Welcome to Please Haul My Freight: Edition 14. Here are some of the items in my notebook this week:

ECONOMICS: Former Obama economic advisor Steven Rattner has a very good analysis of the supply chain slowdown in the New York Times. Here is one part, but I highly recommend reading it all:

“The bulk of our supply problems are the product of an overstimulated economy, not the cause of it. Sure, there have been some Covid-related challenges, such as health-related worker shortages in factories and among transportation workers. But most of our supply problems have been homegrown: Americans have resumed spending freely, and along the way, they have been creating shortages akin to those in a shopping mall on Black Friday.”

WE NEED PEOPLE: Last week I spoke with two well-known food shippers. Both said there is not enough press coverage about labor at receiver docks. Hauls that used to take one day now take two because receivers cannot keep up with the freight. Truck drivers cannot complete as many jobs per day.

So why not just pay warehouse workers more? One of the shippers said it’s not that simple. Wages have gone up for warehouse workers and it’s not making a difference:

“There are a lot of people working from home and doing things around the house, or watching the kids and not paying daycare but living off of one income and changing their lifestyle. And I think business will have to adjust to this new reality.”

A second shipper said he’s frustrated that his rates are rising, but his asset-based motor carriers are not talking about adding capacity.

“Seated truck counts are going down and revenue revenue goes up. And a lot of it's because they've got trucks parked. Some can't find drivers, but I think some are still in a position where they don't want to add capacity because they don't know when the market will turn. It's the typical game, right, they oversupply capacity and demand drops.”

KNIGHT SWIFT: Bill Cassidy and I recently talked to Dave Jackson, CEO of Knight Swift Transportation. I asked him about what these two food shippers had to say. He said KNX has put in the orders, but the OEMs are running into production delays:

“They can get most of the truck put together. It's just today, we can’t source the brakes. And tomorrow, it's brake drums. And tomorrow, it's some little component, even the trailer guys, same thing.”

As to drivers, Jackson pointed out, like warehouse jobs, people don’t seem to be biting on wages and other incentives.

More coming up soon in the Journal of Commerce, so pay attention to a social media channel near you.

THE CAT IS OUT OF THE BAG: Paul Berger of the Wall Street Journal has an article out “Maersk Is Hungry for More U.S. Logistics Companies.” As loyal readers of Please Haul My Freight know, I shared rumors in November of a large international household name pursuing both C.H. Robinson Worldwide and XPO Logistics — from reputable sources. Maersk was that “large international household name.”

Maersk was and may still be interested in C.H. Robinson and XPO Logistics, according to my sources. But remember, this is a rumor and a rumor is NOT news.

From Paul’s article:

“There is a bit of a foot race going on to build end-to-end networks,” said Chris Wofford, the managing partner at West Palm Beach, Fla.-based Wofford Advisors, strategic advisers in global supply chains. “They had floating hotels for freight, and now, as they extend from the ports they are creating a stickier and more value-added array of services.”

I’m sure Maersk is aware J.B. Hunt and Schneider are expanding their transloading businesses. J.B. Hunt owns more than 100,000 containers, so it has the size to compete.

TRANSLOAD VS. IPI: We don’t know whether the decline in truckload rates out of Los Angeles and Seattle, and a rise out of Elizabeth and Norfolk (see chart below) are related port congestion. The truckload rates are courtesy of JOC’s Shipper Truckload Spot Rate Index in coordination with Cargo Chief, DAT Solutions, and Loadsmart.

An increase in IPI is not behind the decline in rates off the West Coast. The Intermodal Association of North America data shows IPI out of the Southwest (including Los Angeles) rose only 1.3% sequentially in January 2022. IPI jumped 21% sequentially out of the Pacific Northwest (Seattle) last month, but this region accounts for minor percentage of the national IPI share.

A STRONG IQ: If you isolate the analysis to DAT iQ’s Top 50 Lanes, you’ll see some seasonality creep back in truckload rates in February, except in the Midwest, which is still on the rise. Maybe it’s Canada related? January was a very strong month for the truckload market. For more, I highly recommend DAT iQ:

Here is what DAT’s CEO Claude Pumilia wrote on Linkedin:

“We released our Truckload Volume Index for January and it’s incredible to see spot rates extend their run to new highs. At $3.11 and $3.59 a mile respectively, it cost nearly $1 a mile more to move dry and reefer freight in January compared with the same time last year. Those figures are based on actual freight transactions, not ‘asking prices’ on the load board.

Demand is sky-high...while overall volumes decreased throughout the month, the number of loads posted to our load board network increased 37.4% compared with December and is up 104.7% versus January 2021.”

LTL CHECKUP: I spoke with a large LTL shipper last week. I’m not going to reveal any details on the person’s identity to share an unvarnished analysis of LTL:

THE BEST: “We like Old Dominion, Averitt Express, Pitt Ohio, A. Duie Pyle. Most of the regional guys are really, really good. The company right behind Old Dominion, closing in now and talking a good game, is Saia. Saia is starting to come back with rate increases that look like Old Dominion, and deservedly so because their service is great.”

XPO Logistics: “Their service is challenged. They take on too much.”

Yellow: “Service was good when we were with Holland or New Penn, but when they went to the one umbrella under Yellow their service has been poor.”

This LTL shipper’s insights are consistent with annual Mastio LTL surveys. This LTL shipper said network-wide rates are rising 10%+ in its LTL contracts.

OMICRON: The Cass Freight Index Shipments Index was down 10.8% sequentially in January and 2.9% year over year in January. Remember Cass is measuring several modes of freight transportation, not only trucking. From Cass:

“The drop in January in the shipments component of the Cass Freight Index is about as good an answer as we have to the question of how big an impact Omicron-related absenteeism and quarantines had on the freight economy. While these effects are lingering in February, they are beginning to fade and we expect a rebound in the coming months as case counts fall sharply…

Tight intermodal capacity continues to slow the network and press freight into the truckload market, particularly off the West Coast, raising the truckload length of haul (LOH) 20% year-over-year in January. Trucking continues to take share from a challenged rail network with intermodal volumes at risk of two straight quarters of double-digit year-over-year declines in Q4’21 and Q1’22.”

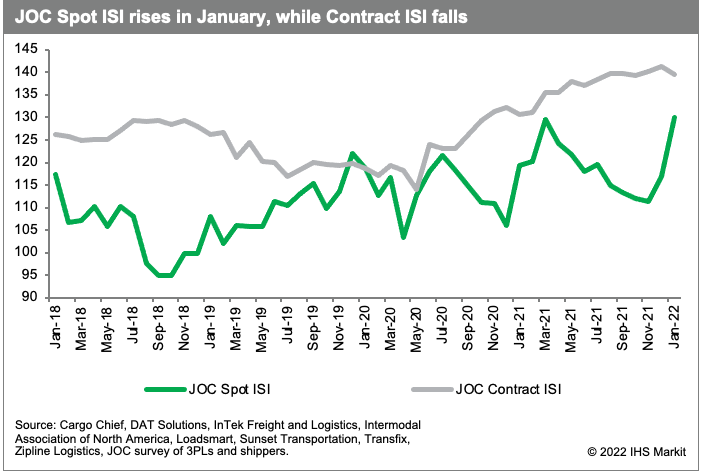

INTERMODAL SPOT MARKET: There was a big rebound in the JOC Domestic Intermodal Savings Index (ISI) in January. The January Spot ISI total was 130.3 (30.3% intermodal spot market savings). Spot truckload rates increased 8 cents while spot intermodal rates dropped 18 cents. We expected the JOC Spot ISI to increase after peak season surcharges were canceled, but it was steeper than we anticipated.

JOC’s Contract ISI fell slightly and may continue to go down as shippers face double-digit rate increases in domestic intermodal contracts in 2022.

SCHNEIDER: The breakup last year between Knight-Swift and BNSF was rough. Without disclosing everything, Dave Jackson confirmed BNSF shifted Swift “out of priority,” or as a Wall Street analyst “to the bottom of the totem pole” late last year. Will this happen with Schneider? BNSF and Schneider say no:

“BNSF is always committed to the highest level of customer service. We will ensure that Schneider’s transition is seamless.”

We will see if that is true, or lip service.

Schneider is already putting containers on Union Pacific trains on non-competitive lanes. This video shows a UP train in Northern California with Schneider containers next to Hub Group, and EMP and UMAX boxes, likely to/from the Pacific Northwest.

Schneider has also imported more than 1,000 containers through Portland since Jan. 1, according to PIERS, a sister product of the Journal of Commerce within IHS Markit. Schneider — like FedEx, Hub Group, and J.B. Hunt — puts cargo for shippers inside the 53-foot containers, rather than moving them empty.

FMC GOES TO FIVE: Max Vekich was sworn-in Feb. 15 as a Commissioner of the Federal Maritime Commission for a term expiring June 30, 2026. That tips the FMC officially 3-2 in favor of Democrats. Also this:

CHUNKER: Never heard of Chunker? Think of it like an AirBnB for the warehousing industry. Shippers, receivers, 3PLs lease warehouse space for short-term capacity needs. The State of California has leased six properties to Chunker to address the congestion in Los Angeles, Long Beach, and Oakland. The lease is for one year with an option for a second year.

The sites include three armories (in Lancaster, Palmdale, and Stockton), a former prison site (Deuel Vocational Institute in Tracy), and two fairground sites (San Joaquin County and Antelope Valley Fairgrounds). Chunker will coordinate between California ports, shipping/trucking companies, and cargo owners to help move containers and free up needed space elsewhere.

IN LIKE A LION: The Port of Baltimore said its four ship-to-shore cranes will be ready to go online next month. When that happens, Baltimore will officially have two berths capable of handling post-Panamax vessels.

JAXPORT: Ceres Terminals has inked a 20-year, $60 million deal to take over the TraPac container terminal in Jacksonville on March 1. A project to dredge to 47 feet at SSA’s Blount Island terminal will be completed this June, but TraPac’s terminal will remain at 42 feet. No word on whether Ceres will pursue deepening when it takes over.

TRANSFIX: One of JOC’s data partners is Transfix, which recently went public through an SPAC (special purpose acquisition company). The digital broker reported annual revenue in 2021 of $296 million, up 60% year over year, and gross profit rose 74% to $17.4 million. Congratulations to the Transfix team.

ALLIANCE: US Multimodal Group closed on a transaction last month to purchase Alliance Shippers Inc., a well-known intermodal marketing company and trucking firm. Steve Golich, an intermodal veteran, continues to run Alliance Shippers as CEO.

Any opinions in this notebook represent the author’s views, not the Journal of Commerce or IHS Markit. Any gossip in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion on anything I wrote or a subject you’d like me to cover?

Email me ari.ashe@ihsmarkit.com to send your thoughts. You may also request our data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paid JOC subscribers.

Don’t have a JOC subscription? You can change that!