Welcome to Edition 8 of the Please Haul My Freight newsletter. Here are some of the items in my reporter’s notebook this week:

LEGISLATING THE CRISIS: Senator Mike Lee of Utah introduced a bill called the STOP the GRINCH Act to address supply chain problems in the US. There are some useful provisions, if done correctly, and items that likely won’t help at all.

The Good: a) “Require the Secretary of Defense to take an inventory of intermodal equipment (including truck chassis) and permit trucking companies to use such equipment provided that use of the equipment does not affect our national security and the truck company agrees to reimburse for any damage to the equipment.” b) “Require the Secretaries of Agriculture, Interior, and Transportation to jointly consult ocean carriers, ports, railroads, and truckers to identify and designate plots of federal land that could temporarily (no more than 6 months) be used for the storage and transfer of empty cargo containers in order to ease the congestion and backlog at U.S. ports.”

In my opinion, you would need to make sure the chassis are leased directly to the trucking companies, and the effort is expanded to include the Midwest, South Central, Northeast, and Southeast US.

The Ehh: a) “Require the Department of Homeland Security to provide temporary waivers of the Jones Act for vessels.” b) “Require the FMCSA to temporarily allow 18-year-old drivers to receive a temporary commercial driver’s license for the transportation of cargo to or from a U.S. port.”

The Jones Act provision has no practical application here. The FMCSA provision will have minimal impact because only 5% of laden imports into California have a listed destination of Arizona, Colorado, Idaho, Nevada, or Utah on the through bill of lading, according to PIERS, a sister product of the Journal of Commerce.

GIVE ME SOME MONEY: CMA CGM came out with an interesting idea.

“An incentive will be provided to the importers that pick up their containers via merchant haulage from all the terminals in Los Angeles and Long Beach in the first eight days, with the intent that they will use it to offset costs incurred by tensions on their supply chains. The incentive will be:

100 USD per container for daytime pickup from Monday to Friday;

200 USD per container at night and on weekends.

CMA CGM's commitment could exceed $22 million over 90 days.”

Do you think it’ll make any difference?

POLLUTION: Walmart, Target, Amazon and Ikea accounted for an estimated 20 million tons of carbon dioxide equivalent emissions using ocean carriers between 2018 and 2020, according to Stand.earth Research. Here is a link to the full report:

“Walmart relies heavily on one ocean carrier, CMA CGM, a French container transportation and shipping company that made $31.5b in revenue in 2020. CMA CGM is the biggest polluter amongst all carriers, accounting for 68% of Walmart’s ocean shipping emissions in 2020 and 33% of emissions across all four companies. CMA CGM is one of the world’s biggest buyers of fossil gas vessels…Walmart should break up with CMA and/ or from fossil gas. However, if the two industry giants could work together on zero-emissions solutions, they could propel the decarbonization of ocean transport.”

IPI PLUNGES: Inland point intermodal — the intact move of ocean boxes from ports to inland rail ramps — plunged 12.9% year over year in October, according to the Intermodal Association of North America. Drilling down it’s all about the West Coast. Between the Southwest and South Central US, IPI if 40-foot containers fell 22% in last three months vs. 2020, and 10% vs. 2019.

Drivers are unhappy in Dallas because there is not enough cargo. Drivers are unhappy in Houston because there is too much cargo and not enough chassis.

CP-KCS TRANSACTION: Here are a few developments you may have missed in the Canadian Pacific acquisition of Kansas City Southern. The STB declared the CP application complete, over the objections of Canadian National and Union Pacific, and set a schedule which calls for final briefs by July 1, 2022. On Nov. 26, CP received the required pre-transaction control approvals from the Mexican Federal Economic Competition Commission and the Mexican Federal Telecommunications Institute.

One concern I have is that the forecasts between Texas and the Midwest may be too rosy. Our JOC Intermodal Savings Index shows truckload rates are competitive — often cheaper — than intermodal from Dallas, Houston, and Laredo to Chicago.

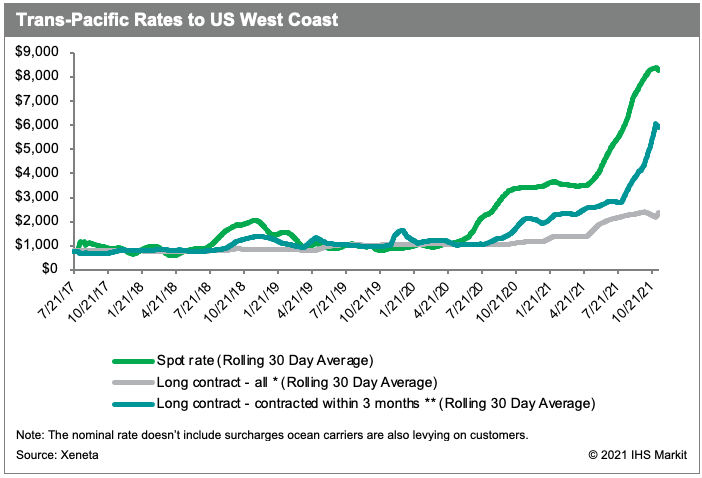

OCEAN CONTRACTS: Xeneta held a “State of the Ocean Freight Market” on Nov. 23. Peter Sand, chief analyst with Xeneta, had this outlook:

“Going back, almost 10 months ago that I said something like, ‘Well, look at these spectacular profits for liners in 2021.’ Trust me on this one: 2022 is going to be even bigger…It all rests on the assumption that carriers are now fixing long‑term contract rates at a much higher level than what they delivered in 2021.”

Patrik Berglund, Xeneta’s CEO, reminded us, however, these are market forces.

“There are comments…about shippers feeling ripped off. I can understand that feeling, but to some degree, this is the ultimate proof of supply and demand and how that works.”

Right now the carriers have pricing power. But for every 2021 and 2022, there is also a 2016. Certainly, though, there are some very raw feelings.

PORT OF BALTIMORE: On Monday, I reported about CSX’s project to establish double-stacking between Baltimore and the Midwest. I asked Greg Slater, Maryland Transportation Secretary, about Norfolk Southern, which also cannot double stack from Baltimore to the Midwest:

“That'll be our next one to tackle as we start to work on this one and see how we can find build partnerships and see if this CSX project can be a model.”

No talks have taken place with the State of Maryland, Amtrak, and NS.

Jim Foote, CEO of CSX, also made an interesting comment about E. Hunter Harrison, who did not support this re-construction project:

“Had Hunter been around long enough to get a little more flavor for what was happening here, he more likely than not would have supported what we've done.”

PORT OF CHARLESTON: Add Charleston to the list of US ports with anchored vessels awaiting a berth to open. Despite the port authority’s previous message that this would go away by Thanksgiving, it has not. Now the port authority is targeting December 15 to clear all the 5 to 10 vessels anchored in the Atlantic.

THE RUNAWAY TRUCK: Despite talk of truckload spot rates having reached their peak, the numbers show some pretty high rates right now, based on data from Cargo Chief and DAT Solutions.

The data is not “seasonally adjusted”, and such an analysis may show rates have plateaued.

TRUCKLOAD CONTRACTS: Jason Seidl of Cowen and Co. released a detailed report on commercial transportation in 2022.

“A multitude of factors are contributing to elevated TL pricing next year, which we model up mid-single digits and as high as low double-digits in 2022, based on both public and private carrier commentary as we work through bid season…We expect intermodal contract pricing up high single digits in 2022.”

INTERMODAL CONTRACTS: I am hearing the same thing as Jason Seidl. Intermodal contract rates may rise 8% nationally in 2022, according to intermodal marketing companies. Sources tell me to expect 10%+ out of California, 5%-8% in the Pacific Northwest, and the rate of inflation (~5-6%) on backhaul lanes. Expect CSX and NS to be aggressive in the eastern US, according to one IMC.

“The East will be a little higher than people expect because truckload capacity constraints are going to exist in New Jersey. Then the Southeast — Charleston, Savannah, Jacksonville — that's going to take truck capacity from Atlanta. So when we think national average, we're closer to 8% because the East Coast is going to be a little bit higher than other people give credit.”

Said another IMC executive to me:

“I don't think 8% to 12% is out of the question of nationally. In the Pacific Northwest I think five to seven probably makes the most sense. With inflation (CPI) being in the mid-single digits, you'd be crazy not to think of a double-digit potentiality for overall intermodal contract rates in a high scarcity market.”

There is wiggle room for railroads to raise contract rates while still providing steep discounts to longhaul trucking. Through October, intermodal contract rates are up 6.1% year over year while truckload contract rates have jumped 26.4% on our 116 indexed lanes. Read our JOC Intermodal Savings Index Q3 report for further details.

XPO SELLOFF: A publication called Dealreporter reported Nov. 19 that XPO is “in the process of selling its European transport and U.S. intermodal segments”, according to “three sources familiar with the situation.”

A source of mine told me the same Nov. 2, but XPO’s spokesperson declined to comment when I asked for information on Nov. 3 and Nov. 20. My source said the deal involves XPO’s 53-foot domestic intermodal business, the old Pacer International division.

While I won’t publicly name the suitor provided by my source, I will say it’s a household name in transportation and logistics in Europe and US looking to expand its already large portfolio of subsidiaries. Is my source correct? I don’t know. But I know Dealreporter is on the right track.

Any opinions represent the author’s views only, not the Journal of Commerce or IHS Markit.

Do you have an opinion on anything I wrote? Or do you have a subject you’d like me to cover? Email me ari.ashe@ihsmarkit.com to send your thoughts, or to request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paid subscribers. Don’t have a subscription? You can change that!