Welcome to Please Haul My Freight: Edition 19. Here are some items in my notebook this week:

TRUCKING RATES: There is definitely a cooling off in the spot dry van truckload market. Demand and rates are supposed to rise at the end of the quarter, but it’s not happening. Drivers are unable to negotiate higher fuel costs into spot transactions with brokers.

One shipper told me it’s already impacting truckload contracts:

“We are renegotiating our contracts right now. Even from when we started, which was only a few weeks ago, to where we are at today, we have motor carriers calling us to ask ‘Can we update our offer?’ We are in the middle of negotiations, they've given us an initial offer, then they're calling to say, ‘Hey, we'd like to adjust it down even further because we want to protect our revenue.’ That's happening right now.”

Jim Nicholson and Jon Payne of digital freight broker Loadsmart believe the market is changing. Could it be a head fake? For sure. All I can say is we are watching.

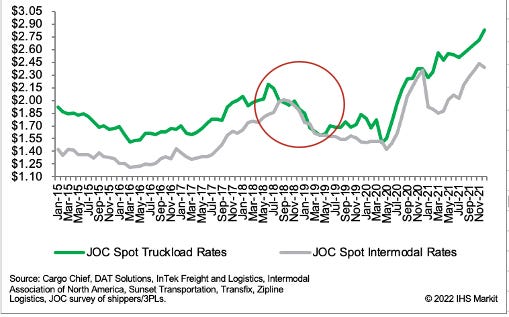

INTERMODAL: Railroads must watch the trucking chart closely, or else they will repeat 2018-2019 (red circle) when the industry was too slow to change to the market.

Shippers said: It’s not worth the hassle to use intermodal if truck capacity is plentiful, faster, and cheaper than rail.

Yes environmental concerns matter, but service and price matter more. And railroads aren’t not doing great with service or rates right now.

From one large IMC:

“There are no 53-foot chassis. You've got 900 containers stacked in KCS Wylie because they don’t have chassis. Pricing is a problem too. UP is getting pretty egregious right now with the [West Coast] surcharges. We're moving volume on trucks versus putting it on the UP. And the thing is that volume is down because the railroads have limited the volume, due to their own operating inefficiencies.”

What is at the root of the inefficiencies?

“They need manpower [in the terminals] and they just can't get it. That's something the railroad may admit one-on-one with us, but they don't want to publicly say it’s the problem. They're struggling to find people [to work in intermodal terminals].”

From a smaller IMC with a book of business in Atlanta:

“CSX Fairburn is struggling. There's been a full revolt from the local draymen in Atlanta. If you get anything touching CSX Fairburn, you have to pre-pull ahead of time. You are not going to make your appointment. You won't even get a driver to accept it. And drivers are no longer willing to roll with the punches at CSX Fairburn. If you want to run out of that ramp, you're paying a premium, you're paying surcharges, you're paying rail storage. We use Norfolk Southern.”

But the same IMC said CSX is performing better than Norfolk Southern outside of Atlanta and Chicago (Bedford Park). NS has consistently struggled in Jacksonville.

AND THE WINNER IS: STG Logistics purchased XPO’s intermodal and drayage division for $710 million last week. More on the details in our story, but it makes sense because STG CEO Paul Svindland was the COO of Pacer International before the 2014 sale to XPO Logistics. Now XPO sells the Pacer business to Svindlind.

STG is known for its less-than containerload (LCL) transload service which leans on J.B. Hunt Transport Services.

Maersk and STG were two of the five parties involved with XPO back in November. Svindland told me he was impressed with the business and former Pacer International VP Paul Smith, who went to XPO in 2014 and will come to STG in 2022.

“When [Pacer] sold to XPO, the business was automotive centric. Fast forward to today, they have 11,000 containers, they're all brand new, and they got some large blue chip, retail and e-commerce customers…

Our goal is to get up to 25,000 containers in the next five years. I’m very confident we can do that. XPO put in an order in for 2,000 containers and we already upped the order for another 2,000, which will take us to 15,000. The expectation would be to order at least at 2,000 per year for the next five years.”

No changes for existing XPO customers. STG will provide capacity to non-asset IMCs, domestic shippers, and for international transloading.

“We will slowly and methodically integrate the traditional legacy STG LCL business. We are going to migrate that over to XPO, now the STG Intermodal network. We are not going to cannibalize any existing business. The reason we're getting 2,000 additional containers is 1,000 are going to be for the legacy STG business. But we will not start migrating legacy business until we receive those boxes. No existing customer of XPO intermodal, now STG Intermodal, will be negatively impacted by this deal.”

No impact either on STG’s relationship with J.B. Hunt because there is enough demand to fill XPO and JBHT boxes. The XPO/JBHT combination gives STG customers access to BNSF, CSX, Norfolk Southern, and UP.

NO CHERRY PICKING: "Not again" is how the truckers put it. Here is the latest on the marine chassis shortage in UP’s Kansas City from a drayage executive:

“The UP will stack the boxes until they get TRAC chassis, and will not unstack the boxes, even if we bring in our own private chassis. They continue to charge rail storage fees [demurrage] but won’t let us get the container out.”

The UP’s no cherry picking policy is something that I’ve written about many, many times. No changes. Trucking companies tell me:

“It is hard to believe that it is legal. They are holding these boxes hostage for their own monetary gain. You should investigate this.”

Here is UP’s statement on this issue:

“Union Pacific has consistently taken steps to provide a seamless and efficient out-gating process for all our customers. We have invested in technology and assets and communicate daily with our shippers, chassis providers and other members of the supply chain to ensure the most productive handling of the freight.

We believe out-gating the longest dwelling containers first is a cost-effective strategy for shippers. When containers must be stacked, select unstacking creates inefficiencies that have negative downstream effects to resources and an intermodal operation. With advance coordination at larger terminals, we have been able to accept private chassis and unstack longer dwelling units to make those available. These are tactical decisions and are day-to-day and ramp-to-ramp.”

UP wants its terminal staff to focus on loading and unloading trains. If crews broke down stacks, grabbed single containers, then rebuilt stacks, it would cause inbound trains to bunch and outbound trains to depart late, the UP argues.

The Surface Transportation Board referred me to this letter to UP in July 2021:

“It is important to underscore that, at this time, the Board has not initiated any actions with respect to the existing intermodal exemption...Right now, the Board’s principal concerns are helping to mitigate the congestion problems at intermodal yards caused by the unprecedented economic situation, improve network fluidity, and provide relief to shippers and receivers who are not in a position to reasonably avoid onerous and potentially business-threatening storage charges.”

ARI’S OP-ED: Remember opinions are mine and don’t represent anybody else.

If this happened at a port, the Federal Maritime Commission may rule it a violation of the U.S. Shipping Act because the fees are incurred through no fault of the BCO. Demurrage is meant to incentivize BCOs to pick up containers in a timely manner, according to the FMC. Rail storage is meant to do the same. If that cannot happen for a reason beyond the control of the BCO, then the fees do not serve as an incentive, the FMC has consistently said. Unless the STB reopens the intermodal exemption, however, and adopts an FMC standard, nothing will happen. If an NVOCC or a drayman is upset, then they should formally complain to the STB.

However, BNSF shows us that a “we will cherry pick” policy leads to multi-hour lift lines. If truckers expect to cherry pick and do so quickly, that’s unrealistic. That won’t happen. And to the extent shipper C cannot find a chassis because shipper A and shipper B held onto chassis too long, it’s neither the fault of shipper C, nor Union Pacific. It’s really on shipper A and shipper B.

PORT OF LOS ANGELES: There is a story in the New York Times about the possibility of a port strike on the West Coast.

This time, odds for a deal without drama are “50-50,” declared Jim McKenna, the chief executive of the Pacific Maritime Association, which represents the shipping terminals in talks with the union.

Talks begin May 12.

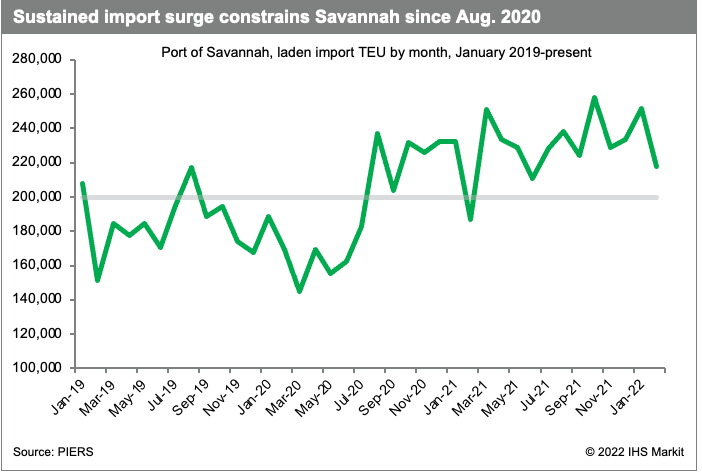

PORT OF SAVANNAH: Savannah has been free flowing since mid-January, and the port will spend more than $538 million to keep it that way as often as possible. Money will go to construct Garden City Terminal West and purchase seven ship-to-shore cranes from Konecranes.

So are these changes being done to address the new reality? By new reality, just compare August 2020-present versus January 2019-July 2020.

GPA CEO Griff Lynch said:

“Yes, we're adding more capacity, and in a traditional environment, we wouldn't have to add most of the things we've done. If we had cargo sitting here for four days, not 11 days — that's two to three times longer — it wouldn’t be necessary. But it means much more space is required in the yard…

We’re better positioned today to handle the vessels coming in, but we're not fully there yet. We are adding berths, but we have a lot of freight coming at us. And, there are a lot of ocean carriers frustrated with congestion north of us, and actually all up and down the East Coast.”

More than 24 are anchored outside the Port of Charleston, and 7 to 15 vessels outside the Port of New York and New Jersey and Port of Virginia since February.

DOCUMENTARY: The Wall Street Journal has released a 54-minute documentary called “Why Global Supply Chains May Never Be the Same.” I won’t get through it in one sitting, but I’ll watch it because of the immense respect I have for the WSJ team.

TURNING THE TIDE: Parsec switched its terminal operation software from Oasis to Tideworks in BNSF Logistics Park Chicago last month and the transition has been turbulent, as I wrote in the edition entitled “International Intrigue,” Tideworks Technology reached out to me about NS Jacksonville, so I asked for an update:

“We appreciate the transition has faced some hurdles, as there can be with any technology or process changeover for a terminal of this magnitude. BNSF is committed to Tideworks, and the groups are still working through the go-live…

It’s important to analyze operational impacts; however, it's too premature in this go-live to provide a comprehensive analysis of the deployment.”

TRAC CHANGES: TRAC Intermodal announced Jim Bowe has retired as Chief Commercial Officer. TRAC named Jake Gilene as his replacement.

JOC INLAND: I encourage readers of Please Haul My Freight to register to attend our conference in Chicago. If there is a topic you’d like JOC to cover in September, then please e-mail me. I always welcome suggestions:

Any opinions in this notebook represent the author’s views, not the Journal of Commerce, IHS Markit, or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paid JOC subscribers. Not a paid subscriber? You can change that!