Welcome Please Haul My Freight: Edition 28. Here are items in my notebook this week:

TRUCKLOAD SPOT RATES: As I’ve written before, there is certainly something going on in truckload spot markets. Data from our partners with DAT Freight and Analytics on the DAT Daily Top 50 Lanes shows the average spot rate, excluding fuel, fell below the 2020 rate on Aug. 10, trailing now on a one- and two-year basis.

The JOC Shipper Truckload Spot Rate Index1 is still between 2020 and 2021 levels. Our data measures broker-to-shipper invoice rates across more than 4,400 US lanes, and most importantly includes fuel surcharges which are $0.36 higher than a year ago and $0.51 higher than two years ago.

Does the JOC Shipper Truckload Spot Rate Index drop under 2020 before the end of this year? I’m not sure. Fuel rates going down are good for motorists, but lowers the fuel surcharge and may drag our index down closer to the 2020 line in Q4.

TRUCKLOAD CONTRACTS: Shippers tell me that the tenor of conversations with asset-based truckload carriers has changed in the last month. More carriers are recognizing the one-way irregular route truckload contract leverage has shifted back toward shippers and are providing rate concessions to keep business, according to my shipper conversations.

Here is what one shipper told me:

“We ran a mini RFP; it was very small. This was freight that wasn't on our previous RFP. We saw some phenomenal savings, surprisingly so, compared with our rates earlier in the year, a 25% reduction in some cases.”

A second shipper:

“We’re having contract carriers come in and say, ‘I want to reduce my rates to be a good partner with you. And I know that contract rates here, I want to reduce them now.’ So we're starting to see asset carriers come in and actually reduce their rates on truckload.”

A third shipper:

“We're not the type of shipper that's going to beat up carriers over rate, and we'll leave money on the table if we have to, but we're asking these guys to share in some of the pain right now because we did during the last two years. So if we give you guys more more freight, then hold the rates flat for 2023.

We gave a lot of money, you know, 10% to 12%, to 15%, in 2020 and 2021. But we’ll also look at it on a customer basis. We might take a cost increase to our top receivers we ship to every week, but then find ways to reduce transportation costs using the spot market or intermodal for lower volume customers, or low-volume lanes.”

THE NUANCE: I spoke with Dave Jackson, CEO of Knight-Swift Transportation. He bemoaned the sexy headlines, clickbait, and attention-grabbing buzzwords that do a poor job actually reporting on trucking correctly. Those stories miss the nuisance of a complicated topic.

I asked him about his view of the truckload contract market, and I am sharing his detailed answer. Pardon the length, but nuance isn’t Twitter-length:

“Contract rates with trailer pools are still very solid from a pricing perspective. That isn't noted in the indices looking at is the relationship between brokers and small carriers which is as transactional as it gets…

Normally when you see pressure on the spot, within a quarter you see similar pressure on contract. That did not happen in 2019. We think it's because of electronic logs that have made it where trailer pools became so valuable. So it's not all one size fits all discussion.

The live load, live unload capacity is dominated by the brokerage market with small carriers. But then you have this different this different group, which in our case we have 73,000 trailers scattered in the trailer pools and nine out of every 10 loads involves a trailer pool. That world doesn't move that the same kind of volatility that the spot market does. And it's a different type of value creation, and frankly, a different kinds of capital investment. And so, so those rates are going to be more resilient.

When I look at contract rates, how are they going to change? I look at a customer relationship where we have baseline commitments with them. And then over the last couple of years, we've seen a record number of special projects, or we'll call them pop-up projects where they've said, ‘Hey, we need help, we'll pay you X amount of days to do these shipments.’ Then there's been other projects where they have really acute needs, and we say we'll do it for this price.

As the world becomes less chaotic, and the demand isn't so strong, then what ends up happening is all of that pop-up business will morph back into one commitment to load hauls.

That will lead to what we charge with that customer to be lower year over year. It isn't necessarily because the contract rate is lower, it's because we're not doing 25% or 30% of our volume with them at a special project spot-type rate. We’re in the process of rationalizing down some of the ultra-high rates that we've done for customer. We're locking those into longer-term commitments at a more normalized rate.

From the outside, as we get into the back half of the year, you're gonna find in the fourth quarter, it's gonna be very difficult for our rate to be positive on a year over year basis.”

INTERMODAL SAVINGS: Earlier this month we released the JOC Intermodal Savings Index 2Q2022 report. You can download a free version below:

The entire 13-page report is available to anyone with a proper JOC subscription tier. Here is a snippet from the Premium Version:

The JOC Spot ISI had the lowest second quarter since 2019 and stands at the precipice of losing share to the truckload market. History shows when the index falls below 110, many shippers are unwilling to deal with the inconsistent service, issues with containers and chassis, rail demurrage, and detention fees, especially if the receiver has on-time and in-full requirements (OTIF) such as Walmart. When the index is below 110, any one of those one-time fees can make trucking the cheaper option…

As we wrote in our Q1 report, there was ample room to raise contract rates on intermodal shippers while providing strong savings to an average customer. Intermodal providers capitalized on this opportunity, raising rates 29 percent including fuel, and 19 percent excluding fuel year over year. Our numbers are closely in line with J.B. Hunt, which reported a 32 percent increase including fuel and 20 percent excluding fuel.

We’ll have a session to the JOC Intermodal Savings Index in Chicago. Click on the image for a special Please Haul My Freight discount on tickets:

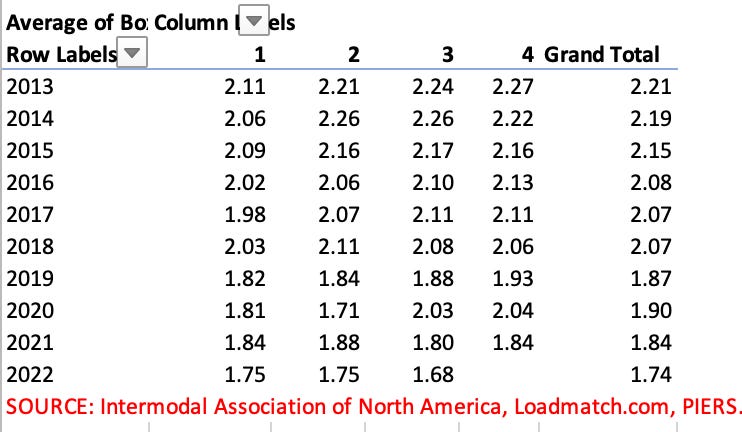

BOX TURNS: I will be doing a presentation for Echo Global Logistics in Chicago this month. One item I’ll talk about is box turns. Our estimates show an average domestic container did two revenue moves per month as recently as 2018.

Today the number is about 1.7. That means asset owners need 7% to 8% more containers and 17% more containers than 2018 just to carry the same volume.

How do we calculate this information? We take Jason Hilsenbeck’s data on 53-foot US container counts released in March, adjust the number monthly using PIERS import records for HS Code 8609.00 going to known domestic container owners.

We take the updated total of containers, then divide into the Intermodal Association of North America’s US-to-US monthly domestic container volume.

CLIFFHANGERS: Georgia Ports Authority CEO Griff Lynch is sounding the bell that a slowdown is on the horizon for volumes into the Port of Savannah. The on-the-water number — the total number of containers in route to Savannah — peaked around 265,000 containers and has since come down.

Lynch said the slowdown will begin in mid-to-late September.

There was NO FREIGHT CLIFF last month as the port handled 530,800 TEU, an 18% increase compared with July 2021. Even the Port of Long Beach reported a 0.1% increase year over year, and only a 1.8% decline in laden imports.

Freight was not “dropping off a cliff” beginning in “the first few weeks of July” in Long Beach or Savannah. Prognostications were for “not just a softening.”

Lynch believes August will be strong, but will there be a cliff in September or October?

“I was at dinner recently with an executive in the industry. I asked the person, ‘How do you see this happening? Do you see a recession? And the person believed it would be a dip, not a cliff.”

I further defined a cliff as more than 20% decline year over year, and a slowdown in that -0% to -15% category, and asked Lynch his opinion:

“I think it's hard to believe a drop of more than 20% would happen. And I don’t see us ‘reverting’ to pre-pandemic volume.”

To recap: Lynch predicts softening yes, in August no, in September maybe, in October yes, a freight cliff no, and “reverting to pre-pandemic levels” no.

SITTING ON THE DOCK: I’ve spoken to three shippers in the last two weeks complaining about how long containers are sitting in Los Angeles and Long Beach before they get onto trains going inland.

One shipper:

“I had two containers at TraPac finally loaded that were both at 80 plus days dwelling. One of the containers was sitting in TraPac for 81 days that just finally got on the railroad. Hallelujah!”

Another shipper had boxes sitting six weeks, and other problems too:

“We actually diverted a couple of containers that we needed that were hot. They've been sitting for two weeks in Southern Cal with no likelihood of loading onto a train anytime soon. So we diverted them to local, paid a diversion fee. And then our ocean carrier told us we have to pay the demurrage because it's been sitting for two weeks.

I said, ‘Are you kidding? I'm doing you a favor. And you want me to pay demurrage because you can't put it on a train?’ Shame on them. The FMC needs to get involved.”

A third shipper is turning to domestic intermodal:

“We try to transload about 50% of our cargo. We're up to the 70%, range now, transloading to J.B. Hunt containers because the transit is much faster than IPI out of Southern California.”

The railroads will argue that metering trains out of Southern California is necessary to prevent the collapse of the terminals in Chicago, Dallas, Kansas City, and Memphis.

BNSF and UP terminals in these cities are already extremely congested and marine chassis are in short supply. UP’s no cherry picking + demurrage policy is once again drawing the ire of the BCOs, but neither the FMC nor STB wish to intercede.

THE BCOS: Importers must accept responsibility too. A top drayage person in Chicago explained that the Fortune 500 retailers are jamming up the intermodal networks by letting inventory sit on marine chassis for weeks and weeks on end.

Containers will sit in drop lots and the BCO won’t separate the container and chassis as the cargo sits for weeks and weeks. The railroads are victims here too, the dray executive argued.

One shipper accepted blame when I asked him about it:

“It’s a vicious cycle, and you describe it very well. It is us BCOs. At the end of today, we are holding on to chassis. We are trying to release them by getting some storage trailers or finding extra warehouse space, but it is not happening as fast as we want. So just to secure ourselves, we're holding on a lot of empties in my yard for the sake of having chassis when we need them. Otherwise, I'm going to be shooting myself in the leg, but it's a vicious cycle. It is not right. And I feel really bad doing that.

But if I leave that chassis, I'm never gonna get it back. Plus once you put a container a stack, if the demand changes and that container becomes hot in couple of weeks, it could be very difficult to reach that box in the stack.”

MARINE CHASSIS: I wrote a cover story in The Journal of Commerce that explores continuing delays in chassis manufacturing. One of the fascinating conversations I had was with TRAC Intermodal. Here is what TRAC COO Val Noel told me:

“Domestic manufacturers are working extremely hard to make plants more productive, trying to hire labor, which has been a challenge. Labor has been a challenge and sourcing subcomponents hasn't made life any any more enjoyable either. But our industry definitely is suffering as a result of not having enough production.

Earlier in the year, it was steel, then it was around tires and the price of tires because of the use of petroleum in manufacturing tires. The componentry right now that's creating a problem for the industry is the suspensions. We’ve kind of played Whack-a-Mole as the year has gone along with different types of componentry being short supply.”

DSV AMBITIONS: The Wall Street Journal reports the international freight forwarder is targeting US acquisitions:

Chief Executive Jens Bjørn Andersen has declined to comment on recent reports by Reuters that DSV is now turning its attention to the global forwarding arm of C. H. Robinson Worldwide Inc., the largest freight middleman in the U.S. with more than $23 billion in revenue last year and a market cap of more than $14.6 billion as of Thursday. But he made clear in an interview this month at DSV’s headquarters outside Copenhagen that DSV has big ambitions and the U.S. market is a key target.

Last year there was a rumor that Maersk wanted to buy C.H. Robinson’s global forwarding arm, but C.H. Robinson said it would only entertain selling the entire business. Did that happen? Who knows? Rumors are rumors, not fact.

PORT OF BALTIMORE: Drivers picketed outside the Port of Baltimore on August 11 protesting long turn times and detention. It’s not the first time drivers have complained about turn times in Baltimore. More from WBAL.

TEXAS RAIL: Conversations are underway to connect Plaquemines Port Harbor, outside of New Orleans, with the Dallas-Ft. Worth via BNSF and UP. More in this story from Transport Topics.

GREEN TRUCKS: The Inflation Reduction Act could deliver a big boost to electric commercial vehicles, according to a Bloomberg article:

The federal government will start doling out up to $40,000 tax credits per heavy-duty truck purchase. While these big rigs can cost upwards of $300,000, that’s a serious incentive, especially considering the vouchers that states including California and New York are offering.

THE BIG APPLE: The Metropolitan Transportation Authority — the MTA as we New Yorkers call them — is proposing a congestion pricing plan for New York City. From CBS 2 in New York.

In one scenario being proposed for congestion pricing, during peak hours small trucks could pay anywhere from $12 to $65. And for large trucks, the price could be anywhere from $12 to $82.

SUNSET: One of our data partners, Sunset Transportation, was recently given a Customs-Trade Partnership Against Terrorism (C-TPAT) certification. Less than 1% of 3PLs in the US have C-TPAT certification.

Here is what Lindsey Graves, CEO of Sunset Transportation, said in a statement:

“We place a high value on the measures and protocols Sunset has in place to protect our customers’ supply chains from nefarious activities such as human & drug trafficking, terrorism, the smuggling of contraband, and the transportation of invasive wildlife species.”

JOC INLAND: If you enjoy Please Haul My Freight, please attend the JOC Inland Distribution Conference from Sept. 26 to Sept. 28 at The Westin Chicago River North.

Click the image for a special discount:

Any opinions in this blog represent the author’s views, not the Journal of Commerce, IHS Markit, or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to JOC subscribers with the proper subscription tier.

Not a JOC subscriber? Click here to become one.

We thank our data partners in the JOC Shipper Truckload Spot Rate Index: Cargo Chief, DAT Freight and Analytics, digital freight broker Loadsmart. We also thank the shippers and 3PLs who contribute to this index on the condition of anonymity.