Welcome to Edition 11 of the Please Haul My Freight newsletter. Here are some of the items in my notebook this week:

TRUCKLOAD RATES: The JOC Shipper Truckload Spot Rate Index has been finalized for December 2021. Our weighted national number was up 6 cents to $3.25 per mile and the unweighted number rose 7 cents to $3.58 per mile1. Rates are soaring out of the Mountain and Pacific Northwest, a trend which digital freight broker Loadsmart2 says is continuing into January. Conditions cooled a little in Arizona and California. The underlying data behind our indexes is available to paid JOC subscribers upon request.

Early January data shows rates up another 15 cents on a weighted basis to $3.39 per mile and 17 cents on an unweighted basis to $3.75 per mile. No cooldown in January yet!

BUSY OCEANS: IHS Markit has certified the laden import totals through December. Imports rose 14.4% last year across all US ports compared with 2020. The five-year annual CAGR for laden imports (going back to 2017) is 4.8%. The last month US imports were less than 2 million TEU — a benchmark for port congestion — was June 2020, according to PIERS, a sister product of the Journal of Commerce. Imports have exceeded 2 million TEU for 18 consecutive months for the first time ever.

AAR DATA: Rail volume last year grew compared with 2020, which is no surprise given the economic shutdown in the early days of COVID-19 and the import volumes above. But the real story of 2021 can be told looking at two periods: Q2 and Q4.

Let’s look at BNSF and UP. In Q2, both US railroads saw volume rise nearly 25% year over year. In Q4, UP’s volume fell 12.5% and BNSF 7.5% year over year, according to the Association of American Railroads. UP’s 2021 volume ended up nearly 3% compared with a year ago, but down 1.1% versus 2019.

And no matter how you slice the data, Q4 was weaker than previous peak seasons.

Interesting when you consider UP instituted a $5,000 surcharge on excess contract loads and all spot business out of Southern California for domestic intermodal business, although IMCs told me it was very busy and nearly impossible to get a 53-foot container without street turning.

The AAR data doesn’t separate domestic intermodal and international intermodal, which we already know was very weak in Q4.

IPI DEBATE: BNSF and UP are ready to move ocean containers. Gene Seroka and Griff Lynch want more importers to rail containers inland, but ocean carriers have either rejected IPI (international intermodal) bookings or set rates so high as to encourage transloading to trucks. Don’t necessarily make ocean carriers the bad guys, however. Railroads charged millions in storage penalties (demurrage) in 2021 and importers are not necessarily responsible to foot the bill on the door moves, otherwise known as carrier haulage. Ocean carriers want to hedge their bets on IPI. Intermodal analyst Larry Gross has a strong piece on this issue in the Journal of Commerce.

PORT ROTATIONS: The number of anchored vessels has gone down in Savannah and gone up in Charleston. Don’t be surprised if ocean carriers that switched their port rotations from Savannah to Charleston a couple months ago reverse those decisions quite soon.

The Port of Charleston has seen a jump in volume, officially handling 2.75 million TEU in 2021, up 19% compared with 2020 and 13% compared with 2019.

WAN HAI: The Federal Maritime Commission is investigating whether Wan Hai is illegally charging detention on containers in California even though terminal operators won’t offer empty return appointments. Wan Hai vessels are now visiting Charleston and Savannah, but don’t expect the same problems. Wan Hai signed terminal agreements with both port authorities, allowing loaded and empty containers to pass through terminals on equal footing with other ocean carriers.

EXPORTERS: Norfolk Southern Railway is reducing service from Cincinnati to West Coast ports. We know exporters have struggled with vessel delays, rolled cargo, and trouble getting containers onto trains. One NVO told me when the export is rolled or railroads won’t accept the container, steamship lines still assess detention penalties, which he argues is unfair since it’s outside the control of the exporter. His company disputes more than a dozen invoices per week totaling $15,000 in detention, or about $350,000 in detention penalties per year. It’s not a top priority of the Federal Maritime Commission, but I wonder how the interpretative rule applies here.

XPO TROUBLE: There has been an increase in the chatter around XPO Logistics in recent months. The latest from Amit Mehotra of Deutsche Bank in a series of investor notes:

“Troy Cooper will step down as President of the company and serve as a senior advisor through the end of June. While President Cooper's exposure to Investors has been very limited over the years, we viewed him to be a critical element of the successful integration efforts of the various acquisitions made by XPO over the last decade (particularly around brokerage and Europe). In this context, we don't find it all that surprising to see his departure, given XPO now appears to be in asset sale mode from various recent media reports.”

“What’s clear to us from [Mastio’s LTL survey] data is that XPO has seen significant deterioration in trends since the company acquired Conway Freight in 2015. For example, in 2015, 70% of LTL shippers surveyed said they would “likely recommend XPO” vs. only 5% that said they would not; in the most recent 2021 study, these numbers trended to 46% and 21%, respectively…

The negative implication is that XPO’s lackluster volume growth over the last 6 years does not appear to be the sole result of proactive culling of business and/or focus on higher yield…but also market share loss due to weaker customer perception of service… It’s very important, in our view, to identify the root cause of XPO’s LTL underperformance, because we continue to believe these issues are fixable over time. To be sure, XPO’s recent LTL strategic action plan does appear to be focused on service via adding additional resources and capacity.”

HAVING THE RIGHT STUFF: Some trucking companies perform better than others. Some shippers and receivers also do better than others. Convoy released a report Monday with a graphic on five characteristics that separate the best and worst docks:

TRB CONFEFENCE: I was a panelist on a supply chain panel on Jan. 10. Here is a copy of my presentation. There were other interesting insights in the session. Tyson Moeller, general director of network development for Union Pacific Railroad:

“We'd like to work with the ocean carriers to see if there's opportunities to put the BCOs onto the waybills. Legally, our contracts are with the ocean carriers and when we’ve gotten into a pinch, we’ve had BCOs reaching out directly to us looking for information. Legally, we can't share the information even if they give us a container number because they're not part of the waybill.

One of the solutions we’d like would be to add BCOs. It's something that we've added into our domestic program and it's worked well so that we can have more dynamic conversations with the carriers along with their BCO customers.”

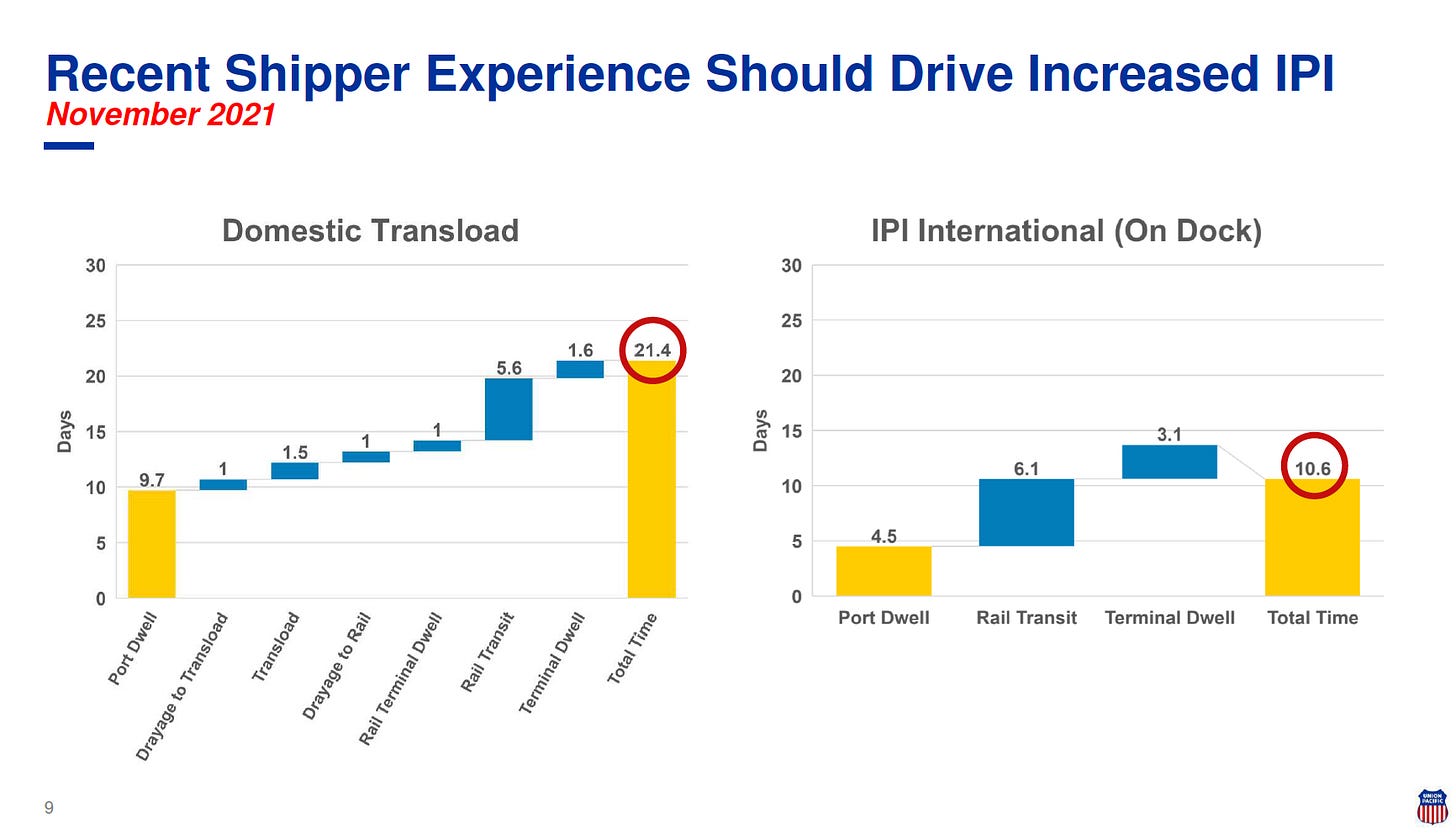

Moeller also showed why he thinks IPI is better than transloading to domestic intermodal. Note this comp is transloading to train, not transloading to OTR trucking.

Jon Gold of the National Retail Federation had this slide with a forward forecast of imports through Q3 2022:

TRUE LEADERSHIP: Lance Uggla, CEO of IHS Markit, our parent company, sent all our employees an e-mail to end 2021. Although not related to freight, it’s a great discussion on life. Mr. Uggla’s sage advice is important for everyone, not just IHS Markit:

“In Satya Nadella’s new book he speaks about the shift from a ‘Know it all’ culture to a ‘Learn it all’ culture at Microsoft. There’s something valuable here and I just wanted to flag this as a useful reminder to all of us Type-A individuals (others can ignore this!) to make 2022 a year of learning not knowing!

Let’s listen more. As we pause to listen we get so many added benefits that lead to improved results. Try to double your listening time at every opportunity. This can be even more valuable in practice with our children, friends and partners…

The past year has taught us many things, but personally I feel that we have developed a lot more empathy for each other…

Finally, calmness in leadership; please don’t yell or berate. This is so passé. Is it even a thing anymore? So 90s!!”

Any opinions in this notebook represent the author’s views, not the Journal of Commerce or IHS Markit. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion on anything I wrote or a subject you’d like me to cover?

Email me ari.ashe@ihsmarkit.com to send your thoughts. You may also request our data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paid JOC subscribers. Don’t have a JOC subscription? You can change that!

Our JOC Shipper Truckload Spot Rate Index is a JOC analysis of data from Cargo Chief, DAT Solutions, Loadsmart, and a survey of 3PLs and shippers.

Digital freight broker Loadsmart is a JOC data partner providing biweekly dry-van spot rates — i.e. what they would charge a shipper on a one-off basis.