Welcome Please Haul My Freight: Edition 25. Here are items in my notebook this week:

CALIFORNIA AB5: The US Supreme Court will not review the 9th Circuit’s reversal of an injunction to halt enforcement of California’s AB5 law for the trucking industry. This is the law that changes the standard of what is an employee versus an independent contractor. From Scopelitis, Garvin, Light, Hanson & Feary:

“As a result, the injunction that has been in place for roughly two years will be lifted quickly and complying with AB 5 will be a reality for trucking companies in California.

Motor carriers should immediately evaluate their California operations to determine what steps, if any, should be taken to respond to the changed backdrop for trucking.”

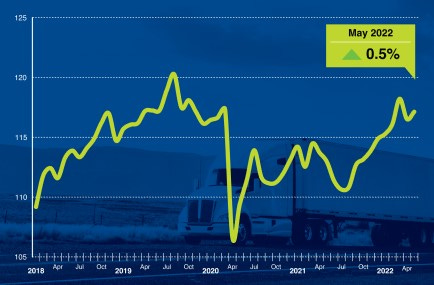

THAT’S HEAVY, DOC: American Trucking Associations reported truck tonnage was up 3.7% YoY in May, and up 0.5% MoM. The ATA index is heavily weighted toward contract van freight, and suggests the decline in spot rates isn’t necessarily a freight recession, just a rebalancing to the contract market.

Could the spot rate decline cause contract van rates to fall? For sure. Watch for the PMI to fall below 50 as a trigger for a real freight recession.

CONTRACT RATES: Shippers are already seeing rate concessions from asset-based truckload carriers. Now don’t mistaken that for a widespread clawback of rates, but rather a rate hike closer in line with inflation.

Here is what one shipper told me:

“I do expect everybody's cost to go up, year over year over year, but I mean, if you're exceeding the CPI with your rate increases, that's not going to hold water.”

Here is how a second shipper is balancing contract and spot:

“We don't have a firm policy that we have to go secondary primary tender acceptance, which allows us the flexibility of weighing ‘what is the spot market doing?’ Maybe I don't want to go, you know, three, four carriers down on my [contract carrier] routing guide after my primary carrier rejects it.”

This shipper said, however, that the primary carrier acceptance rate is well over 90% right now, so very few loads end up on the spot market.

SPOT TL RATES: Here are some intra-June numbers on the spot market. Yes, the YoY comps have gone negative, but still looking good over a two-year basis….for now:

From Cargo Chief — a JOC data partner — on our Top 200 Lanes in the JOC Shipper Truckload Spot Rate Index:

June 2022: $2,909.86 (-5.02% YoY)

June 2021: $3,063.68

Times are definitely harder on the owner-operator in 2022. Owner-operators are spending a higher percentage of their total paycheck on fuel. With non-fuel revenue lower, the owner-operator is having a challenging time making covering truck payments, insurance payments, and taxes.

We will talk more about this at the JOC Inland Distribution Conference. Click the image for a special Please Haul My Freight discount:

OH CANADA: Conditions on the Canadian rails struggling right now, according to a story from our Bill Mongelluzzo.

The congestion at rail hubs in eastern Canada is a direct result of drayage capacity shortages at those facilities. “It’s an on-going situation with both railroads (Canadian Pacific and Canadian National),” said Julia Kuzeljevich, public affairs manager at the Canadian International Freight Forwarders Association (CIFFA).

CIFFA noted that the drayage problem, which first surfaced in Toronto in May, has extended to Montreal.

Here is what one IMC told me about domestic intermodal:

“CP in Bensenville and Schiller Park is atrocious right now. I’ve got containers sitting in those terminals for 15 days, and they are canceling trains. When they cancel the inbound trains, that means my outbound containers cannot go either. I don’t know if 15 days is going to turn into 25, I just really don’t know at this point.

I know Montreal is the biggest problem in the CP network other than Schiller Park. In the CN network, Brampton is not fluid, and we’ve just stopped using CN because it’s so bad.”

CP was recently charging $500 for its voluntarily guaranteed 53-ft. box program, which is not high historically.

ENTANGLING ALLIANCES: BNSF’s international intermodal logjam in Chicago and Memphis has spread to Dallas, as we reported June 27. Here is the full statement of BNSF Railway to JOC.com. BNSF has been transparent every step along the way:

“Our Alliance facility currently has an elevated inventory of more than 2,000 inbound containers due to a shortage of available chassis due to extended street turn times rather than a physical shortage of assets and ongoing challenges associated with customer warehouse capacity throughput.

Due to the ongoing volume demand, BNSF is ground stacking international units to provide yard capacity to unload additional freight. Alliance differs from LPC in that it is not designed as a grounded operation. We stack only as an exception. Because of the configuration at our Alliance facility, containers are accessed from the sides, meaning boxes at the center may be inaccessible. Stacked containers at the mainland yard at LPC remain fully accessible due to the crane configuration that is designed to handle container stacking.

To provide further accessibility to Alliance customers, we began using additional offsite storage. The offsite yard ensures containers are fully accessible due to a smaller footprint.

We are suspending patron notifications and not charging storage fees for containers that are not available for pick up at Alliance. At Alliance, BNSF is providing visibility to customers once the container is accessible, and customers can always check the status of a container in real time using the customer tool on BNSF.com and through our RailPASS mobile application.

The current limited embargo in place affects automotive shipments as well as specific agricultural and industrial commodities bound for California. Intermodal shipments, which are being managed through alternate means, are not covered by this embargo.”

BNSF said that it is not charging rail storage, a form of demurrage, whereas Union Pacific Railroad charges fees in the same situation. That’s an important point.

The BCOs, NVOs, and truckers want the Federal Maritime Commission to regulate rail demurrage using FMC interpretative rule of the US Shipping Act.

Commissioner Carl Bentzel believes the FMC has jurisdiction, but we’ve heard nothing from Commissioners Dye, Maffei, Sola, or Vekich, or any US Surface Transportation Board members.

STB FILINGS: The US Class I railroads filed service plan updates to the STB.

From BNSF’s filing:

We continue to see a significant number of trains queue for intermodal service in our LPC facility because shippers are not pulling containers fast enough to allow BNSF to ground new containers. These conditions are driven primarily by an ongoing chassis shortage that BNSF is extremely limited to influence…

We are forced to stage trains at various places across our network as they wait for landing capacity to become available at LPC, including in areas that are jointly used in Southern California to support business utilizing our Southern Transcon lines…

To address these issues and ensure we can maintain production at LPC, we are working with San Pedro Bay port terminals on slot allocations to better ensure volume is loaded to LPC to match the truck/chassis capacity to outgate units, and over the next two weeks will begin limiting the total number of intermodal trains originating from California facilities and destined to LPC.

From Norfolk Southern’s filing:

Norfolk Southern will re-work its intermodal service to enhance its service and improve network fluidity. To illustrate how this will work, take, for example, local intermodal service between Chicago and Harrisburg, Pennsylvania.

Currently, Norfolk Southern has one scheduled intermodal train operating between 47th St. Yard in Chicago and Harrisburg Yard. There are two scheduled trains between 63rd St. Yard (also in Chicago) and Rutherford Yard (which is also in Harrisburg). Because there is only one train per day operating between 47th St. and Harrisburg, a customer whose container misses the launching of a train at 47th Street needs to wait 24 hours before the next train from that terminal to Harrisburg. This also means that containers in 47th Street will tend to dwell for up to 24 hours between trains. Once TOP|SPG is launched, local intermodal service between Chicago and Harrisburg will be consolidated.

Norfolk Southern will have four scheduled trains operating between 47th Street and Harrisburg Yard. No local trains will operate between 63rd St. and Rutherford. This means that a customer whose container misses the launching of a train from 47th St. will only need to wait about 6 hours on average before that container will leave on the next train.

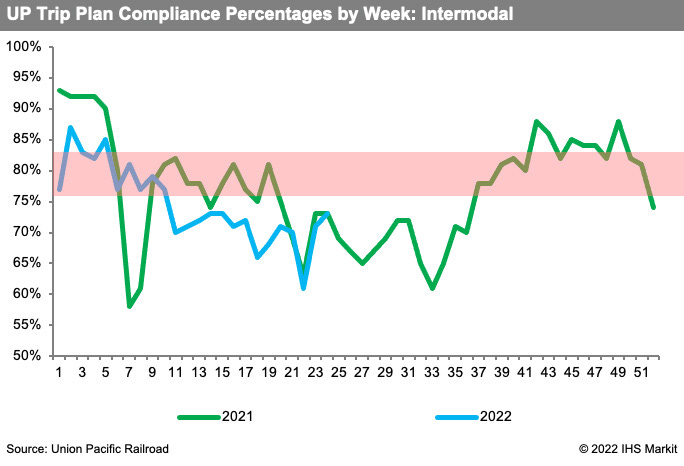

UP STB FILING: Here is what caught my eye in UP’s filing:

Union Pacific’s goal is to achieve a system average [trip plan compliance] Intermodal target of 80% by the end of December 2022 performing within the range of 76% and 83%.

Here is UP’s intermodal trip plan compliance by week:

Is 76% to 83% a “truck-like” experience for on-time delivery?

Here is what one shipper told me:

“UP is not even close. Our service level agreements [for truckload call for] 95% and we are getting close to that… If the rails don't turn their problems around in a deflationary market, I'll give to OTR carriers as long as I can get a good rate and good service…

Sidenote: Is there anybody on the STB that understands that 76% on-time is not a good number?”

Here is a second shipper:

“Truck-like performance is 90% to 95%. When we think about how to use the intermodal, this is exactly why we struggle with it. If they cannot equate to a truck performance, and if all my savings get eaten up by Walmart chargebacks, it doesn't matter. I have saved nothing.

In fact, I might come out on the other end of it with OTIF [on-time, in full requirements].

I look at how we track it, what my expectations are, what my leadership's expectations are, and what my key customers hold us accountable to, and if I came up with 76% that's failing. If I came in with 83%, that's failing.”

A third shipper:

“I am also encouraged by Marty Oberman’s persistence to obtain answers and advocate for shippers… I would agree that’s not really ‘truck-like’. From a truck perspective, minimum 95% and landing somewhere in the upper 80’s/lower 90’s at any given time. Current on-time delivery performance on lanes/regions [in high-volume UP lanes] is in the lower-mid 90’s when hauled OTR.”

I LEFT MY HEART: Union Pacific is embarking on a construction project to increase lift capacity in Lathrop. While it won’t be ready before Schneider’s switchover, UP knows NorCal is a pinch point that will only worsen if unaddressed. Some UP traffic will temporarily switch to Oakland. More in our story on JOC.com.

UP VIEWPOINTS: Union Pacific’s Kari Kirchhoefer has an editorial on the UP website about intermodal on June 30:

The best solution for rail is to continue to work directly with all parties of the supply chain to keep it fluid. As a “middle” segment in that chain, it is important for us to continue to haul import containers from the ports. But just as important – those containers cannot dwell at our inland terminals after they arrive.

The last miles of the supply chain must have the capacity to take the freight once it arrives at our inland facility. That means having the necessary truck drivers to get containers to distribution centers and warehouses, and having the necessary labor and capacity at warehouses to unload those containers as soon as possible and get the empty container with the associated chassis returned to the terminals.

Kari will be speak on our panel, “Intermodal II: Domestic Intermodal Service” at the JOC Inland Distribution Conference Sept. 26-28 in Chicago. She will be on stage with me, Michael Baumgardt of Schneider National, Drew Johnson of CSX, and Adam Rodery of Mode Transportation. A special discount for Please Haul My Freight readers is available at the bottom of the page.

INTERMODAL SERVICE: More commentary in the last seven days on domestic intermodal service. Here is one IMC:

“We've seen more fluidity in Southern California and that's about 35% of my business. When I say normalcy, we still are supplying ourselves with street turns of containers. But we're talking about what was a raging dumpster fire in Q1 to slightly better, so let's put it in perspective. We're not celebrating by any means. We're talking about small incremental gains that are not driven by them operating more effectively.”

I’ve heard mixed views from intermodal shippers. Three shippers shared difficulties they’ve had securing containers from one IMC. A fourth shipper, though, gave this same IMC positive reviews, but said one of its competitors underperformed in Q2.

SPOT INTERMODAL: As I wrote a few weeks ago, domestic intermodal contract rates are saving shippers a lot of money compared with trucking, but spot rates are a lot tighter. Here are some examples based on unvetted, unverified June numbers:

CLIFF CLAVEN: Steve Ferreira of Ocean Audit Inc. had shared some interesting data in a LinkedIn post. S&P Global is the parent company of The Journal of Commerce:

No signs of a mushroom cloud, an imminent crash, or other sexy label. That isn’t to say something isn’t happening; just read this article, “Container shipping market showing clear signs of weakness: analysts.”

PORT OF OAKLAND: Importers using the Port of Oakland will have less free time to pick up their boxes, according to CNBC: four days, instead of seven.

PORT OF CHARLESTON: FMC Commission Louis Sola wrote a letter to President Biden last week on the Hugh K. Leatherman terminal:

“The terminal is not being utilized fully due to a labor dispute between the ILA and the South Carolina Ports Authority. The matter is currently before the US National Labor Relations Board and there is no clear indication of when the matter will be resolved. I am shocked that this much needed terminal is laying fallow during this time of crisis due to an organized labor dispute in a right to work state. Growing up in a union household, I am one who would generally be considered pro-labor.

Nevertheless, the thought that a labor dispute would contribute to this nation’s current supply chain problem defies logic. Blocking the utilization of this terminal contributes to the delay in the import and export of needed commodities and contributes to the general level of Co2 emissions as ships loiter at sea awaiting an opening at the pier.

It should be obvious to even the most casual of observers that the opening of this terminal is essential. Every asset at our disposal should be utilized in this effort.”

CHECKPOINT CHARLIE: Governor Greg Abbott said Texas will add new checkpoints for trucks entering from Mexico after migrants were found dead recently in an abandoned tractor-trailer found in San Antonio. The Texas Tribune reports the checkpoints won’t be on the border but further inland.

FUEL SURCHARGES: The intermodal community learned two months ago just how dependent they were when Blume Global was hit with a ransomware attack. We are also very dependent on the Department of Energy. The Energy Information Administration has not released diesel rates for the last two weeks, and it’s throwing off fuel surcharges in trucking. The EIA is the standard for fuel surcharges.

AUTONOMOUS TRUCKS: A group of 35 companies, including Aurora, Embark, TuSimple, Uber Freight, UPS, Volvo, and Waymo sent a letter urging Governor Gavin Newsom to “initiate a thoughtful rulemaking process that gives autonomous trucks a chance to work for California,” rather than fall behind other states.

GREEN BAY: Schneider National led a round of funding for a in a startup that is building an online marketplace for industrial raw materials, according to the Wall Street Journal. Here is more from the article:

The agreement brings Schneider a potential strategic expansion of its capabilities in the specialized market for bulk deliveries to industrial customers. Schneider said its bulk division, which is 4% of its total business, hauls mostly chemicals.

JOHNNY BRYAN: J.B. Hunt Transport Services signed a long-term deal with Swire Shipping Pte. Ltd. to provide charter service to deliver its 53-foot containers into Port of Everett in Washington and Port of Hueneme in California. Given J.B. Hunt will go from 109,000 to 150,000 domestic containers in the next five years, that will give a lot of business to this charter service. It also provides another opportunity to Asian importers as J.B. Hunt, and other IMCs, look to fill these boxes with cargo crossing the Pacific Ocean to generate revenue loads to offset their costs.

CHASSIS ACQUISITION: Private equity firms GIC, OMERS Infrastructure and Wren House have bought DCLI from Apollo Global Management and EQT Infrastructure. Will the new PE ownership allow DCLI to complete the purchase of domestic chassis over the next 12-18 months or tighten the purse strings?

DCLI placed an order for 40,000 domestic chassis and about 9,000 units have been delivered. DCLI anticipates receiving 2,000 and 4,000 per month to cover the remaining 31,000 units in the order, according to COFC Logistics.

UP has received about 2,000 of its 5,600 chassis order — for those keeping score.

JOC INLAND: If you enjoy Please Haul My Freight, please attend the JOC Inland Distribution Conference from Sept. 26 to Sept. 28 at The Westin Chicago River North.

Below is just one of the sessions that will touch on many of the topics above. Click on the image for a special Please Haul My Freight discount:

Any opinions in this blog represent the author’s views, not the Journal of Commerce, IHS Markit, or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paying JOC subscribers. Not a subscriber? Click here to become one.