Welcome to Please Haul My Freight: Edition 14. Here are some of the items in my notebook this week:

HUB GROUP: Forget any thoughts that Hub Group will leave Union Pacific Railroad for BNSF Railway. Dave Yeager put the kibosh on that:

“As far as some of the new entrants that are coming on to the Union Pacific, we've been competing with them for many, many years. And so we really don't foresee a significant competitive change. I'd point out that Hub as the largest intermodal partner on the UP. In fact where we're twice the size of Schneider intermodal and five times the size of Knight intermodal. We also have 40% more drivers that we have allocated towards the intermodal than either of our competitors. We have a great relationship with the UP.”

Hub also ordered 6,550 containers for 2022, or a net growth of 6,000 when you filter out retired containers. It will also purchase 550 reefer containers.

SCHNEIDER: After Swift announced it would leave BNSF for UP last summer, a source told me BNSF deprioritized Swift through allocations, stacking, and parking boxes. BNSF may have a different story and gossip is not fact. But one Fortune 500 shipper is concerned this will also happen to Schneider. Schneider said it does not believe service will be disrupted in Q3 or Q4 and BNSF will live up to its contractual commitments through Dec. 31, 2022.

Schneider does not foresee any problems sourcing containers to Mexico, although another industry source told me BNSF partners send empty containers from Dallas to Mexico, but that’s not an option for UP.

More in a story soon on JOC.com about what Schneider told me.

CHARLESTON: The congestion once plaguing Savannah has migrated to Charleston and Norfolk. CMA CGM and Hapag Lloyd announced it will skip Charleston and Savannah on upcoming sailings of the INDAMEX 1 Service.

Jim Newsome, CEO of SC Ports, provided this presentation on CNBC. Note how many import loads (in light blue) came to Charleston in November 2021-January 2022:

The root problem is 7,400 containers have sat more than 15 days in Charleston as of Feb. 8 — or 1 out of 3 imports. Normal is 1,000 containers. Now shippers may have a good reason for not getting their containers, but the decision is having upstream ramifications.

SC Ports has a disadvantage because it does not have on-dock rail. Truckers are necessary to haul containers between the Wando Welch Terminal and the US Class I railroads — about 15 miles — locking up capacity that otherwise would service BCOs.

To compensate, the port authority is opening between 0300 and 0500 for rail drays. While CSX service in unaffected, Norfolk Southern has restrictions into Charleston, according to a Norfolk Southern spokesman:

“We have plans to stair-step gates from some markets [to Charleston] in the coming week. We successfully drew the stack counts to sub-650 from a high of 1,500. Drayage in the market has not improved.”

SC Ports and Norfolk Southern are using Inland Port Greer as a buffer for containers going to Charleston, according to Newsome.

NORFOLK: It’s not just Charleston. Nearly a dozen vessels are now anchored outside the Port of Virginia. Here is the latest update on what’s happening in Norfolk.

The good news? The number of vessels anchored outside Los Angeles and Long Beach is going down, and my Southern California contacts tell me conditions are not as bad as three months ago.

ASIAN IMPORTS: Two BCOs have recently complained to me about a lack of capacity on containerships in Japan and South Korea. Vessels get loaded with containers in China, leaving little capacity in Busan or Tokyo. Excess capacity is quickly filled with spot market loads paying huge rates, as one BCO explained. IHS Markit data backs them up.

There were only two Asian countries whose market share grew to the US in the last two years: China and Vietnam. Fifteen countries saw their market share decline or flatline — including Japan and South Korea — according to PIERS, a sister product of the Journal of Commerce within IHS Markit.

China represented 59.6% of Asia-to-US container trade in 2021. Tariffs?!? What?

RESIN EXPORTS: S&P Global has a good article out about how congestion is hurting resin exporters:

Without a chassis or a truck driver, empty containers cannot be taken to warehouses to be filled with packaged resin, traders said.

Resin packaged in 55-lb. bags that are stacked on pallets awaiting loading and transport has increasingly filled warehouse space, sources said. That can leave warehouses unable to take in more resin until packaged product gets moved out.

"They are all packed to the gills," a trader said of packaging warehouses.

Other traders said they have cargoes sold in late 2021 that have yet to get loaded onto a ship for export.

"We're still loading product we sold in December," a trader said. "Some orders were delayed for February shipment."

JOC’s Michael Angell also has a story on resin exporters.

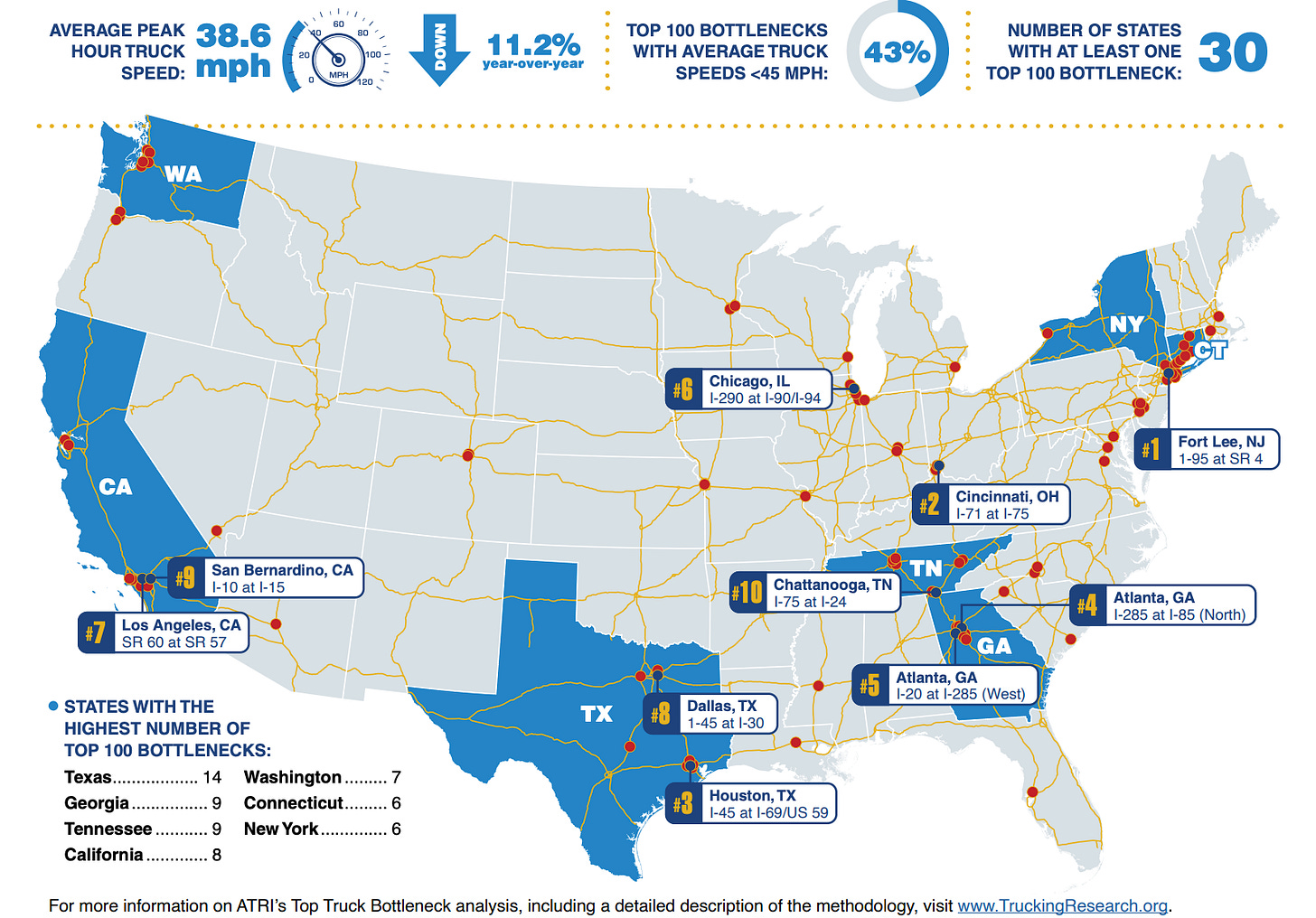

HIGHWAY CONGESTION: The American Transportation Research Institute is out with its top 10 highway bottlenecks slowing truckers in the US. Here is the report:

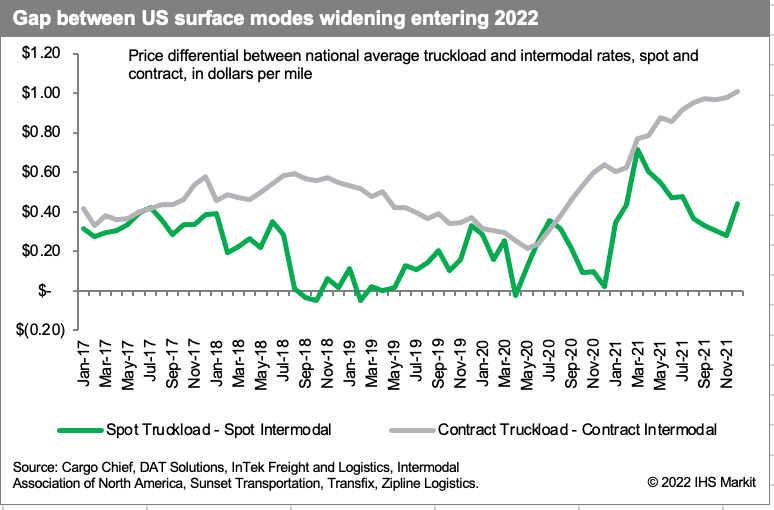

CONTRACT RATES: Based on conversations with shippers, brokers, and IMCs, truckload contracts may rise by 7% to 9% in the US, while domestic intermodal contracts may climb 10%+. Ramp-to-ramp intermodal rates are up $150 to $350 per container, and even a bit more when IMC margins are added into the final quote. There is room to raise domestic intermodal rates, however, while still saving money versus truckload contracts, according to the JOC Intermodal Savings Index Q4 report.

TRUCK CONVOY: By now most of you probably know about the truck protests in Ottawa over the vaccine mandate. Several major CPG shippers are monitoring the potential of a US convoy to Washington DC on March 1. As one shipper told me:

“I’m confident we will get capacity. Just a matter if we see a short-term increase in spot rates.”

SPOT TL RATES: I’ve finalized our JOC Shipper Truckload Spot Rate Index earlier this week for January 2022. This measures broker-to-shipper rates. It’s a different twist on data from our partners DAT Solutions and Cargo Chief, which along with Loadsmart feed us information.

Note how truckload rates on the West Coast were flat-to-down sequentially. Union Pacific and NVOs indicate that IPI (international intermodal) volume picked up in January after a 16% decline in Q4. That would explain these results.

CHICAGO TURN TIMES: Another signal of more IPI is an increase in truck turn times in Chicago, according to the Illinois Trucking Association and Geostamp. Longer turn times — measured in minutes — usually indicate a rise in volume.

Red numbers mean longer turn times — bad for supply chain fluidity. Green numbers mean shorter turn times — good for supply chain fluidity. Lots of red.

OTHER CITIES: Even more evidence in Dallas, Kansas City, and Memphis. Fluidity is down for BNSF, NS, and UP. For NS, the problem is too many containers coming into Kansas City, creating a land scarcity to handle outbound containers. Trucking executives in Kansas City are struggling to reach Union Pacific to troubleshoot problems, and UP has also resumed its no cherry picking policy, they tell me.

In Memphis, we get this from a dray executive:

“A shortage of pool chassis reared over the last couple weeks…BNSF continues to have major dwell issues with throughput during regular business hours; CSX and NS throughput remain an hour-plus per turn. UP and CN remain fluid.”

In Dallas, we hear this from an NVO source:

“Dallas is having problems which they've not had in the past. Dallas has been spared most of this craziness last year. But they're stacking loads in Dallas on BNSF where there are no chassis.”

Not all the signs, however, point to the IPI rising in January. The Association of American Railroads data shows no uptick in overall intermodal volume (domestic and international) in January versus December. More in our next newsletter with data from the Intermodal Association of North America.

CHARM CITY USA: German automaker BMW opened a 75,000 square-foot distribution center in Sparrows Point near the Port of Baltimore, a top US port for automobiles. The Port of Baltimore also received a $1.8 million EPA grant from the Diesel Emission Reduction Act (DERA) program to replace six forklifts, four yard trucks, and three dray trucks with new energy-efficient equipment. The new dray trucks will be the first electric-powered trucks to serve the Port of Baltimore.

WAREHOUSING: A report is out from CBRE on real estate investment in 2021:

The Americas region Q4 had record quarterly volume of $305 billion, up by 90% from Q4 2020.

The industrial sector accounted for 22% of total investment volume in Q4, on par with growth in the previous two quarters. Industrial investment in the sector increased by 53% year-over-year to $160 billion in 2021.

Richard Barkham, Global Chief Economist for CBRE, said in a statement:

“Another year of investment growth is expected in 2022, albeit at a more moderate pace than in 2021. Economic growth and low interest rates will fuel investment activity. Headwinds, such as rising inflation, geopolitical tensions and the potential for a COVID-19 resurgence may cause some jitters in Q1 2022. CBRE estimates that annual global investment volume will increase by roughly 8% in 2022.”

DCLI CHASSIS: The situation is a lot better today than it was 45 days ago with domestic chassis on BNSF Railway. DCLI has put a lot of work into domestic chassis and coordinated with dozens of retailers, intermodal providers, and LTL companies. They’ve made the transition as smooth as possible. Demand is just off the charts 53-foot chassis, and street dwells are a major problem. DCLI CEO Bill Shea will talk about it on the TPM Chassis Panel on March 1, and we will have a TPM Intermodal Panel on February 28, so join us in Long Beach, California.

MSC USA: Mediterranean Shipping Co. will spend $13.7 million to add 25,000 square feet adjacent to its current headquarters in Mt. Pleasant, South Carolina near the Port of Charleston, which will open in 2023.

Any opinions in this notebook represent the author’s views, not the Journal of Commerce or IHS Markit. Any gossip in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion on anything I wrote or a subject you’d like me to cover?

Email me ari.ashe@ihsmarkit.com to send your thoughts. You may also request our data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paid JOC subscribers. Don’t have a JOC subscription? You can change that!