Welcome Please Haul My Freight: Edition 33. Sorry for the long delay between posts. I’ve been busy with the new Journal of Commerce website. Here are some items in my notebook this week:

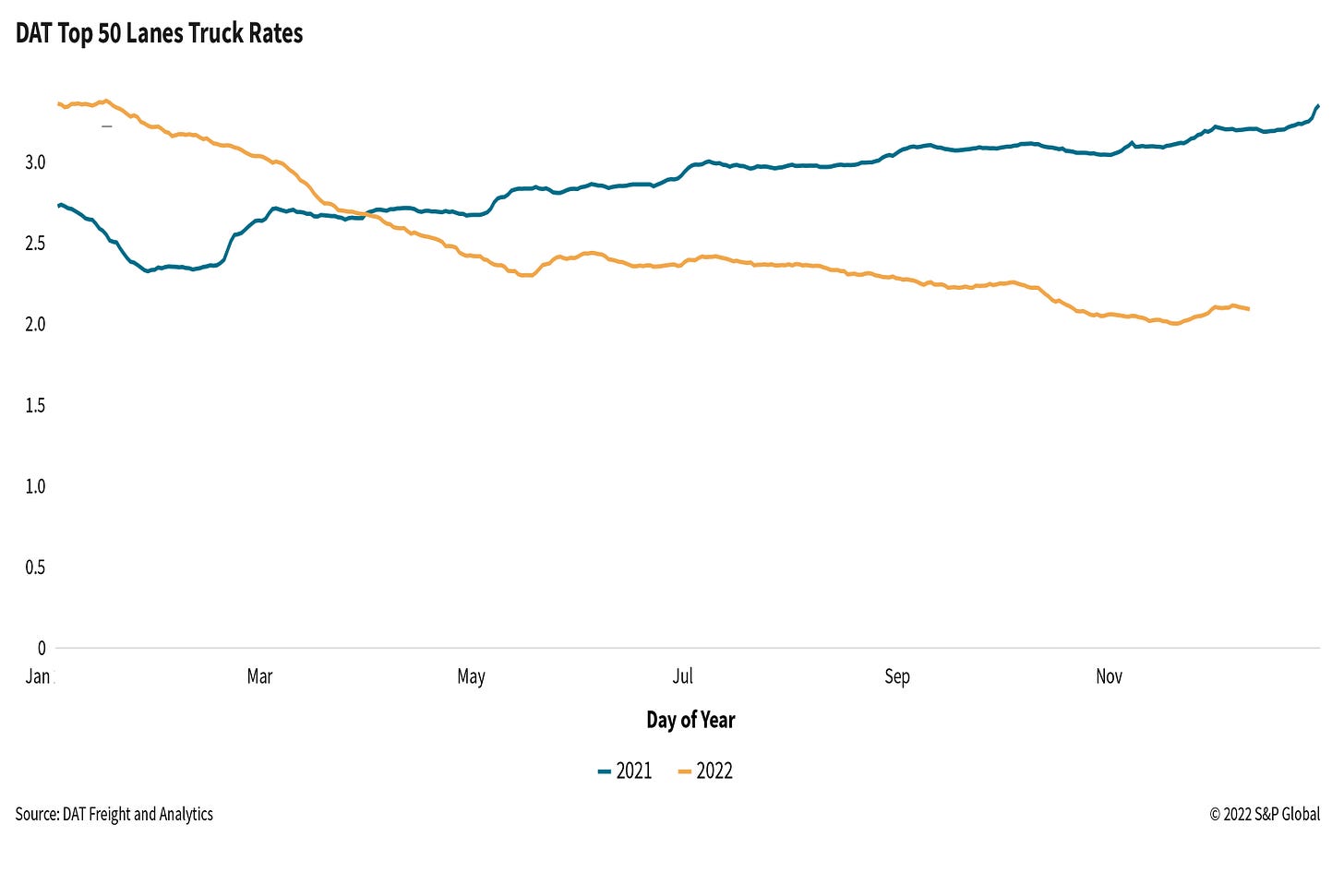

SPOT TRUCKLOAD: A little glimmer of Christmas hope in the spot truckload data. The DAT Top 50 Lanes shows truckload spot rates are up 0.5% month over month. Our JOC Shipper Truckload Spot Rate Index has December up 0.6% month over month on a preliminary basis. Our data from digital broker Loadsmart jumped 9.3% between our first and second December quotes on our 4,000+ US lanes.

Now that’s what’s supposed to happen before Christmas, so I’m not reading anything more into it than the holidays.

ATA TONNAGE: The American Trucking Associations' For-Hire Truck Tonnage Index decreased 2.5% in November, following a 1.2% decline in October, due to a soft fall freight season and a slowing goods economy, according to ATA Chief Economist Bob Costello. The index increased 0.8% compared to November 2021, the 15th straight year-over-year gain but the smallest over that period, while year-to-date through November, tonnage was up 3.7% compared to the same period in 2021.

SPOT MARKET PENALTY: I’ve been tracking the “spot market penalty” in trucking — i.e. what is the added cost for going out of contract to the spot market. DAT data has this “penalty” (or lack thereof) in the -10% to -12% range. No surprise shippers are getting -8% to -15% on incumbent truckload contract renewals, according to DAT.

I’m paying close attention to the domestic intermodal penalty.

As of November 30, spot intermodal markets were only $0.12 higher than contract intermodal markets, the narrowest gap since June 2020. Pay attention to how many intermodal shippers are riding the spot market in 2023. It’s a risky gamble, very risky.

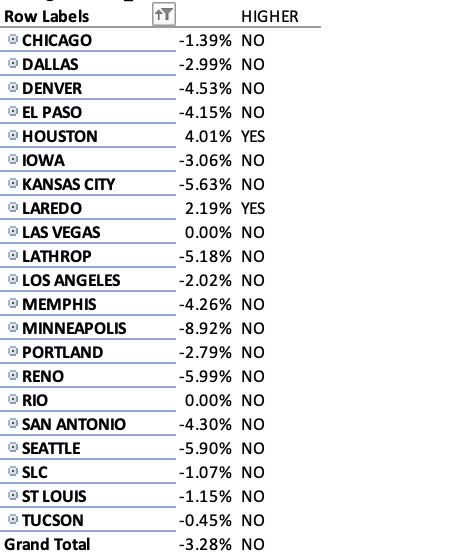

CONTRACT INTERMODAL: Union Pacific Railroad released its aggregate rates on Dec. 16 for small shippers who use the EMP and UMAX boxes. UP has definitely noticed the tides have turned toward shippers, as discussed in this article. While I will not disclose rates for individual lanes, here are the high-level findings by origin:

Hub Group, J.B. Hunt, and Schneider are being very aggressive in jockeying for market share. Schneider wants to capitalize on its new UP partnership in 2023. J.B. Hunt has more space now on BNSF Railway trains and the containers to fill the additional slots. And Hub Group doesn’t want to concede share to the other two.

The winner here is the intermodal shipper who is seeing a race to the bottom. The losers are the non-asset IMCs because some EMP and UMAX rates will not be competitive against the big three.

I WANT YOU: Are you a domestic intermodal shipper? Do you use Hub Group, J.B. Hunt, Schneider National, Swift Intermodal, STG Logistics (formerly XPO), or a non-asset IMC? I want to hear from you on an anonymous survey called “Grading the IMCs.” I re-emphasize the survey will be anonymous. Click the photo to ask to contact me for details:

THE RECAP: Marketwatch wrote up a good synopsis of the year that was in US ports. It’s a good read. I also recommend a Cargomatic discussion with FMC Chairman Daniel Maffei and this look ahead to the 2023 trucking market with DAT’s Dean Croke and ACT’s Tim Denoyer.

IPI REVERSAL: Intermodal volume leaving US West Coast ports was down 30% in November compared to a decade ago, according to the Intermodal Association of North America. Inland point intermodal (IPI) volume originating on the US East Coast was 48% higher in November than in November 2012.

See the interesting reversal on IPI volume:

UNION WINS: The National Labor Relations Board (NLRB) has ruled that the International Longshoremen's Association (ILA) did not violate the law when it sued the United States Maritime Association (USMX) and two of its carrier members for breach of contract regarding work at the Hugh K. Leatherman terminal in Charleston. ILA sued USMX and its carrier members after they used non-unionized labor to operate state-owned lift equipment for containerships at the Leatherman terminal.

The NLRB found that the ILA's lawsuit met the requirements for a lawful work preservation objective, as its objective was the preservation of work traditionally performed by employees represented by the ILA and therefore the port had the power to give the employees the work in question and were therefore primary employers.

CHARLESTON: The Charleston Harbor in South Carolina has been deepened to 52 feet, making it the deepest harbor on the East Coast. The infrastructure project, which cost around $580 million, was fully funded by state and federal dollars and took four years to complete. The deepening means that large ships calling the East Coast can access Charleston at any time, leading to increased competitiveness, new ship services and more cargo for the state.

NEW YORK-NEW JERSEY: Warehouse demand at the Port of New York and New Jersey remains strong as new tenants specializing in food and beverage, auto parts, and pharmaceuticals add capacity to the area. These companies, primarily cold-chain and life sciences firms, have replaced e-commerce and quick-delivery companies as the main drivers of demand. The Port of NY-NJ has been the busiest US port for the past four months, with container volumes up 8% year-to-date through November.

CLEAN AIR: The Biden administration has announced stricter standards on emissions from trucks, buses and vans from the 2027 model year. The rules, the first update to clean air standards for heavy-duty vehicles in over 20 years, are expected to result in a 48% reduction in nitrogen oxide, a 28% reduction in benzene, a 23% reduction in volatile organic compounds and an 18% reduction in carbon monoxide by 2045. Nitrogen oxide is roughly 300 times as potent as CO2 at warming the atmosphere and accounts for around 7% of all US greenhouse gas emissions.

DENIED: The FMCSA has denied an application from the Trucking Alliance, a group of large motor carriers, for an exemption from Federal Motor Carrier Safety Regulations (FMCSRs). The exemption would have amended the definition of actual knowledge to include an employer's knowledge of a positive hair test for controlled substances, which would have required such results to be reported to the FMCSA Drug and Alcohol Clearinghouse. The FMCSA determined that it lacks the statutory authority to grant the exemption request.

FACEBOOK: Real Women in Trucking has filed a complaint with the Equal Opportunity Employment Commission alleging that Facebook's targeted employment ads discriminate against women and older users. The complaint says that the ads for jobs in blue-collar fields, such as trucking, reached an audience that was 99% male and under the age of 55. Facebook's parent company Meta said it is reviewing the complaint.

Any opinions in this blog represent the author’s views, not the Journal of Commerce or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to JOC subscribers with the proper subscription tier.

Not a Journal of Commerce subscriber? Click here to become one.