Welcome to Edition 7 of the Please Haul My Freight newsletter. Here are some of the items in my reporter’s notebook this week:

JOC INTERMODAL SAVINGS INDEX: Our JOC Spot ISI and JOC Contract ISI have been finalized for October. This Index tracks how much an average shipper should expect to save using domestic intermodal rail compared with longhaul trucking across the US. The JOC Spot ISI fell 1 point sequentially to 112.4, while the JOC Contract ISI rose 0.5 point to 140.3. The spot market reading trended toward the lower end of Jason Miller’s forecast in our JOC Intermodal Savings Index Q3 Report1, while the contract reading trended on the higher end.

As a reminder, the underlying data behind our indexes are available upon request to JOC paid subscribers.

TRUCKLOAD RATES: DAT Solutions releases spot rates on the Top 50 US truckload dry-van lanes to DAT iQ customers. The latest DAT numbers show rates up 1.5% since Nov. 1, although it has fallen about 1% in the last 10 days. The data also shows the year-over-year growth rates have slowed:

The FMIC-Cowen Index also shows sequential declines in rates:

“Dry van spot rates stepped down 5% sequentially (last) week, while still up over 22% compared to levels a year ago. Temp control spot rates decreased sequentially as well. Dry van contract rates increased sequentially, while temp control contract rates decreased sequentially.”

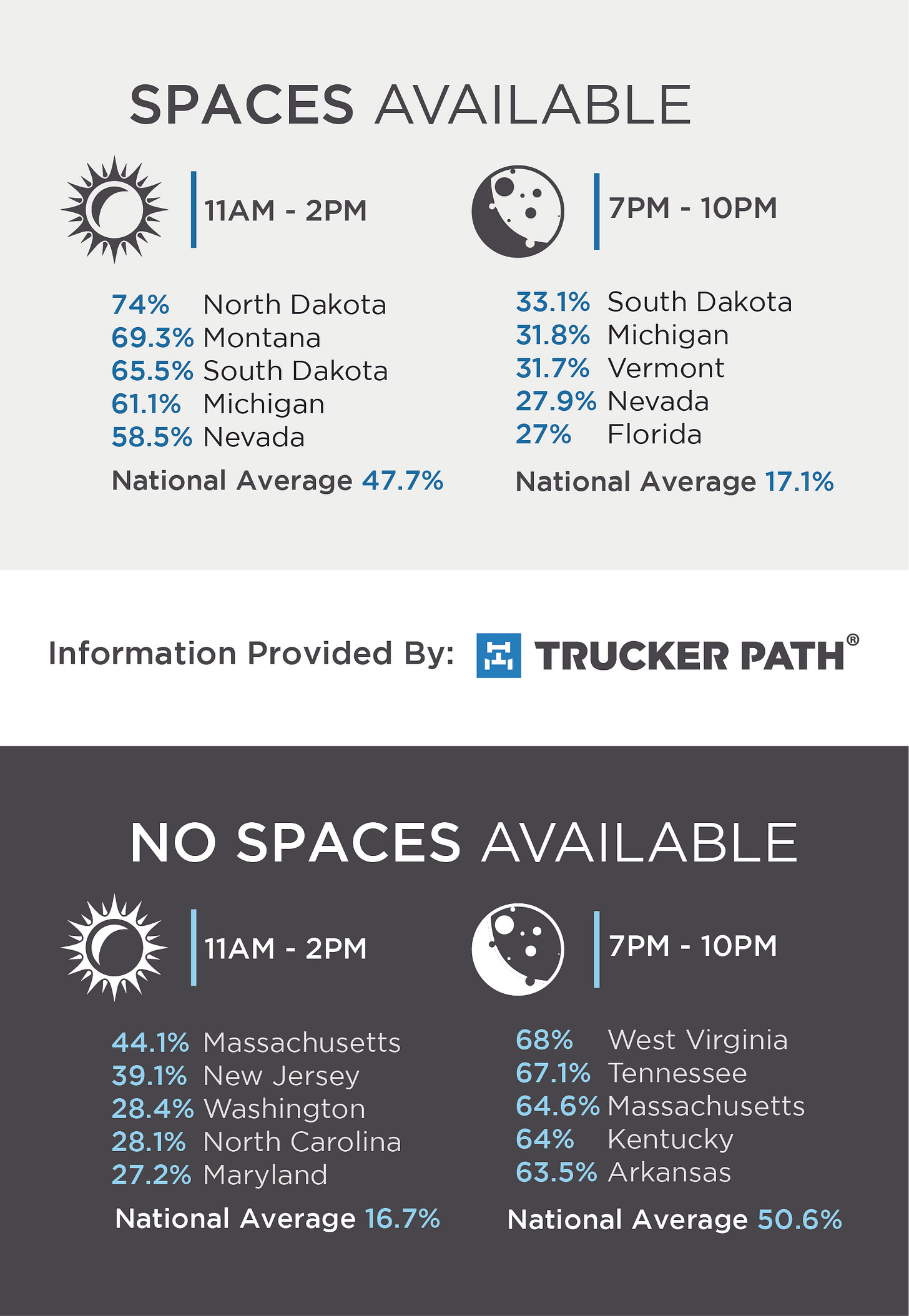

NO PARKING: Trucker Path released a survey about which states are the easiest and hardest to find truck parking. Below are the winners and losers:

NO WAREHOUSING: Real estate firm Transwestern is out with a report on industrial warehousing. Among the key findings:

There is 636.6 million square feet of industrial space currently under construction nationally, nearly double the volume five years ago. About 27% of this space is concentrated in six markets: Atlanta, Chicago, Dallas, Inland Empire, Philadelphia, and Phoenix.

The national vacancy rate dropped to 4.7% in the third quarter. Inland Empire, Los Angeles, Orange County, and New Jersey markets posted vacancy below 3%, underscoring the need for creative property strategies for both owners and users of industrial space.

CBS 60 MINUTES: Often I have qualms with how the mainstream press is covering this supply chain meltdown. However, Bill Whitaker of CBS News had perhaps the best TV report this year on the Port of Los Angeles and Port of Long Beach: Bill Whitaker report. Paul Berger also had a strong article in the Wall Street Journal.

NO CHASSIS: One issue Whitaker brought up is the chassis trapped underneath empties unable to be returned to the ports, tying up wheels that could go to picking up imports. Chassis providers can’t control this factor, but TRAC Intermodal said it is doing what it can with out-of-service levels:

“As OOS heavily impacts availability in a meaningful way, we have worked diligently to reduce OOS units through close collaboration with our maintenance and repair vendors, helping to ease availability shortfalls as much as possible. Current OOS numbers across TRAC’s fleet are at record lows of 3%, a sharp drop from last year’s OOS levels of 7%. At the Port of Los Angeles and Long Beach, the nation’s largest and busiest port, OOS levels are also at record lows of 2 to 3%.”

IANA DATA: The Intermodal Association of North America has released its monthly intermodal volume data. The eye-opening result how the restrictions on IPI moves off the West Coast reduced the international intermodal volume. IANA’s data show ocean containers on rail fell 12.9% year over year in October. On a rolling three-month basis, international intermodal volume is down 6% compared with August-October 2020. The silver lining is that there is less congestion in BNSF and UP ramps compared with August, although it’s extremely difficult to find a chassis to serve ground terminals right now.

One interesting phenomenon is trucking companies are holding onto chassis, even over a weekend, paying $100 in rental fees to ensure a driver walking in the door Monday morning has a chassis ready to go because supply is so tight. Many BCOs are splitting the bill because they want their containers.

PORT OF CHARLESTON: Pay no attention to the handful of vessels anchored outside Charleston. Port officials in South Carolina tell me they shut down a berth in the Wando Welch Terminal for a few days to unload new ship-to-shore cranes. They expect everything to be cleared within a week.

The port pushed back the launch of its new chassis pool to early 2023 because it has taken longer than anticipated to negotiate deals with chassis manufacturers, the port told me. There is a trickle down effect as Savannah's chassis shortage may have been alleviated had Charleston left the South Atlantic Chassis Pool next May, as originally planned.

NO SEMICONDUCTORS: IHS Markit, our parent company, has a startling report about just how bad the semiconductor shortage is right now:

“IHS Markit anticipates that the automotive market will be constrained substantially by semiconductor supply shortages not just for the next several months but for all of 2022 and into 2023 as well.

Virtually the entire auto market worldwide is supply-constrained, which has never happened before in peace time. At run-rates recorded in September and October, vehicle supply looks to be 15% to 20% below potential global demand (perhaps as many as one in every six cars ordered could not be delivered, even with a one-year wait).”

As American Trucking Associations CEO Chris Spear reminded the House Transportation and Infrastructure Committee on Wednesday, trucks also require semiconductors.

“Microchips obviously are not just for cars, but they're also for trucks. And they're less profitable in cars and trucks than they are in the phones that we have, or our iPads…So productivity and the economics of supply and sourcing is causing a problem.”

HOUSE T&I HEARING: There wasn’t much new that came out of the aforementioned House hearing on the supply chain. But David Correll of the MIT Center for Transportation and Logistics, had a good quote:

“We tend to frame this issue, to use a television analogy, like it's a detective show. If we just analyze this issue consistently enough, or cleverly enough, we're going to ID the one culprit. But I don't think it's a detective show.”

We also learned Anne Reinke, President & CEO of the Transportation Intermediaries Association (TIA), has Rock ‘Em Sock ‘Em Robots in her office. How cool!

TMS INTEGRATION: AscendTMS has added the digital funding and payment tools of Axle Payments. Freight brokers using Axle Payments automatically get a full subscription to AscendTMS. Ascend’s CEO Tim Higham told me:

“The soft launch alone garnered 146 new customers for Axle Payments in just 90 days. Digital freight tech tools that work are DEFINITELY in demand.”

Do you have an opinion on anything I wrote? Or do you have a subject you’d like me to include in my next newsletter? Email me ari.ashe@ihsmarkit.com to send your thoughts, or to request the underlying data behind our indexes.

Happy Thanksgiving! :-)

We credit our data partners for the JOC Intermodal Savings Index: Cargo Chief, InTek Freight and Logistics, Intermodal Association of North America, Loadsmart, Jason Miller of Michigan State University, Sunset Transportation, Transfix, and Zipline Logistics. Loadsmart and Transfix are digital 3PLs which match shippers with capacity. We also survey and use data from other 3PLs on the condition of anonymity.