Welcome to Please Haul My Freight — Edition 21. Here are items in my reporter’s notebook right now:

TRUCKLOAD: A lot of commentary in the last week about the slowdown in spot market dry van rates, and whether it’s indicative of an imminent freight recession:

Chris Caton of Prologis:

“Because Shanghai is shut down, there are going to be fewer containers that are going to be redistributed, and that will affect trucking volumes. But it's not because of lack of demand from the ultimate consumer. It's because of lack of supply by the producers. I think that's a problem that people will start talking about next quarter in a big, big way.”

Michael Gerdin of Heartland Express:

“While the current levels are down compared against the unprecedented levels experienced in the later months of 2020, we continue to have significantly more opportunities to haul freight than we are able to cover with our existing fleet and available drivers.”

Dave Jackson of Knight Swift:

“When we look at what's happened most recently in freight rates and the reports of the death of the freight market, which have been greatly exaggerated, I think that what we're seeing a little bit of is seasonality.”

Jim Gattoni of Landstar:

“We've seen a little softness, absolutely, but it's not what you're reading about. It's not even close to what I've seen in the Wall Street Journal article about 37% drop in spot rate since December. And to tell you the truth, and when I went through our spot rates, they actually climbed from December into January, January to February, and then a little bit of pullback in March. But we're still sitting at or above the December number when we closed out the March book.”

Dean Croke of DAT in a blog post:

Fear mongering in recent weeks and talks of a ‘freight recession’ have sent freight markets and sections of the media into a spin — like the dimwitted Chicken Little character did when he warned farmyard animals the sky was falling when an acorn fell on his head in the 1940s Disney movie.

Since then, the term ‘the sky is falling’ has generally been accepted as an idiom suggesting that disaster is imminent, and while that may well be the case for some in the trucking industry, we’re far from a disaster.

The current downward trend in national average spot rates and rapidly loosening capacity isn’t a blip either. If you’re an owner-operator invested heavily in the dry van or reefer spot market, it sure feels like the sky is falling.

From Uber Freight:

Although some economic factors might bring trucking rates lower, they cannot explain the steep decline we saw in March. In addition to supply recovery from Omicron, this was mostly driven by spot volumes moving under new contracts.

ATA’s Truck Tonnage Index, weighted toward contract truckload, suggests DAT and Uber Freight are correct.

FLIPPING NEGATIVE: What’s happening in the spot market is something. It matters; it’s news. The DAT Top 50 Lanes went negative year over year on March 31. Now spot truckload rates for the JOC Intermodal Savings Index (117 US lanes) are lower vs. April 2021 with a second data source.

The unnamed company quoted $2.206 on average across our 117 indexed lanes this month. It charged $2.261 on the same lanes in April 2021.

Our Cargo Chief numbers, however, are 2.5% higher than one year ago on the 117 lanes, and the JOC Shipper Truckload Spot Rate Index of 4,335 lanes will be about 6% to 8% higher than April 2021.

REPORTS OUT: The U.S. Bank Freight Payment Index was released last week for Q1. Shipments rose 1.1% year over year, but spending increased 27.5% in Q1. More in the quarterly report.

INTERMODAL SAVINGS: The JOC Intermodal Savings Index (ISI) Q1 Report will be released early next week, but below are some numbers.

The JOC Spot ISI measures spot intermodal vs. spot truckload rates. The JOC Contract ISI measures contract intermodal vs. contract truckload rates.

Our JOC Spot ISI fell in March because truckload spot rates dropped as Union Pacific implemented surcharges in Los Angeles, Oakland, and Seattle. Railroads may lose spot business on sub-1,200 mile lanes if they don’t adjust their rates. Be careful!

SIMPLY THE BEST: Here is a tale of the tape of J.B. Hunt versus IMCs surveyed by the Intermodal Association North America.

It’s impressive since J.B. Hunt’s rail partners experienced service disruptions in Q1 (see BNSF & NS Jacksonville items in “The Taxman Cometh,” and intermodal train speed data below from the Association of American Railroads).

NORFOLK SOUTHERN: One location where J.B. Hunt ran into service issues in Q1 was Jacksonville. I asked Norfolk Southern to clarify whether a crane fires in December and March will result in the spotty domestic intermodal service into 2023.

Here is what NS wrote back:

We are developing plans to ensure we have the lift and terminal capacity available to serve the Jacksonville demand with minimal interruption. This includes bringing in additional lift capacity over the next several weeks and working to get the damaged cranes repaired by the end of July.

In addition, we are working with our partners at FEC to have a portion of NS traffic load and ground at their Bowden facility.

Through these actions, we believe we can minimize the impacts to our Jacksonville services.

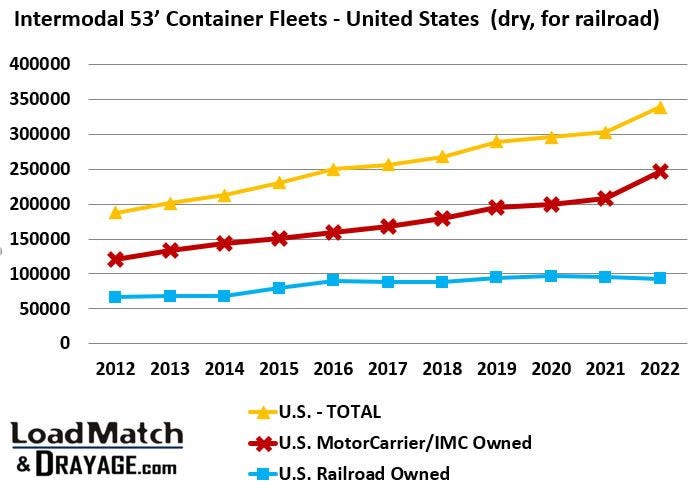

DOMESTIC CONTAINERS: Jason Hilsenbeck of Drayage.com and Loadmatch released his annual 53-foot container survey and provided a synopsis on LinkedIn.

Top line numbers from Jason Hilsenbeck:

Total US domestic containers (dry): 336,500 (+11% YoY)

Privately-owned domestic containers: 243,675 (+17% YoY)

Rail-owned domestic containers: 92,825 (-2.4% YoY)

Some notes here from me:

All the big IMCs — Hub Group, J.B. Hunt, Schneider National, XPO/STG Logistics, Swift Intermodal — added containers. About 20,000 new domestic containers combined, according to PIERS import data.

Amazon and Walmart added more than 6,000 containers combined since January 1, 2021, according to PIERS records. Amazon has brought in nearly 1,400 containers since January 1 alone, according to PIERS.

NON-ASSET IMCS: Are the US railroads committed to non-asset IMCs? It’s a question I hear all the time, and address in this story. I must give credit to David Vernon, a Wall Street transportation analyst with Bernstein. Vernon got CSX and UP to provide answers on their earnings call.

Here is what UP said:

LANCE FRITZ: I would guess, Kenny, given the growth that we're seeing, first through Knight Swift and then with Schneider, and the continued growth, it's probably fair to say the ratio of privates versus EMP-UMAXes grows towards the private side.

KENNY ROCKER: That's fair.

In a follow up, I asked UP whether Fritz means UP will not buy more EMP or UMAX containers in 2022. Here was UP’s answer to me:

We are committed to our EMP/UMAX programs, as is evident by our substantial investments in new chassis and GPS for our containers. With respect to containers, due to increased chassis turn times, we have yet to fully utilize our existing rail container fleet.

However, CSX CEO Jim Foote indicated a willingness to purchase UMAX containers. I asked CSX to clarify after the earnings call, and here is how CSX responded:

CSX is committed to intermodal growth with both CSX-owned rail asset users and privately-owned domestic container providers. CSX continues to order new rail asset containers and refurbish its existing fleet to meet growing market demand. We have also committed to outfitting our UMAX fleet with GPS units to improve asset utilization and customer experience. CSX views [the] rail asset as a key portion of its intermodal portfolio and will continue to invest as needed to capture growth, along with our asset based partners.

LET’S MEET UP: The US Surface Transportation Board will hold two day of hearings April 26 and 27 on “Urgent Issues in Rail Service.” Other than the Federal Maritime Commission, there are no containerized folks on the witness list. Nevertheless, here is a link to the livestream.

The National Shipper Advisory Committee to the Federal Maritime Commission is meeting April 27, and it’s drafted an interesting recommendation on intermodal rail. The committee wants the FMC to swoop in and take jurisdiction from the Surface Transportation Board over rail storage fees, a form of demurrage, on “through bills of lading,” or when the ocean carrier handles door-to-door logistics. The livestream will be posted on the FMC.gov website Wednesday.

HAPAG LLOYD: An administration law judge ordered Hapag-Lloyd to pay $822,220 in civil damages related to improperly assessed detention to Golden State Logistics in Southern California. Golden State Logistics provided evidence using Blue Cargo — a technology platform — that no appointments were available to return Hapag empties in Los Angeles or Long Beach.

Want to file a complaint? The FMC posted this video on April 22 with instructions on how to do it.

DUAL MISSIONS: Two marine terminals in Port of New York & New Jersey proposed a mandatory dual-mission rule last week, requiring trucking companies to match empty container returns to import pickups as a surge of Asian freight diverted from the US West Coast adds to ongoing space pressure. Michael Angell has more in our JOC exclusive.

OLD BAY SEASONING: A new loop — the Chesapeake Bay Express — launches May 9 from Yantian starting with the CMA CGM Callisto (11,356 TEU). It stops in Norfolk, Charleston, Savannah, and Miami in June. But why is it called the Chesapeake Bay Express if it’s not traveling on the Chesapeake to the Port of Baltimore?!? Maryland!

LABOR DAY: I asked a shipper to explain why it’s so hard to get warehouse labor in his distribution centers. Prior to COVID, a warehouse job typically paid the same or less than unemployment benefits. Now many pay $17 to $21 per hour, he said.

“The problem is every industry has raised their salaries. So if you can go work at Starbucks and make $17 an hour, then why do you want to work in a D.C. doing hard work? $17 an hour? Does that make sense?

Why do you want to work in a dusty, smelly, wet, hot, warehouse when you can go into an air conditioned building like Starbucks and earn the same salary?”

Labor is also a challenge for intermodal terminal operators ITS Conglobal, Pacrail, Parsec, and Rail Terminal Services. Yard hostlers are not often air conditioned.

Who wants to drive a yard hostler in Texas in August? Or in Chicago in January?

KNIGHT RIDER: Dave Jackson had a few interesting LTL quotes on its earnings call.

“You could maybe say we now have a super-regional LTL presence, and we're on our way to a national presence.”

“When you can be super-regional, there's pricing opportunities with that…When you can be national, there's even more pricing opportunity.”

Jackson needs to fill in gaps in the Northeast and Southwest to become a national LTL Possible targets: A. Duie Pyle, Dependable Companies, Pitt Ohio, and Oak Harbor Freight Lines.

JOC INLAND: If you enjoy Please Haul My Freight, please register to attend our conference at the Westin Chicago River North this September. Find me and say hello!

Any opinions in this notebook represent the author’s views, not the Journal of Commerce, IHS Markit, or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paid JOC subscribers.

Not a paid subscriber? Sign up for one!