Welcome to Edition 9 of the Please Haul My Freight newsletter. Here are some of the items in my notebook this week:

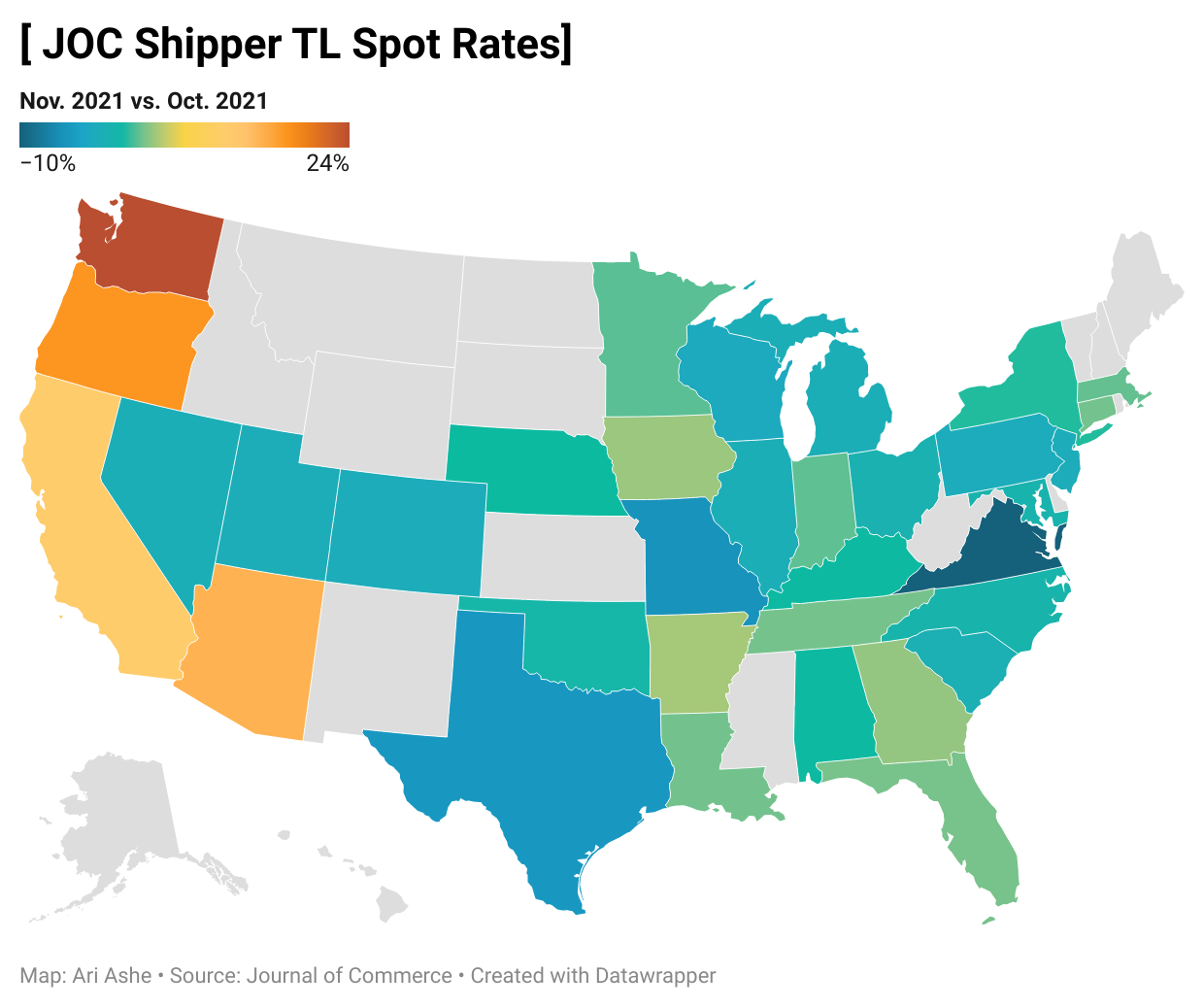

TRUCKLOAD RATES: Our JOC Shipper Spot Truckload Rates1 are finalized for November. This data measures what truckload brokers are charging shippers on invoices across 4,300 US lane combinations. Our weighted national number rose 3 cents month over month to $3.18 per mile. Our unweighted national number rose a penny to $3.50 per mile.

When we break the numbers down by state, rates were flat month over month in every region except on the West Coast where prices rose out of Arizona, California, Oregon, and Washington.

The DAT Freight and Analytics forecast for the next few weeks shows no cool down:

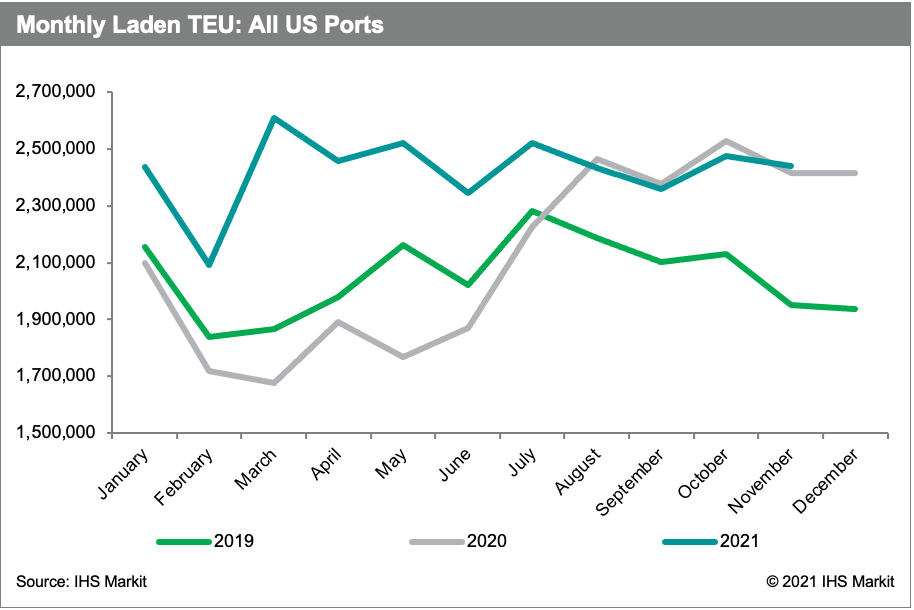

IPI-TRANSLOAD: Part of this West Coast phenomenon is the shift away from inland point intermodal (the intact move of an ocean container inland on a train) and toward transloading. The Intermodal Association of North America (IANA) reported a 12.9% decline year over year in IPI in October. The reason is the floating rate ocean carriers charge NVOCCs for IPI is through the roof, much like ocean shipping rates.

An NVO uses a mixture of fixed and floating rates. Fixed rates save a lot of money during the 12-week peak season but not so much the other 40 weeks. But we’ve had a year of unending peak “season-esque” months in 2021, so floating rates are out of whack. IPI is more expensive than truckload in Los Angeles and Seattle.

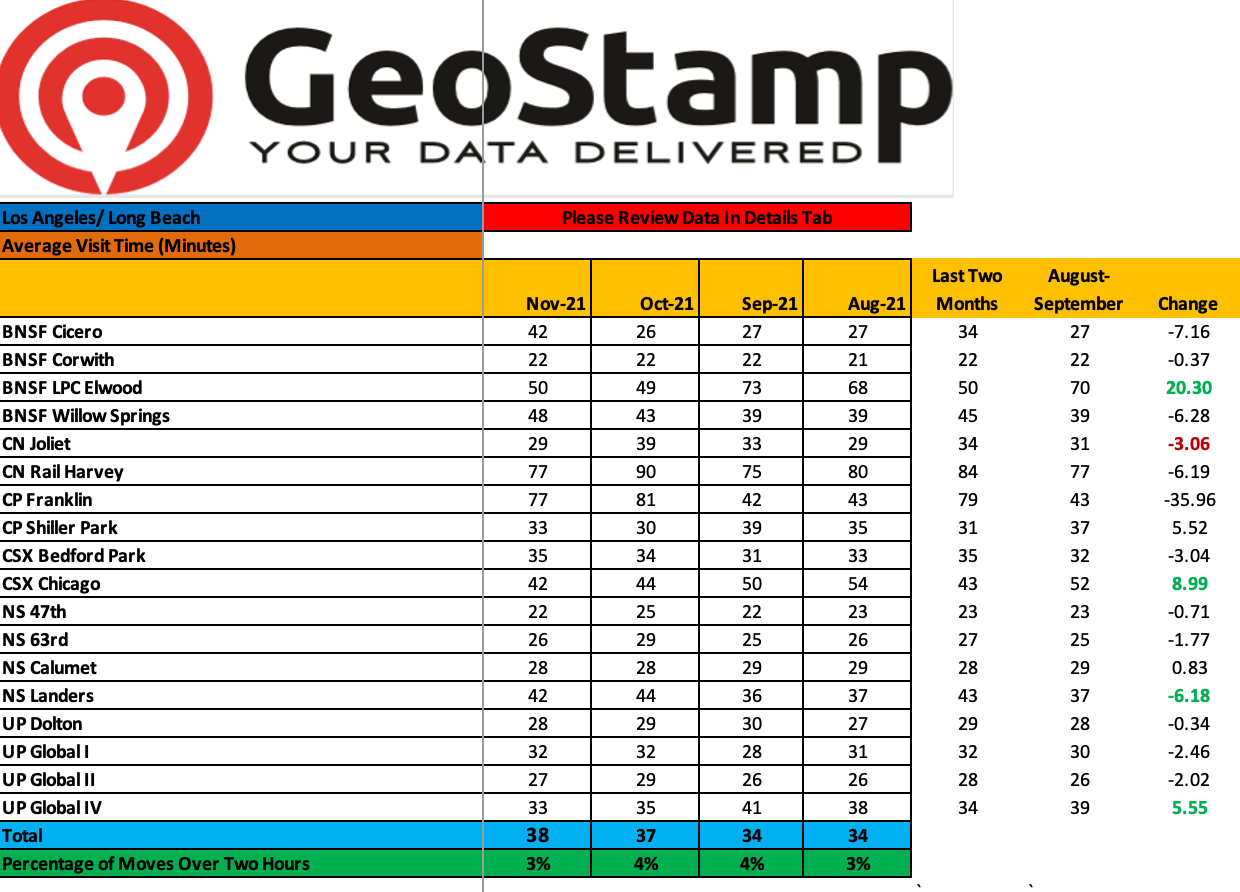

CHICAGO TURN TIMES: Truck turn times were mixed in November in Chicago rail ramps, according to the Illinois Trucking Association and Geostamp. BNSF and Union Pacific Global IV are smoother because of the IPI decline. Truck turns were longer in Norfolk Southern Landers, and the overall average is higher than September.

Let me know what you are seeing in Chicago. How much of this is a chassis story?

INTERMODAL SAVINGS INDEX: Preliminary numbers are calculated for November’s JOC’s Intermodal Savings Index. This index measures how much an average shipper may save using domestic intermodal versus longhaul trucking.

The JOC Spot ISI will fall one point to 111ish, which is roughly the same value as a year ago. The JOC Contract ISI will rise about one point to 140ish — or 40% savings on intermodal contacts versus truckload contracts — a record high which will linger until intermodal contracts reset in Q1.

Intermodal contracts may rise 8% nationally and 10%+ in California, but there is still plenty of room to deliver a strong bargain.

Index figures will be finalized after our weighting based on IANA’s volume data.

GET OUTTA HERE: Add ZIM Integrated Shipping Services to the list of ocean carriers providing incentives to pick containers quickly, in this case from WBCT. ZIM will provide $200 for each container removed within four days after discharge from vessel and will be made directly to the trucker. CMA CGM announced a similar program a couple weeks ago.

MOHAWK CASE: One of the test cases on detention and demurrage — Mohawk Global Logistics v. Mediterranean Shipping Co. — was officially settled Dec. 9.

I had asked Richard Roche of Mohawk about his response to those who had hoped this test case would go all the way to a ruling.

“While settlement does not set precedent, there are more irons in the fire between the FMC’s anticipated Advanced Notice of Proposed Rulemaking resulting from Fact Finding 29 and the Ocean Shipping Reform Act which has now passed the House, that will better define the rules of engagement for demurrage and detention practices moving forward.”

To be fair, Roche’s first job is to his company and his BCO clients. Litigation can be expensive and take a long time.

J.B. HUNT-SWIFT: I recently reported that Costco and Walmart have turned to J.B. Hunt and Swift Intermodal to tap 53-foot dray capacity to retrieve ocean boxes. There were a couple items that didn’t make it into the story.

While I identified the Posen as one vessel, sources told me the AS Catalina to Seattle and the Queen Esther to Vancouver are charted vessels for top retailers.

I’ve heard that Walmart is heavily leaning on J.B. Hunt to assist in Southern California. That’s not surprising as the two are long-term partners.

I’ve heard there are major issues with charters going into the Pasha Terminal — a small breakbulk lot — in the Port of Los Angeles. That may explain why I’m seeing more bulk cargo ships with containers going to the Port of Everett in the PIERS data.

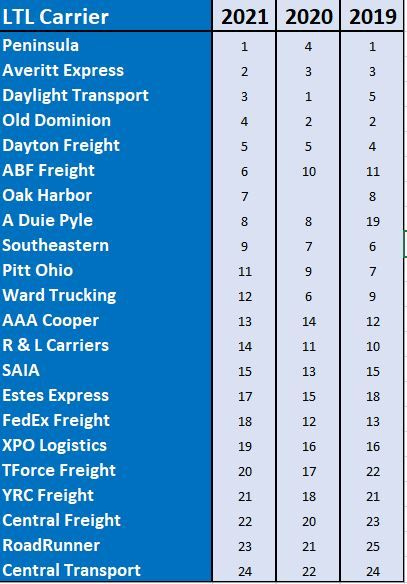

LTL RANKINGS: Mastio release its annual LTL report on Nov. 30. There were no surprises: Old Dominion Freight Line was near the top, Central Transport and Roadrunner were at the bottom.2

LET’S MAKE A DEAL: There was a rumor that XPO’s small box business was shutting down on January 1. This refers to domestic US freight traveling in an ocean container from east to west where a receiver unloads the container, and the empty is returned to the port. But an XPO spokesperson said the program isn’t being shuttered.

Remember a major international transportation and logistics provider is rumored to want XPO’s European business and US intermodal division. Another source told me the same international name is also interested in C.H. Robinson. I believe C.H. Robinson would only want to sell the entire company rather than certain pieces.

Let’s see if this international suitor wants to spend $17-$20 billion.

Any opinions in this notebook represent the author’s views, not the Journal of Commerce or IHS Markit. Any rumors in this notebook are just that: rumors. Unconfirmed. Not enough to include in a news article.

Do you have an opinion on what I wrote? Do you have a subject you’d like me to cover?

Email me ari.ashe@ihsmarkit.com to send your thoughts, or to request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paid JOC subscribers. Don’t have a JOC subscription? You can change that!

We thank our data contributors to JOC’s Indexes: Cargo Chief, DAT Freight and Analytics, InTek Freight and Logistics, Intermodal Association of North America, Loadsmart, Sunset Transportation, Transfix, Zipline Logistics, and other 3PLs/shippers who contribute on the condition of anonymity.

Central Freight Lines is going out of business and will file Ch. 7 bankruptcy, according to FreightWaves. Since I urged people to credit the Journal of Commerce the Ashley Furniture purchasing Wilson Logistics because I did the hard work — not Freightwaves — it’s only right to acknowledge their work in the Central Freight story. While Freightwaves failed to credit me for Ashley Furniture, I believe strong, well-sourced journalism must be acknowledged because it’s become a fleeting practice. I understand why some news organizations have policies not to credit a competitor’s scoop, so my feelings may not represent others. However, I prefer to treat others the way I want to be treated.