Welcome to Edition 10 of the Please Haul My Freight newsletter. Here are some of the items in my notebook this week:

APL LOGISTICS: The wholesaler is leaving BNSF Railway to partner with Union Pacific Railroad on Jan. 1, 2022. APL Logistics owns just shy of 1,000 containers, according to Jason Hilsenbeck. Remember, Swift Intermodal will officially join UP next week too. A source close to the situation told me:

“This had nothing to do with APL Logistics’ relationship with the BNSF. BNSF always treated APLL like APLL mattered. They are a class organization and have been a major part of APLL’s growing intermodal business the past several years.”

Without APL or Swift, the other options besides J.B. Hunt and Schneider are C.H. Robinson, COFC Logistics, and Matson Logistics. COFC and C.H. Robinson have the most containers of the remaining non-Hunt, non-Schneider providers.1

DETENTION-DEMURRAGE: The Federal Maritime Commission issued three policy statements Dec. 28 clarifying several points around complaints on issues such as detention and demurrage. Among the key parts:

“Because an individual or company may face challenges to bringing a private party complaint unrelated to the complaint’s merits, the Commission emphasizes that individuals and companies are not the only persons who may file complaints alleging violations of Title 46, Chapter 411. Rather, any person may file a complaint alleging a violation, including shippers’ associations and trade groups or trade associations.

An association could thus file a complaint to protect the interests of its members even if the association itself did not suffer actual injury. This does not mean, however, that the nature or status of the person filing a complaint is inconsequential. Reparations, for instance, are only available to a person who suffers ‘actual injury’ caused by a prohibited act.”

Also language on the anti-retaliation provisions:

“For this system to function effectively, shippers and other industry participants must be able to raise claims with and provide information to the Commission without fear of retaliation for having done so. The Commission has, and will continue, to take seriously and investigate thoroughly allegations of carrier retaliation.

The Commission confirms that: (1) although § 41104(a)(3) protects ‘shippers,’ that term includes more than just cargo owners; (2) protected activity includes not only filing a complaint with the Commission but also participating in Commission investigatory or enforcement efforts, commenting on a rulemaking, or using Consumer Affairs and Dispute Resolution Services.”

This comes as the FMC is taking a hard look at Hapag Lloyd with the Ocean Avenue Express complaint. The FMC is also investigating whether Ocean Network Express violated the US Shipping Act, and whether Wan Hai lines unfairly charged detention penalties on cargo owners when marine terminal operators would not accept the empty containers. Several important FMC cases we will monitor going into 2022.

RAIL VOLUME: Intermodal traffic is down in Q4 and it’s more than just a tough year-over-year comparison. The Association of American Railroads reports 4,039,950 containers moved between Weeks 40 and 50. That’s the lowest number since 2016. It’s also true when adding in Week 51 (see below), which includes data from everyone except BNSF.

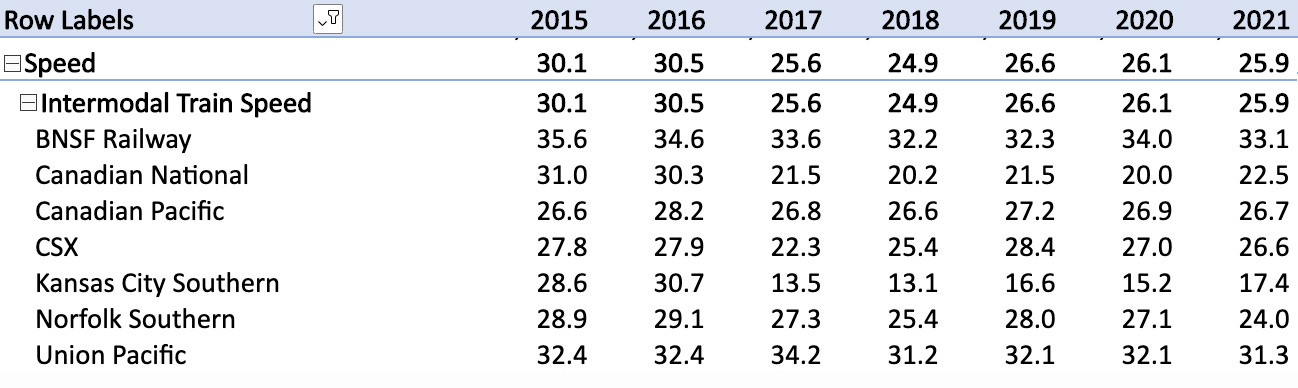

Intermodal train speeds are also slower between Weeks 40 and 50 than in 2019 or 2020. Usually when intermodal volume goes down, average train speeds go up. Not so this year.

To defend the railroads, truck companies tell me congestion is nowhere near as bad today as it was in Q2 and Q3 in Chicago, Kansas City, Memphis, and the Ohio Valley.

What are you seeing on the rails these days? I’m eager to hear from you!

STAGGERING: Xeneta produced an insightful recap about the ocean shipping industry, arguing “As Long As Reliability In Container Shipping Remains Low, Interest In It Will Remain High.”

“If rates on one trade suddenly shoot upwards, as was the case in the Far East to US rates, rates on other routes follow the trend to keep them attractive to ship operators — otherwise, they just move the ship. Adding on to this effect, some operators decided that despite higher freight rates on their usual trade lane, they still prefer to send their ships to the most lucrative market. Reverse cascading saw smaller ships…deployed on the Transpacific trade lane.

The extra ships got stuck at anchorages, some of which set sail without the necessary agreements with terminals.

Lastly, a delay at destination ports means that ships are often late to start their next scheduled (origin) departure, leaving carriers with a blank sailing option or finding another available ship. This left everyone scrambling to get hold of the spare capacity available on the charter market…

Many new ships, ordered this year, will be delivered from 2023 onwards and will add capacity on the sea. However, unless ports and hinterland connections can ensure the free flow of cargo, end-to-end, these extra ships will instead just join the queues outside the ports — just as we have seen with the extra loaders added on the Transpacific in the past few months.”

Do you agree or disagree with Xeneta? Let me know!

IPI MATH: To solve the hinterland connections, ocean carriers have either denied IPI bookings or raised floating rates on NVOs so high that IPI is cost prohibitive. See the following post to my colleague Bill Mongelluzzo from Nicolaus Mateus, an import logistics manager with Furniture Manufacture.

“Your article should be more directed to the container owners not letting #importers / #BCOs borrow their equipment inland without paying a hefty fee of $8,000+. Although the below is an example in the East Coast, I will bet you a beer (payable at #TPM22) that it will be the same scenario for importers in Chicago who want to rail containers from LA/LB ports.

At the end of the day, #trucking will be a more reliable and faster way of transporting #containers inland (in most cases):

— Current spot rates to Savannah from Shanghai (port to port) ~$14,500 FEU

— Current spot rates to Atlanta ramp via Savannah from Shanghai (port to ramp) ~ $24,000 FEU”

Mateus is saying that the ocean carrier will charge $14,500 from Shanghai to Savannah, but if the same importer wants to ship from Shanghai to Atlanta through Savannah, it’s $24,000. In other words, nearly $10,000 for the IPI!

It’s no surprise IPI was down 17% year over year in November and down 12% over the last three months, according to the Intermodal Association of North America.

TRUCKLOAD RATES: Transloading into 53-foot dry van trucks is one reason why over-the-road spot rates keep rising. Our latest December data2 from digital freight broker Loadsmart shows the weighted national broker-to-shipper rate is up 6 cents from November to $3.24 per mile. The data tracks retail rates for shippers, a compliment to DAT’s Trendlines of broker-to-driver wholesale rates.

Although the California outbound rates are settling down, the rates out of the Pacific Northwest are quickly rising. I’m not sure whether this is because our sample size is bigger in California than Oregon and Washington, but certainly there is a lot of transloading in Portland, Seattle, and Tacoma right now.

UYGHUR MUSLIMS: US President Joe Biden signed the Uyghur Forced Labor Prevention Act last week to push back against China’s treatment of Uyghur Muslims, which human rights advocates call genocide. The law bans imports from China's Xinjiang region. Unfortunately very little cargo comes from Xinjiang, as Steve Ferreira points out. I could only find 324 TEU imported from the region since Jan. 1, 2020, according to PIERS, a sister product of JOC.com within IHS Markit. Some products include Dig It Toys made by MB Wolverine — which I could not find in stock with any US retailer — and girls knit pants sold through a small online-based shop.

COME TO WASHINGTON D.C.: Reciprocal switching is a hot-button issue among non-intermodal railroad users. The Surface Transportation Board will hold a hearing next March at its DC headquarters on reciprocal switching. Railroads and shippers have duked it out over reciprocal switching for years. Railroads oppose it, calling it “forced access.” Many shippers support it, calling it “competitive switching.”

SAVE THE DATE: If you haven’t registered for TPM 2022 in Long Beach, California, February 27 to March 2, then your New Year’s resolution must be to attend our conference. I will moderate sessions on the following topics:

When will the market get enough marine chassis to make a dent in the port congestion?

How do shippers view detention and demurrage given all the congestion in 2021? What’s next on the detention and demurrage issue? What about rail storage fees?

After the yo-yo in IPI volume in 2021, where do we go in 2022? What is the proper balance between IPI and transloading? Not so much IPI that rail ramps are overwhelmed but enough IPI loads to keep drivers busy. And what can ocean carriers, NVOs, railroads and trucking companies do to keep the pendulum balanced in 2022?

A possible surprise railroad guest!

HAPPY NEW YEAR: Shana Tova. L’Chaim!

Any opinions in this notebook represent the author’s views, not the Journal of Commerce or IHS Markit. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion on anything I wrote or a subject you’d like me to cover?

Email me ari.ashe@ihsmarkit.com to send your thoughts. You may also request our data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paid JOC subscribers. Don’t have a JOC subscription? You can change that!

I will add that Garry Old of COFC and Tim Humbert of C.H. Robinson are really good guys.

I thank Russell Jones of Cargo Chief, Ken Adamo and Dean Croke of DAT Solutions, Giovanni Battistella and Flavio Truzzi of Loadsmart, Connie Morgan and Shane Thomas of Sunset Transportation, and Andrew Lynch of Zipline for constantly feeding data to the Journal of Commerce to compare truckload and intermodal rail rates every week. Many thanks to our anonymous 3PLs and shippers who send us information — you know who you are.