Welcome to Please Haul My Freight: Edition 15. Here are some of the items in my notebook heading into our TPM Conference:

DEJA VU ALL OVER AGAIN: For the second consecutive year, Union Pacific Railroad is implementing surcharges in March. This year, the surcharge will impact shippers in Los Angeles, Lathrop-Oakland, Seattle-Tacoma effective March 13. The highest total is $4,000 on small shippers out of Los Angeles. It applies to loads above the weekly contractual allotment and spot market loads. See my story for surcharges by city and size of shipper.

WAR IN THE UKRAINE: It’s a horrible scene in the Ukraine. Let’s hope for an end to the conflict soon. So what products are at risk through this conflict? Here is what we know from PIERS, a sister product of JOC.com with IHS Markit:

TOP EXPORTS: Automobiles, paper and forest products (GP Cellulose, International Paper), seafood (to Ukraine)

TOP IMPORTS: Wood products (PG Wood, Central National Gottesman) and weapons/ammunition (Sporting Supplies International).

I would think vodka probably is on the list too, but many of the records do not list a country of origin. The conflict in Ukraine is hurting Asia-Europe trade, including containerized shipping, and transshipments of oil and gas, and liquid/dry bulk cargo, as the Journal of Commerce notes.

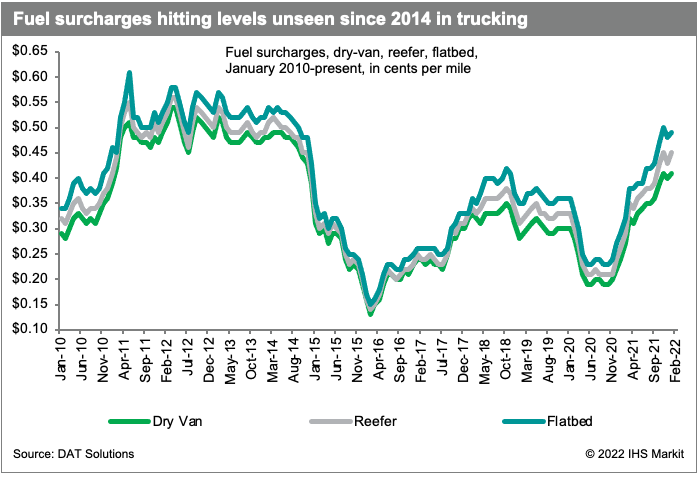

FUEL SURCHARGES: The conflict with Russia won’t help with the price for fuel. Take a look at this chart from DAT Solutions of monthly fuel surcharges in trucking. The last time fuel surcharges were this high was eight years ago.

CHINA SAYS NO: The Peterson Institute for International Economic finds the Trump administration’s trade deal with China to purchase $200 billion of new US exports by December 31, 2021 was a dud:

In the end, China bought only 57 percent of the US exports it had committed to purchase under the agreement, not even enough to reach its import levels from before the trade war. Put differently, China bought none of the additional $200 billion of exports Trump’s deal had promised.

But Trump’s “phase one” agreement with his “very, very good friend” President Xi Jinping was not a total washout. The deal did halt his spiraling trade war. And several of its elements should be kept, notably China’s commitments to remove technical barriers to US farm exports, respect intellectual property, and open up its financial services sector. However, signing something that was problematic, if not unrealistic, from the start, shows some degree of bad faith on both sides.

UNION NEGOTIATIONS: The National Retail Federation wrote a letter Feb. 24 to the President of the ILWU, the union representing dockworkers on the West Coast, and the CEO of the Pacific Maritime Association, representing the ports and marine terminal operators. The NRF urged both sides to sign a deal done before the current collective bargaining agreement expires June 30.

“It is important to note that in a recent NRF member survey, many respondents indicated a strong concern about the upcoming negotiations; even the perceived risk of a disruption will force retailers and other shippers to reevaluate their use of U.S. West Coast ports. Without a clear commitment to keep negotiating, cargo shifts to other gateways would likely happen even if a disruption never occurs, simply due to the need to mitigate the risk of a disruption. ”

SOUTH CAROLINA: The South Carolina Ports Authority put an embargo on exports in dry containers through the Port of Charleston between 5 a.m. and noon last Thursday and Friday. Norfolk Southern is capping loads into Charleston: 25 per day from Atlanta, 20 from Memphis, 5 from Huntsville as of Feb. 25.

Here is my thought, and this is my opinion and my opinion only:

Normally there are about 1,000 containers not picked up within 15 days. Today the number is about 8,000, or one out of three import containers. This is not California where you need an appointment to pick up a container, or an empty return appointment. I cannot believe all 8,000 containers are sitting through no fault of the BCO. Is it hard to get a trucker? Yes. Is it hard to get a chassis? Yes.

But some importers are purposely using the terminal as a mobile warehouse. We are now seeing how demurrage wreaks havoc when unchecked. The port is running out of room. That is why Charleston is working vessels slower than normal, why Norfolk Southern is metering exports from Atlanta, Huntsville, and Memphis, and why the anchored vessel count keeps rising.

There are many reasons why the vessels anchor outside a port, but importers must accept their role in this too.

SACP 3.0: A memorandum of understanding has been signed for the South Atlantic Chassis Pool 3.0. Consolidated Chassis Management (CCM) must still reach long-term agreements with lessors such as TRAC and DCLI to take possession of 45,000 refurbished chassis. CCM will set rates, issue invoices, and collect revenue from customers. Box rules go away, and the chassis lessors generate cash from the leases to CCM.

Please read my article for more.

POP-UP YARDS: There can be no argument the pop-up storage yards have been critical to the success of the Port of Savannah clearing the 30 vessels anchored last autumn. The Georgia Ports Authority recently made a deal with Norfolk Southern to use Huntsville, Alabama, according to CEO Griff Lynch.

“The Huntsville site is ready for us now. No volume going there presently but it’s ‘in the rotation’ if needed.”

There may also be permanent pop-up yards — not necessary six, perhaps one or two.

It’s an idea the GPA has talked about internally. If the economics work — the demurrage fees paid by BCOs fully finance the operations — then it is a possible:

“We would have to deploy the equipment, we have to put employees out there. I think from what we've seen is that a majority of them will be self sustaining, but it's not fully proven out yet. We have to give this a year, a whole full cycle of seeing the business through the peaks and the valleys to see if the economics work.”

How much money is that? Not sure. I know this is what the Biden administration touted in previous statements:

Working with the Georgia Ports Authority to address congestion at the Port of Savannah through a $7 million investment in “pop-up” inland ports that help relieve capacity in Savannah.

BIDEN REPORT: The US Department of Transportation released “Supply Chain Assessment of the Transportation Industrial Base: Freight and Logistics,” as part of Executive Order 14017 on America’s Supply Chains issued Feb. 24.

A couple of goals caught my attention:

— Focus on increasing domestic manufacturing of new chassis, containers, zero-emission equipment, and gantry cranes, including consideration of enhanced price preference in Federal Acquisition Regulations (FARs) updates.

— Consider opportunities to develop a domestic supply base for specialized cargo handling equipment and gantry cranes that are not currently available from a U.S. manufacturer.

— Coordinate with States, local governments, and port authorities, as well as Federal partners such as the Department of Defense (DoD), to identify temporary solutions to ease congestion, such as “pop-up” intermodal yards. “Pop-up” intermodal yards can foster longer-term investments in resiliency and reduce the environmental impact of freight movement.

TWO-WAY STREET: Mike Regan of TranzAct, a very smart consultant to shippers, has a blog post about what motor carriers advise shippers going into contract season:

As one CEO of a large truckload carrier told me during lunch at the Food Shippers of America Conference: "Shippers have the time to give us a 'Report Card' on how we are performing, but never take the time to ask us for our Report Card about their performance. In short, they really don’t want to know about how their decisions and practices affect our cost structure and our ability to serve their company." Unfortunately, I had to agree because based on experience relatively few shippers understand their own docks or the docks at their suppliers or customers. But make no mistake about it: Your carriers know who is on their "naughty and nice list” – and they are pricing their services accordingly.

Do you agree with Mike Regan? Email me and let me know.

TURNING THE TIDE: BNSF’s contractor Parsec rolled out a new operating system in Logistics Park Chicago last week. The transition to this new software — Tideworks Technology — did not go smoothly, according to my sources in Joliet-Elwood.

“This new system isn't working too well. We’re still very tight on all chassis, and we can't turn the trains fast enough. Some [employees] couldn't figure out the old [Wabtec] Oasis system, and that was much simpler than Tideworks.”

As one drayage executive told Jason Hilsenbeck of Loadmatch.com and Drayage.com:

“The BN is bogged down because they have a new system that keeps crashing. On Wednesday [Feb. 23], seven hours to have them finally say they have no idea what they did with a load and then Thursday it appeared in Lot S.”

BNSF acknowledge the problems in an advisory Feb. 24:

During this process, we experienced some temporary challenges related to inventory management. We are resolving these issues and will evaluate hub conditions on Monday, Feb. 28 to determine if conditions allow for a return to normal operations at that time.

QUOTE OF THE DAY: The award with no prize whatsoever goes to Steve Cox, president of Steam Logistics:

TODAY IS THE DAY: S&P Global will close a deal today to acquire IHS Markit, and the Journal of Commerce joins the S&P Global family. Yay!

Any opinions in this notebook represent the author’s views, not the Journal of Commerce or IHS Markit. Any gossip in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion on anything I wrote or a subject you’d like me to cover?

Email me ari.ashe@ihsmarkit.com to send your thoughts. You may also request our data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paid JOC subscribers.

Don’t have a JOC.com account? You can change that!