Welcome Please Haul My Freight: Edition 34. Here are some items in my notebook this week:

SPOT TL RATES: As we close out the year, a brief recovery in truckload spot rates on DAT’s Top 50 Lanes. But overall, a lump of coal for trucking companies in 2022 as markets have shifted toward shippers.

The most common theme from shippers, however, is sticking with their contract carriers because they know the upswing will happen again.

IN-DEPTH: DAT released a 2023 Freight Focus report, and I highly recommend reading it, including page 11 entitled “Transportation Conversion Factor” and page 13 entitled “Key Issue for Shippers.” Also this nugget for those keeping score:

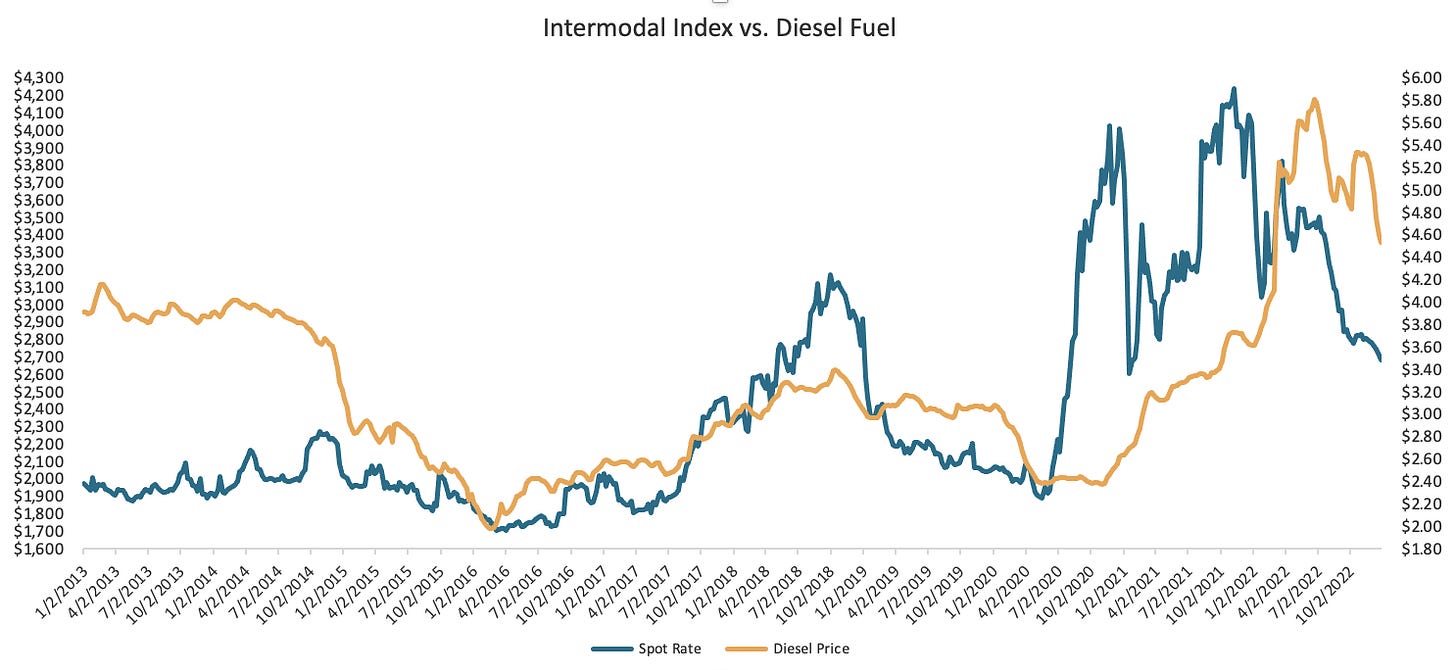

FUEL: The JOC Intermodal Savings Index (ISI) is a proprietary calculation we compile on what an average shipper is saving using domestic intermodal instead of one-way truckload (“OTR”) in 120 US lanes.

One factor of the index — particularly the JOC Spot ISI — is the fuel surcharge.

When fuel surcharges were 50%-60% of the linehaul, it was hard to compete with trucking on the East Coast. If intermodal providers can provide a competitive linehaul rate and fuel surcharges can be between 30%-40% in 2023, then IMCs have a fighting chance with shippers.

SPOT INTERMODAL: I wanted to share another chart related to spot intermodal rates from Rick LaGore, CEO of InTek Freight and Logistics:

What this chart tells me is how far spot intermodal rates have fallen in 2022. According to LaGore, the average rate on 112 US lanes is $1,090 lower today than it was in December 2021. Spot rates are lower on 91 out of the 112 lanes year over year.

The JOC Intermodal Savings Index has spot intermodal rates down 20% compared with December 2021.

INTERMODAL SURVEY: Do you use InTek? How about J.B. Hunt, Hub Group, or Schneider? Maybe Uber Freight, Mode Transportation, STG, or Swift Intermodal?

If your company uses domestic intermodal, then please participate in a new survey launching in 2023. Any IMCs using the large asset-owning intermodal providers listed above are also welcome.

Click the picture to contact me:

FMC RULES: The Federal Maritime Commission ruled Dec. 29 in TCW Inc v. Evergreen Shipping Agency. It upheld the original decision that Evergreen was not entitled to charge detention for a three-day period in which the port of Savannah was closed. TCW’s BCO customer incurred detention in the early days of the COVID-19 pandemic because its factory was closed. TCW tried to return containers but couldn’t on a Saturday, Sunday, or Monday because of Memorial Day weekend. The FMC ruled Evergreen must refund the final three days of detention but can keep the remainder.

HAPAG-LLOYD: An NVO has accused Hapag-Lloyd and railroad CSX of improperly levying nearly $300,000 in fees after the NVO exceeded its contractually allowed container free time. The NVO said the charges were the result of CSX’s failure to make the containers available before the free time expired. Hapag-Lloyd will also reroute a vessel service into the Port of Charleston to the Wando Welch terminal, according to the Post and Courier, after the recent ruling in the Leatherman terminal lawsuit. For details on the case, see our last edition entitled “Merry Christmas 2022.”

GET YOUR BOXES: The Port of Houston will introduce a $45 fee for import containers left at the port for longer than the allotted free time, starting from 8 days after the free time has expired. The fee is intended to minimize long-term storage of containers and improve cargo movement.

IT RAINES NO MORE: Norfolk Southern Railway will shut down Raines lot on Dec. 31. This was a spillover lot outside Memphis that NS opened in September when import volume put on trains from Savannah to Memphis were up ~50% year over year and congestion was high. However, traffic has slowed with Savannah to Memphis container traffic down more than 20% in November and likely down 20% again in December, according to the Georgia Ports Authority.

TAXING CONTAINERS: Joliet City Council Member Cesar Guerrero has proposed a container tax to generate revenue from the expected expansion of operations at the Union Pacific Global IV. The tax would offset the cost of truck traffic on local roads, police services and other city services. The idea of a container tax had previously been considered and other possibilities, including a unique tax for intermodal operations, have also been explored.

MORE MONEY PLEASE: Virginia Senators Tim Kaine and Mark Warner have requested federal funding for improving Interstate 81. The state wants to improve a 29-mile chokepoint in I-64 between Richmond and Williamsburg, but there is a $125 million funding gap. The state has committed $470 million and a regional transportation authority has pledged $100 million. The state received a $25 million federal grant, but is needs more aid. I-64 is a key corridor to/from the Port of Virginia.

WAREHOUSING: Seefried Properties has started work on the 287-acre Live Oak Logistics Center in Savannah, Georgia, which will offer over four million sq. ft. of distribution and manufacturing space. The first speculative building at the center, which is six miles from the Georgia Ports Authority’s Garden City Terminal, will be delivered in Q4 2023 and include 669,760 sq ft of cross-dock space. Leasing efforts for the project will be led by Cushman & Wakefield.

BARSTOW POLICE: Barstow Police Chief Andy Espinoza is implementing measures to address crime in the city as it prepares for a surge in economic development from BNSF Railway's $1.5 billion rail facility. This includes the formation of a Crime Impact Team and the use of automated license plate readers. The department is also seeking to hire five more police officers and aims to increase this number further once the population increases as a result of the BNSF project.

DID YOU KNOW: From our friends at the Scopelitis law firm. The final 3G network, Verizon, is scheduled to sunset on December 31, 2022. FMCSA is encouraging motor carriers to verify that their ELD will continue to function properly before the shutdown. For shippers, now is the time to check in with some of those really small niche carriers in your network to make sure they’re in compliance.

Any opinions in this blog represent the author’s views, not the Journal of Commerce or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to JOC subscribers with the proper subscription tier.

Not a Journal of Commerce subscriber? Click here to become one.