Welcome to Edition 6 of the Please Haul My Freight newsletter. Here are some of the items in my reporter’s notebook this week:

CP-KCS APPLICATION: Canadian Pacific and Kansas City Southern filed an application of more than 4,000 pages to the Surface Transportation Board earlier this month. An IHS Markit report in the application estimates 82.8 million truck miles taken off US highways, and a diversion of 64,018 trailers or containers to intermodal. The applicants highlight lanes between Mexico and Minneapolis and Detroit. Here are my thoughts. One, this would require a significant increase in capex because the current fleet of 8,150 CP containers aren’t enough to support non-asset IMC business. CP would need to court J.B. Hunt, Hub Group, and Schneider to use the new lanes. Two, CP mentions the capacity restraints in Detroit which may limit the upside. Three, what type of freight demand is there into Minneapolis? According to IHS Markit’s Transearch, the top commodities trucked between Dallas and Minneapolis in 2019 were soft drinks, mineral water, farm products, and paper/pulpboard.

L.A. AND LONG BEACH: The White House says that the emergency fees due to go into full effect on Nov. 15 are reducing dwell times on Los Angeles and Long Beach.

“In just one week, the number of containers that have been dwelling on the docks for at least nine days has fallen over 20% according to data provided by the ports. This is an early, but promising sign that each link in the chain is working together to help more goods leave the ports, and to free up more space on the ports.”

TRANSPAC RATES: Freightos reports ocean shipping rates have cooled recently:

“Asia-North America West Coast rates fell 26% this week, though they remain extremely high at $13,924/FEU…For the first time since June, there are reports that many bookings can be made without paying the hefty premiums that were a major factor in the July spike, suggesting drops in premiums are contributors to the current decrease as well.”

Laden import volume, though, is not slowing down. Nearly 2.6 million TEU were imported into the US in October, according to PIERS, a sister product of JOC within IHS Markit. It’s the 16th consecutive month of imports topping 2 million TEU. In comparison, it happened only seven out of 16 times between March 2019 and July 2020.

INLAND MARKETS: Congestion in Chicago, Memphis, and Kansas City has significantly eased compared with three months ago. Turn times in BNSF Logistics Park Chicago fell from 73 minutes on average in September to 49 minutes in October. UP Global IV fell from 41 minutes to 35 minutes, according to the Illinois Trucking Association and Geostamp. UP Global III’s containers may be completely clear before the end of this year, according to NVOs. UP told me in a statement:

“Additionally, our rail network and terminals are fluid with sufficient capacity to move more volume. In fact, Union Pacific is encouraging our customers to ship more IPI volume from the West Coast ports by rail as a means of easing port congestion.”

Tom Williams of BNSF Railway told me that using peel piles and off-site lots helped to get on top of the congestion:

“One of the things that we developed through this supply chain surge is better transparency to the cargo, whose cargo it is, and the needs of that cargo. And we're not 100% there, but we made a big leap forward, especially with large beneficial cargo owners in identifying their freight, then working with the ocean carriers and BCOs…And we are not going to stop making that advancement because we're planning for a future where we're going to handle large volumes, again, in the Midwest, and we need to be 100% there on the transparency.”

BNSF also re-idled Harvard yard on Nov. 2, but Williams said cranes will remain in Marion (outside of Memphis) to quickly reopen the yard, if necessary.

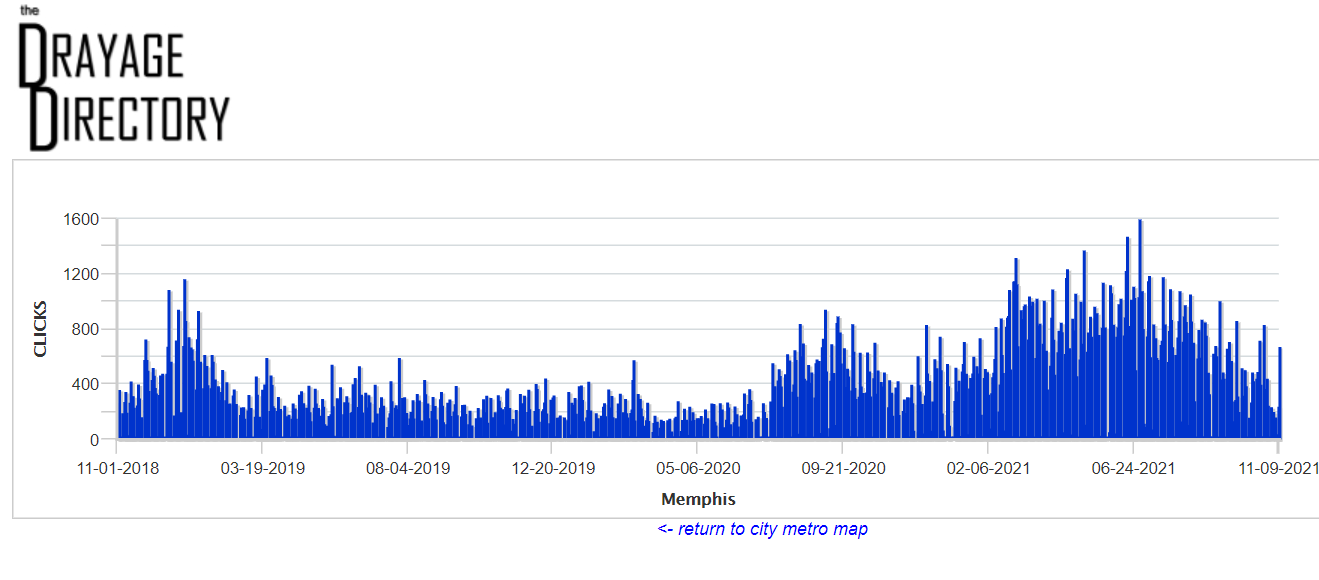

DRAYAGE DEMAND: Data shows drayage demand and rates are also down. BookYourCargo reports October national spot dray rates fell 5.8% sequentially. Jason Hilsenbeck’s Drayage Demand Index shows demand is also cooling:

“Demand for drayage in Chicago has decreased 57% since the peak three months ago… However it has become extremely difficult finding capacity for Los Angeles/Long Beach as drayage demand has increased 104% during same time. In Memphis, we had 80-90 dray loads on the board two months ago, now it shows 38. In Kansas City and Dallas-Ft. Worth, you can get next-day dray power for 20/40’s.”

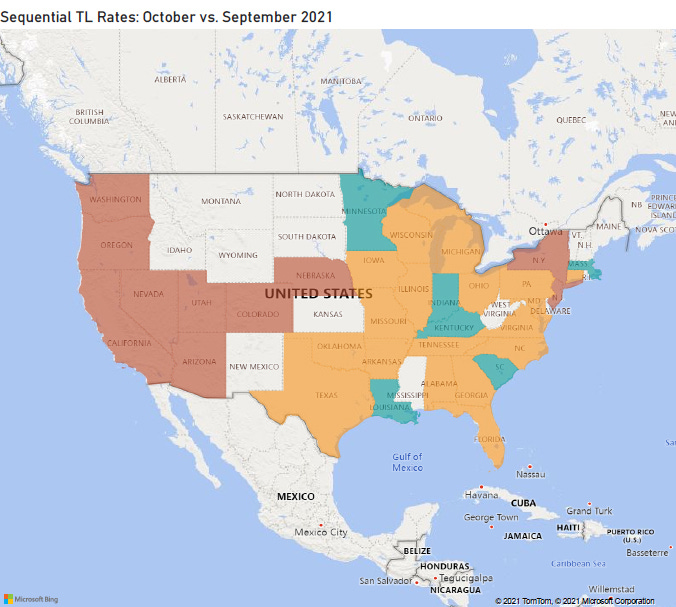

JOC SHIPPER TRUCKLOAD RATE INDEX: Our JOC Shipper Truckload Spot Rate Index has been finalized for October 2021, a metric tracking broker-to-shipper retail spot dry-van rates. Our weighted national number rose 3 cents sequentially to $3.15 per mile, fuel included. Rates were up 20% compared with October 2020. Our map breaks the data down by state: blue equals cool (decreases), yellow equals lukewarm (flattish rates), and red equals hot (increases).1

The underlying data is available to paid JOC subscribers. E-mail me with your request.

DRIVER RETENTION: StayMetrics released a new report on truck driver turnover and retention. Among the findings:

Since April 2021, the retention rates for the 7-day, 30-day, 45-day, and 60-day milestones shown in the Stay Days have been fairly consistent. The 7-day rate has been at or above 95%, 30-day above 85%, 45-day above 82%, and 60-day above 80%.

Newly-hired drivers are staying an average of 270, 229, and 244 days in their first year for the last three reported months…Looking forward though, this trend may dip back down, as the 270-day retention rate numbers for October and November are lower.

JOC INTERMODAL SAVINGS INDEX: The JOC ISI tracks how much an average shipper should anticipate saving using domestic intermodal compared with truckload. In the JOC Intermodal Savings Index Q3 report, we discuss how contract intermodal savings have increased while spot savings have decreased this year. Our preliminary October estimates show JOC’s Spot ISI will fall to 112 and JOC’s Contract ISI will stay around 139. Here is the price differential between truck and rail nationally:

The underlying JOC Intermodal Savings Index is also available to paid JOC subscribers. E-mail me with your request.

MINOR DELAYS: The Georgia Ports Authority hoped to complete dredging this year, but it’s now targeting March 2022. The South Carolina Ports Authority pushed back its new chassis pool. It was due to launch in May 2022, then was delayed to late 2022, and now the port is targeting early 2023. Dorsey Intermodal will provide 5,000 chassis to the pool. Here is more on why chassis production has been slowed.

Do you have an opinion on anything I wrote? Or do you have a subject you’d like me to include in my next newsletter? Email me ari.ashe@ihsmarkit.com to send your thoughts, or to request the underlying data behind our indexes.

We credit Cargo Chief, DAT Solutions, Loadsmart, and a JOC survey of 3PLs as our data partners behind the JOC Shipper Truckload Spot Rate Index. We credit Cargo Chief, DAT Solutions, InTek Freight and Logistics, Loadsmart, Sunset Transportation, Transfix, and Zipline Logistics as data partners in our JOC Intermodal Savings Index.