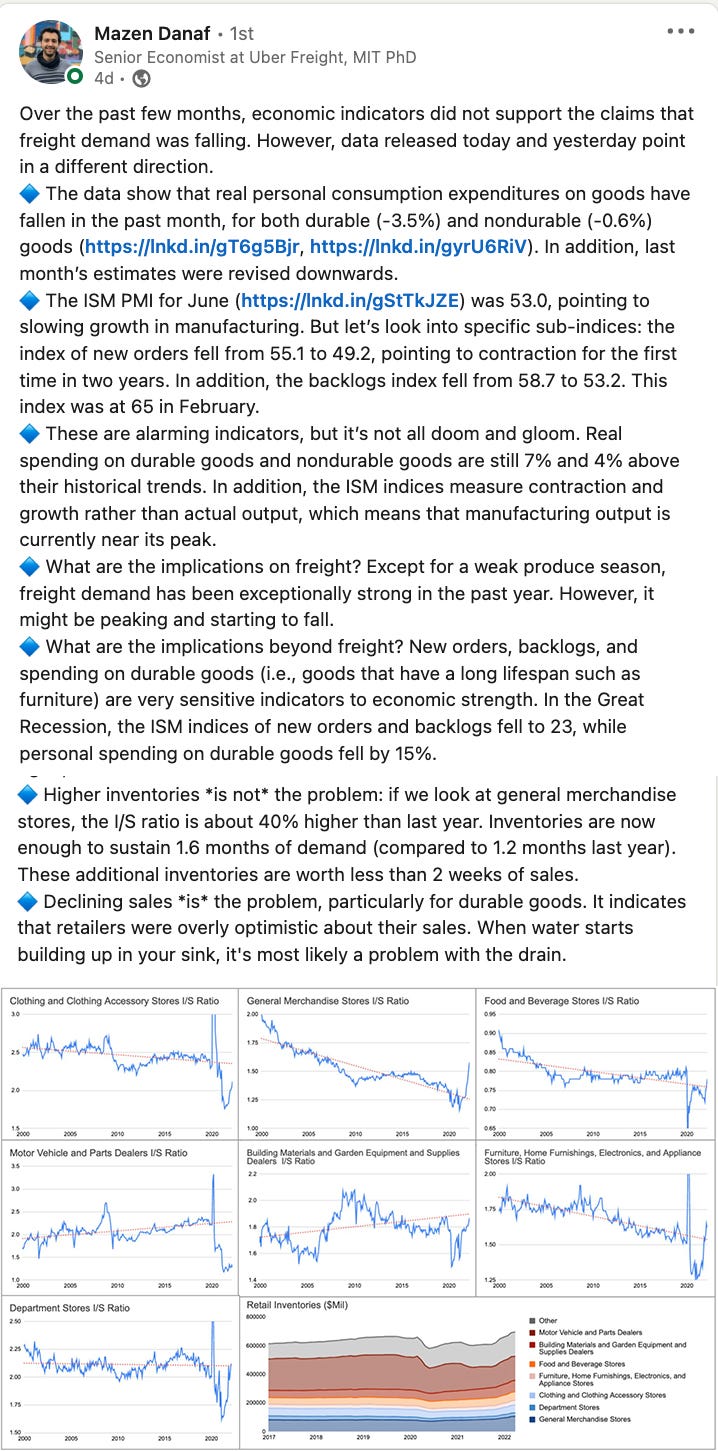

UBER: I’m always open to other ideas, and changing opinions as the market is not a static concept. Here is what one Uber Freight economist said on two LinkedIn posts:

MEXICO, NO: There was an article in the Financial Times on how the tariffs on China did not cause a massive nearshoring to Mexico.

“Most of the gains have gone to Asean, India and Korea,” said UBS in a recent report examining nearshoring in Mexico. “At least for now, the US import penetration data does not support the view that Mexico has been a net beneficiary of nearshoring.”

THAT’S NUTS: The Los Angeles Times report a story, “A billion pounds of California almonds stranded at ports amid drought, trade woes.” Here is a portion:

The bottleneck at the Port of Oakland, historically the major gateway for Central California dried fruits and nuts bound for international markets, is expected to drag on for months to come. The good news, growers like to point out, is that the nutritious oval-shaped nuts have a shelf life of about two years.

Perhaps the OSRA law will help out these exporters.

WALMART: The Wall Street Journal reports that Walmart will charge new fuel and pickup fees on suppliers beginning Aug. 1 using “collect transportation agreements.”

A collect transportation agreement refers to when a receiver — such as Home Depot, Target, or Walmart — procures the transportation for the shipper. A prepaid agreement is when a shipper handles the transportation to the receiver.

From the article:

The shift “is a result of Walmart adapting to the significant transformation and increased cost seen in the transportation industry over the past few years,” said the memo sent to suppliers last Friday afternoon.

This will impact the small and mid-sized suppliers who often used collect transportation agreements because Walmart can negotiate a better rate for trucking. Larger suppliers tend to use prepaid transportation and won’t be impacted.

I LOVE NY: Pitt Ohio reached an agreement in principle to acquire Teal’s Express equipment and terminal assets effective August 13, 2022. Teal’s Express and Pitt Ohio have partnered to provide LTL service to and from NY state since 2016.

LAND, HO: I will certainly give credit to the competition for good journalism. Freightwaves reports Vermont-based LandAir will shut down operations. Don’t confuse LandAir with Landair Holdings. LandAir is an LTL serving the Northeast US and Canada. Landair Holdings is a dedicated for-hire truckload carrier, drayage, warehousing and logistics company owned by Covenant Transport.

FRANK AND JOE: Hardy Brothers Trucking will have the honor of transporting the US Capitol Christmas Tree this year.

ANDY WARHOL: As intermodal vet Chad Schilleman wrote on July 7, “The idea of waiting for something makes it more exciting.” Why quote Andy Warhol?

Because the Energy Information Administration has resumed releasing US Highway Diesel Fuel Rates. The EIA data is the underlying official source for fuel surcharges assessed in most intermodal and trucking contracts.

JOC INLAND: If you enjoy Please Haul My Freight, please attend the JOC Inland Distribution Conference from Sept. 26 to Sept. 28 at The Westin Chicago River North.

Click the image for a special Please Haul My Freight discount:

Any opinions in this blog represent the author’s views, not the Journal of Commerce, IHS Markit, or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paying JOC subscribers. Not a subscriber? Click here to become one.