Welcome to Please Haul My Freight: Edition 23. Here are items in my notebook this week:

FREIGHT RECESSION: Tim Denoyer of ACT Research believes there is an imminent freight recession, according to the Cass Freight Index report.

“After a nearly two-year cycle of surging freight volumes, the freight cycle has downshifted with a thud…

As recently as the start of this year, pricing power in the truckload market was firmly with fleets. After nearly two years in this position, the concept of the pricing power pendulum almost seemed obsolete to many. Until it swung and cratered rates. Once a pendulum gets going, it’s very hard to stop…

Normal contract timing would suggest there’s room for this index to continue to rise for a little longer after the peak in spot rates, but the clock is ticking.”

To be clear, there is something happening in the dry van spot market. It’s not nothing. It’s something. It’s news. And it’s important to discuss.

But we must be careful about framing, perspective, and vocabulary: is it a market correction, a downturn, a leveling off, a cooldown, a recession, or a bloodbath? Is it a three month event? Six months? What modes of transportation are impacted? Which modes are not impacted? How does today compared with pre-COVID?

NO FREIGHT RECESSION: Some are NOT on the imminent recession bandwagon.

Ben Cubitt of Transplace told JOC’s Bill Cassidy:

"Some of the frothiness at the top has calmed down. It's not so much that we're in a freight recession as some of the real inefficiencies have been worked out of our network…

Things are a little bit better for shippers, but we know what surrender metrics look like, and these are not surrender metrics. It's not like 2017 where clearly it was going to be a shippers' market. There's no shipper who can go to their top 10 asset carriers and say, 'Hey, I want rates cut 10 percent.’”

Michigan State University Professor Jason Miller on the Producer Price Index, and another post on consumer spending:

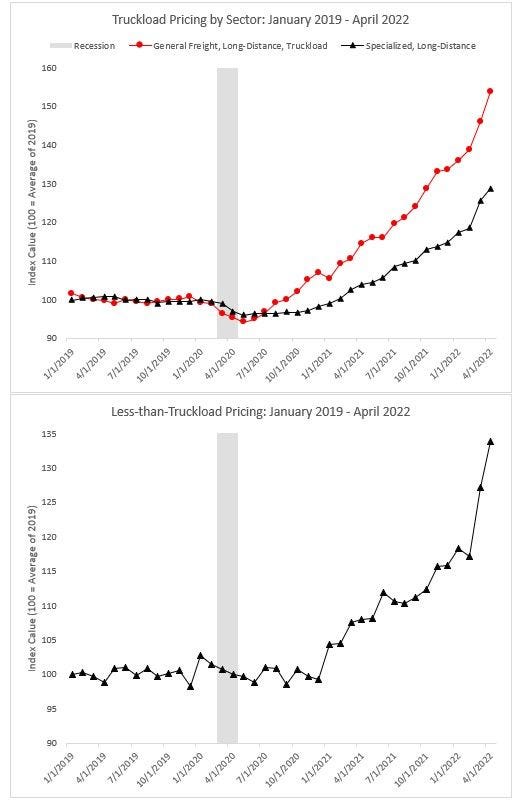

Despite talk of a freight recession coming in April, prices across all long-distance sectors of trucking increased strongly. Top plot shows PPI data for general freight trucking, long-distance, truckload (red, circle) and specialized trucking, long-distance (black, triangle)…Bottom plot shows general freight trucking, long-distance, LTL.

From David Vernon, a Wall Street transportation analyst with Bernstein:

The word on everybody's lips is 'recession" as central banks have started hiking to bring down inflation, and logistics stocks are having a hard time working against that backdrop. Meanwhile, lockdowns in China are still going on, with Shanghai into its second month. Port and airport throughput is impaired, and life remains challenging for companies dependent on international supply chains. Add to this an already constrained airfreight market, still suffering further on EU-Asia trades from the inability to overfly Russia. Forget normalization of global freight markets in 2022: 2023 looks more realistic.

DAT also compiled opinions on this topic in a blog post last week.

CHINA: A lockdown in Shanghai is beginning to be lifted this week in phases, with stores and factories reopening, but no one is quite sure how long it will take for the market to rebound. Could it be four weeks? Eight weeks?

It hasn’t had an impact on US import volumes, however, according to PIERS, a sister product of JOC within IHS Markit, part of S&P Global. Laden US imports in April were up 6.8% YoY from China, up 6.5% from Asia, and up 6.6% from all countries.

No evidence of a volume recession:

AN OCEAN ANALOGY: Look at the correlation between spot rates in ocean and dry van truckload to give proper context to this recession discussion:

Spot market rates have fallen 20% to 35% in the last 16 weeks — ocean and dry van. But rates are far higher than two years ago. There is A LOT of room — think AT&T Stadium — before US shippers are paying anywhere close to the old rates. Contract rates are also still high for both ocean and dry-van trucking.

Saying there is an imminent freight recession without proper context is like saying the data above proves we’re on the verge of Hanjin days, unleashing such a bloodbath that will sink BBC Chartering (breakbulk) and Wallenius Wilhelmsen (ro-ro).

Yes there is something happening in the dry van spot market. It’s not nothing. It’s something. It’s news. And it’s important to discuss. But let’s put it in perspective!

CMA TO THE RESCUE: CMA CGM is offering incentives to return empties within four days of pickup in Chicago, Dallas, Los Angeles, Kansas City, and Memphis.

The program runs until July 15:

A $300 credit per dry container returned to eligible locations during calendar days 1–4.

Calculation of incentive credits on a weekly basis with a credit memo issued every 14 days to each applicable importer of record.

Utilization of EDI transaction data to assess credit, thus no additional documentation required from customers.

FMC MEETING: The Federal Maritime Commission will meet Wednesday May 18. Here is the agenda for the meeting.

NORFOLK: The Port of Virginia received the frames for 970 gooseneck chassis from a CIE Manufacturing (formerly CIMC) plant in Thailand last week. Now CIE will assemble the units, according to Arthur Ellerman, managing director of the Hampton Roads Chassis Pool. The Port of Virginia also took possession of 15 hybrid shuttle trucks this month, which use less fuel than diesel-powered auto strads.

SAVANNAH: If spot rates don’t go back up soon in Savannah, expect some of the drivers who got their own UIIA authority in late 2021 to fold up and come back to their old employers, especially once their six-month insurance policies expire. Spot dray rates from Savannah to Atlanta are down from the peak in Q4 2021.

NO FUEL, NO FREIGHT: There are concerns the next supply chain crisis is a diesel shortage. Without fuel, most cranes and trucks stop working unless they are fully electric. Cargo stalls and terminals grind to a halt. More from Bloomberg:

More than 1 million barrels a day of the country’s oil refining capacity — or about 5% overall — has shut since the beginning of the pandemic…

“We are on the razor’s edge,” said John Auers, executive vice president at Turner, Mason & Co. in Dallas. “We’re ripe for a potential supply crisis.”

Meanwhile, the East Coast is on the brink of a diesel shortage that risks crippling already strained supply chains that have disrupted the flow of everything from grocery staples to construction supplies in the past two years…

“Too much refining capacity was closed during the pandemic,” Bloomberg Intelligence’s Fernando Valle said. “Diesel shortages and the price surge are likely here to stay.”

AMAZON: Amazon signed a deal with transportation management system provider MercuryGate that will show Amazon Prime trailers as a spot market option for MercuryGate’s shippers. I guess Amazon wants to haul more than Amazon orders!

GETTING AN APPOINTMENT: Digital broker Loadsmart, one of JOC’s valued data partners, announced carriers scheduled seven million appointments at 3,000 warehouses within the last year using its Opendock appointment scheduling software. Opendock was a smart acquisition for Loadsmart because shippers and receivers use appointments to manage the flow of trucks at their docks.

RYDER ON THE STORM: HG Vora Capital has made a bid to buy Ryder System, Inc. for $4.4 billion, or $86 per share. The hedge fund already owns a 9.9% stake in Ryder. If the Board of Directors and shareholders approve the deal, it would be interesting to see next steps. I heard a rumor that Ryder unsuccessfully tried to acquire Alliance Shippers last year, but I don’t know if that’s true or not.

XPO YARD SALE: XPO Logistics is considering a sale of its freight-forwarding unit, according to Bloomberg News. The unit could be valued at $400 million to $600 million, said a source who asked not to be identified. XPO spent nearly six months shopping its intermodal and drayage division before selling to STG Logistics for $711 million in March. It’s feels like Brad Jacobs is planning his exit strategy.

BNSF ATTENDANCE: BNSF Railway released a video last Friday about changes it’ll make to its controversial Hi-Viz attendance policy effective June 1, but unions have already called it “unimpressive” and “little more than fluff.” Here is an explanation of the Hi-Viz policy.

UNION PACIFIC: Two announcements from Union Pacific recently. One is that surcharges have been suspended in California and Washington. Second is that service into Mexico is disrupted on Ferromex through Eagle Pass and Nogales. UP owns a 26% stake in Ferromex.

DOMESTIC CHASSIS: Conditions are much better in the Kansas City Southern terminal in Wylie (outside Dallas) than two months ago, as the normal flow of domestic containers has been restored. However, IMCs are running into problems sourcing chassis in Pennsylvania on Norfolk Southern right now. More as we hear it…

MARINE CHASSIS: Chassis providers are struggling in Chicago right now supplying marine chassis for BNSF, CSX, Norfolk Southern, and the Canadian rails. Conditions are much better than a year ago, however, in Union Pacific Global IV, and in Dallas, Kansas City, Memphis, and St. Louis.

MORE READING: For more content, I encourage you to read The Freight Forward with the latest edition released May 15. Author Cathy Morrow Roberson takes the best stories in the Journal of Commerce and weaves them in a market narrative.

Cathy also flagged this from the Solo Brands earnings call:

JOC INLAND: If you enjoy Please Haul My Freight, register to attend the JOC Inland Distribution Conference at The Westin Chicago River North in September.

Any opinions in this blog represent the author’s views, not the Journal of Commerce, IHS Markit, or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paying JOC subscribers. Not a subscriber? Click here to become one.

Any update on potential BNSF strike?