WARNING: This edition will have a lot of rumor and opinion as this edition covers what I heard through my meetings at TPM 2022. Please, please, please remember rumors are just that. Rumors are not fact. Rumors are not news stories. Rumors are rumors and only rumors. Treat them as such.

Welcome to Please Haul My Freight: Edition 16. Here are some of the items in my TPM 2022 notebook:

DETENTION AND DEMURRAGE: I talked to a shipper at TPM22 which spent millions in detention and demurrage in Los Angeles-Long Beach in 2021:

“They're shortening the free time and raising the demurrage fees. You can't get appointments to pick the stuff up, or appointments to return the empties. I would say probably 75% of our detention and demurrage was unfair, perhaps more. I'm gonna spend [omitted figure] million dollars which gets me nothing over 12 months.”

He blames the lack of free time for demurrage:

“We’ve got four days out here [in SoCal]. I can't get anything out of the ports in four days out here. We used to have 15 days in Savannah. We don't have that anymore.”

But not all demurrage is unfair demurrage.

Michael Shaughnessy Jr. of Balsam Brands outlined clear examples of questionable penalties on the West Coast, but he acknowledged cases when his warehouse was full:

“We had to fix the warehouse piece so that we get more throughput in the warehouses, and when we can't do that, it’s our responsibility to pay demurrage.”

Steven Hughes, who serves on the FMC Shipper Advisory Panel, also acknowledged not all demurrage is egregious:

“If a company consciously brings in let's say 100 containers, and they know that they only have space at the warehouse for 50 containers, and their DC isn't up to snuff, then that’s an issue that that company has gotten into if they have to leave it at the port. I'm sorry, but yeah, they should be paying the demurrage because it’s not the fault of the port or the terminal if they haven't planned effectively, or if they have a transportation problems outside of the terminal that are causing them to store those containers on terminal.”

Are there cases in which the D&D is highly questionable? Absolutely.

Are there cases in which the D&D is reasonable, fair, and appropriate? For sure.

What is happening in Charleston reminds us that a terminal has a finite amount of space. When 7,000 containers sit 15+ days and 3,000 containers sit 30+ days, there are consequences on port operations resulting in 24 vessels anchored outside the harbor.

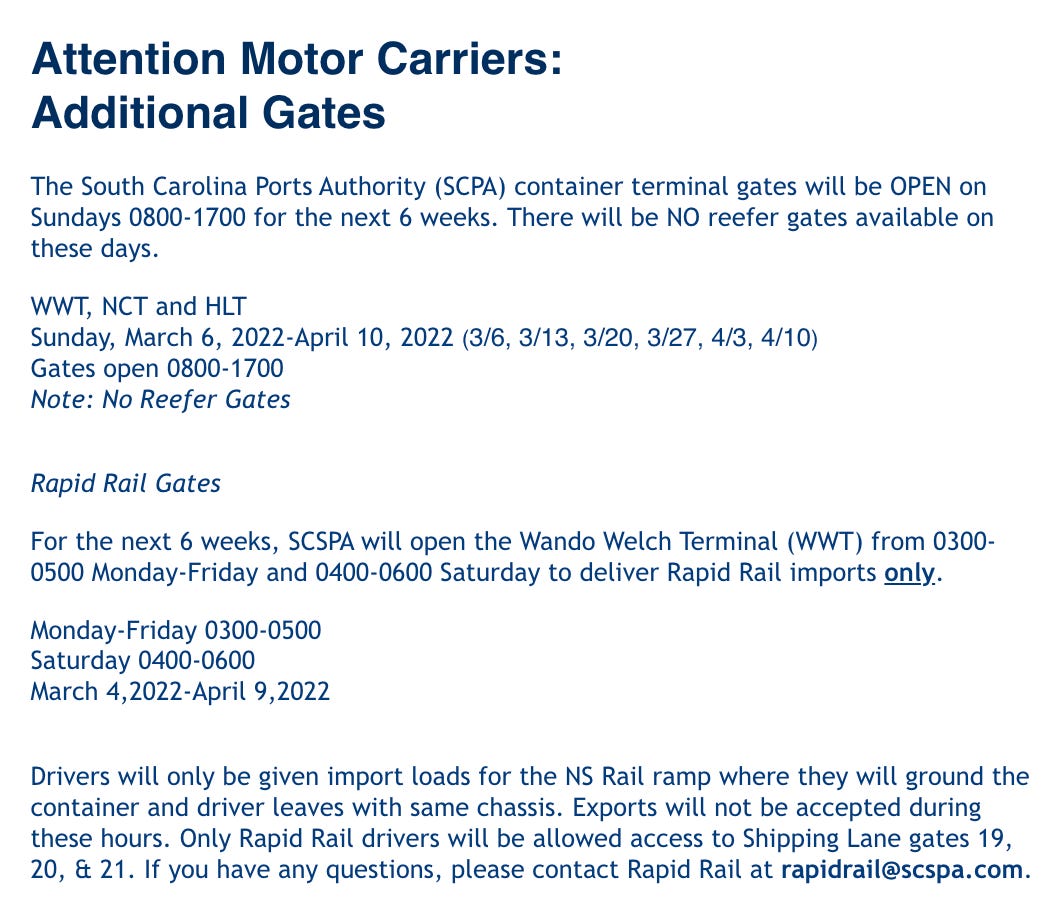

DUM SPIRO SPERO: The Port of Charleston is opening on Sundays to clear the backlog of vessels. SC Ports CEO Jim Newsome told TPM22 there are ~26,000 import containers in Charleston port terminals right now. Two years ago, the total was 6,000.

The Rapid Rail Gates is targeting Norfolk Southern, which is limiting exports to Charleston from Atlanta and Memphis. The SC Ports plan is:

Drivers pick up imports in the Wando terminal for NS in the morning.

Dray the imports to the NS Charleston terminal.

Drop the import off and then re-use the chassis to grab an export load.

Dray the export from NS Charleston to the Wando terminal in afternoon.

PORT STRIKE: Shippers are already planning for a US West Coast port strike:

“It's cheaper for me to go through Houston, transload and truck it to Southern California than LA-Long Beach because of all the demurrage. I'm diverting probably 150 to 200 containers per week to Houston. If there were a strike, we would end up coming through Houston with the majority of that stuff.

I'm looking at some things in Mexico as well. It's a little more fragmented, but you have to have those conversations.”

Here is what another shipper said about using New York and New Jersey as a hedge:

“I've always brought in through both coasts, but the East Coast was always on a lower scale. Now I'm intentionally increasing that. It's more of kind of like risk mitigation, right? We know some lanes can take longer and maybe it’s going to cost a little bit more, but it won’t cost as much as airfreight during a port strike.”

A third shipper told me he’s talking with ocean carriers about using Savannah as a workaround to the Midwest.

DRAYAGE: Contract drayage rates are going up in Dallas and Los Angeles. One shipper told me about his approach:

“The companies that service us are those that really support us. It's very easy to see the shiny big logos and the big brands paying big dollars. If you take that, that tells me a lot about you as a company. We will stick with our dray partners when this market is over, will they?”

Here is a real-life example from a trusted source. Walmart agreed to pay big bucks to Carrier X [I am omitting the name to protect the innocent] in Dallas this year to cover an anticipated increase in volume for Walmart’s distribution center in Baytown, Texas. What happens?

Carrier X offers bonuses and higher wages to hire drivers to handle the Walmart business.

Drivers ask Carrier Y and Carrier Z to match Carrier X’s offer.

Carriers Y and Z agree because you cannot run a drayage operation without drivers.

Carriers Y and Z raise dray rates to their mid-size and small BCOs. You can’t survive as a business with negative margins.

Dray rates go up for everyone.

Expect contract dray rates to rise as long as the big brands will pay big bucks.

STREET TURNS: CMA CGM and APL are adding a new $15 fee for street turns in domestic repositioning programs (DRP). This is when a domestic load is put into an ocean container to go from east to west. The domestic load is unloaded at the West Coast customer, then the empty is returned to the port to go back to Asia.

I spoke with Tony Barnes of ROAR Logistics, which does a lot of domestic repositioning business:

“We have been using the Avantida software for about two weeks now and it works very well, instantaneous approval for street turns as long as the box is an active CMA unit – whether owned or leased – which is very helpful to us versus having to wait on their equipment team in Norfolk to provide approval, which at times has taken up to an hour, depending on the time of day. If the box is not within the CMA system, instantaneous declination of request is good as well. System seems to be simple to navigate with minimal training – so very user friendly.”

Critics point out it is bad policy to charge administrative fees for street turns, which benefit motor carriers, shipping lines, and exporters alike. Efficiencies reduce costs for CMA CGM in the long run, so why disincentivize the practice? And the charges will trickle down to the BCO.

MORE WAREHOUSES: During one of my sessions, an audience member asked: Can one solution be that shippers reduce their length of haul by having more physical distribution locations?

Holly Pierce of C&D Trojan answered:

“That is a long-term solution for what I hope is more of a short-term problem. Getting involved in real estate and labor as well as all the equipment and setup costs for multiple distribution centers is unwelcome, especially in a time when margins are eroding quickly due to supply chain costs.”

Pierce also discussed the idea of 24-7 operations at the ports:

“If you don’t have warehouses with three shifts, seven days a week, it doesn’t matter. If you don’t have dray truckers who are willing to come in at 2 a.m. on a Saturday, it doesn’t matter. If you don’t have the labor in place to sufficiently move and carry that product, whether on an ocean container, on the rail, or transloaded into an over-the-road truck, it doesn’t matter.”

The common retort is: it’s a pay shortage, not a labor shortage. But she said offering higher wages hasn’t made a difference.

UNION PACIFIC: An IMC source warned against reading too much into UP’s comments about its commitment to non-asset business. The source made four points:

UP’s agreement with Schneider and Swift provides a large number of appointment slots, an exemption to appointment rationing, and a guarantee any rolled cargo will get a train the following day.

Much of the 5,600 new UP chassis will assist Hub Group, which doesn’t have an insourced chassis pool. The 5,600 also address the new realities of drop-and-hook which elongate street dwells and require larger chassis pools.

UP’s investment in GPS devices is a minimum capital expenditure.

UP is not buying or refurbishing UMAX containers, retiring the boxes or selling them. UP remains committed to EMP containers because Hub Group and UPS use EMPs during peak season. EMPs are also used in Mexico.

If true, non-asset IMCs will have trouble getting appointment slots. Intermodal analyst Larry Gross briefly touched on this point in the TPM22 intermodal panel:

“They [Union Pacific] are not investing in the rail-owned fleet. What is going to be the mechanism by which small IMCs are going to have access to capacity? If railroads in the era of PSR are not going to invest in more domestic containers, then someone else is going to have to fill in the gap.”

BNSF-SCHNEIDER: BNSF did not know that Schneider was leaving to join Union Pacific and were totally surprised in January, according to two sources. Dave Jackson, CEO of Knight Swift Transportation, told Bill Cassidy and me that BNSF put Swift Intermodal at the bottom of the totem pole after it announced a move to Union Pacific. I’m sure BNSF has quite a different story, so I am not suggesting the Knight Swift version is fact.

Nevertheless, an intermodal veteran told me Schneider customers are right to be concerned about service on BNSF later this year:

“If there are only a couple spaces left on the train, who do you think is going to get loaded: the orange box [Schneider] or the blue box [C.H. Robinson]? You’re going to prioritize the customer who isn’t leaving in a couple months for your competitor.”

One Schneider customer is talking with Hub Group and J.B. Hunt about putting more loads on their networks. The customer wants to use J.B. Hunt in the future because its supply chain matches better to BNSF’s intermodal network.

The second shipper told me:

“We’re about 50-50 between J.B. Hunt and Schneider. All our international transloads go to J.B. Hunt, but we use Schneider on a lot of our domestic moves. It probably won’t be 50-50 anymore [in 2023].”

Conversely, a third shipper may give Schneider its Los Angeles to Seattle volume after the switch because it uses Schneider on CSX in the eastern US.

CH ROBINSON: C.H. Robinson handed two board seats to activist investors Ancora Catalyst Institutional and Pacific Point Wealth Management LLC last week. A knowledgable source likened this to activist investors who ousted J.J. Ruest at Canadian National Railway and Michael Ward at CSX Transportation. If true, then CEO Bob Biesterfeld’s job is in jeopardy, or minimally he’s on thin ice because of the underperformance of the North American division.

That probably also means any Maersk takeover is no longer an option.

TL REVIEW: Shippers and brokers who move dry-van truckload loads told me rates have come down a little bit in the last 30 days. Data from DAT Solutions and the JOC Shipper Truckload Spot Rate Index show this is accurate. Our outbound dry-van shipper rates were flattish month-over-month in February. Our weighted national number fell 1 cent to $3.37 per mile, but our unweighted number rose 2 cents to $3.80 per mile, according to JOC’s preliminary February estimates.

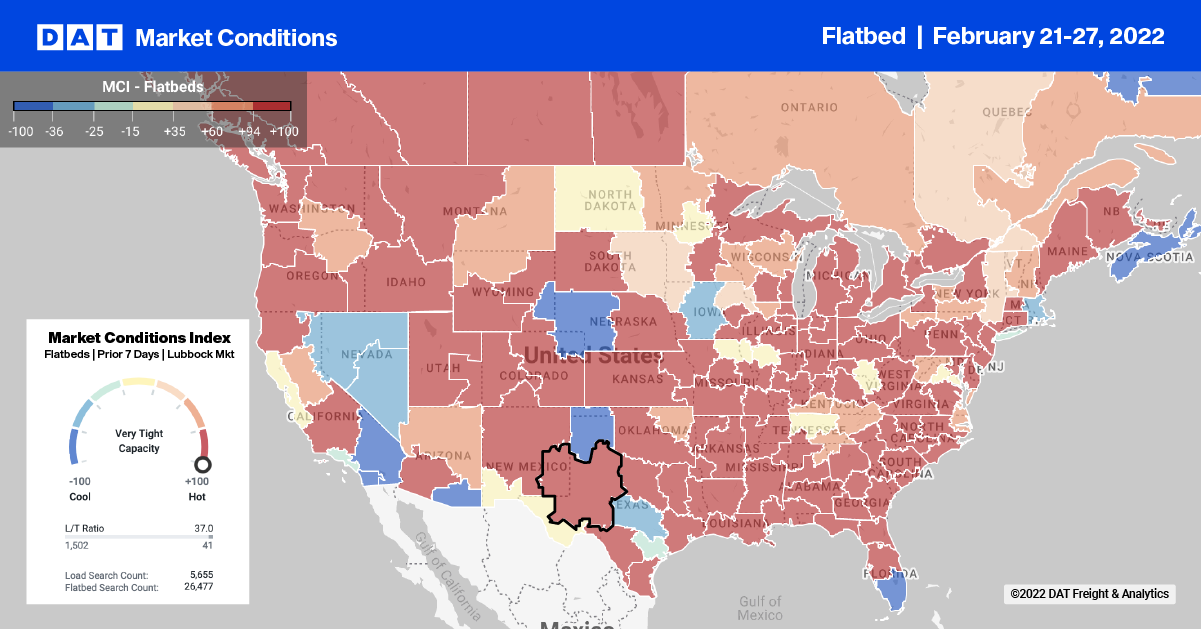

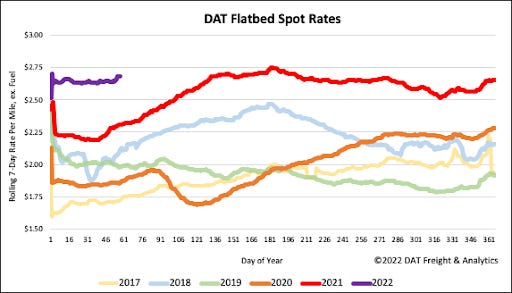

Flatbed and temperature-controlled truck rates remain hot (pun intended). One reefer broker told us:

“The holidays were crazy for reefer. For something we would normally pay $2,500, we were paying $4,500. After the holidays, they started to come down a little bit but it's still pretty rough. Nobody wants to handle produce. If drivers late to a stop, they're they're going to get a fine and nobody wants to deal with that.”

Here is some flatbed data from DAT:

LTL REVIEW: In a previous edition of this reporter’s notebook, I mentioned a shipper said his LTL rates were up 10%+ in 2022. I spoke to two other shippers at TPM which said their LTL contract rates were up 5% to 7%. Another shipper said “definitely 10%+”, so it depends on the customer.

We asked shippers for their opinions on carriers:

ArcBest: “We use ABF [Freight] for all our moves and they are great. No complaints. They do a great job.”

Estes: “Estes is up or down. There are some LTLs that are probably are better than others, but they all fall down.”

R+L Carriers: “There are some areas where they've struggled, but overall they are a good provider and we have a great relationship with them.”

Yellow: “We use Reddaway and we’ve struggled with them over time. They've had a lot of labor issues and a lot of turnover in their management team.”

KNIGHT RIDER: Remember how Knight-Swift bought AAA Cooper, Midwest Motor Express, and Midnite Express? Dave Jackson told us that Knight-Swift’s vision is to build a national LTL network, and teased potential future acquisitions when I noted how his network doesn’t cover the West Coast/PNW and Northeastern US. I spoke at TPM22 with an LTL source to spitball some possibilities:

The Dependable Companies: West Coast LTL

A. Duie Pyle: Northeast LTL

Pitt Ohio Transport Group: Northeast and Midwest LTL

AMA Transport: Northeast LTL

Ward Transport: Northeast LTL

Of those options, I think Dependable Companies and A. Duie Pyle are the best matches.

Any opinions in this notebook represent the author’s views, not the Journal of Commerce or S&P Global/IHS Markit. Any rumors in this notebook are just that: gossip. Unconfirmed. Not news stories.

Do you have an opinion on anything I wrote or a subject you’d like me to cover?

Email me ari.ashe@ihsmarkit.com to send your thoughts. You may also request our data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paid JOC subscribers.

Don’t have a JOC.com account? You can change that!