Welcome Please Haul My Freight: Edition 46. Here are some items in my notebook this week:

CHASSIS: In case you missed the news, the Coalition of American Chassis Manufacturers filed a case against CIE Manufacturing, formerly CIMC Intermodal, alleging the company is still using China for chassis labelled as “Made in Thailand,” evading antidumping and countervailing duties.

CIE has suspended importing chassis into the US until further notice.

The Coalition thinks its investigator who observed the Thai factory observed clear inconsistencies with mass production of chassis in the country.

CIE’s CEO Trevor Ash (no relation) was adamant that the claims were totally false and retaliation for CIE’s case against Pitts Enterprise filed in 2022.

Ash was not shying away from answering my questions. He’s on the record saying “no way, no how” are they shipping product from China to Thailand, and nothing from the Dongguan (China) facility comes to the US either. He said there is overwhelming evidence to show CIE is playing by the rules.

We’ll see who is right as the CBP conducts its investigation.

YELLOW: All the talk of the last month has been Yellow. Will it or won’t it go under? And then it did. There are two things that I think shippers need to watch.

As shippers use other LTL providers, will the service of those LTL providers degrade for existing customers? For example, if I’m a long-term XPO customer, I don’t want XPO to take on so much new business that my service gets worse.

Second, watch the impact on the full truckload market. Shippers are telling me that the rates are cheap enough that it makes more sense to send 5 to 7 pallets on a full truckload.

I’ll be talking truckload with Crete Carrier during our Inland Distribution Conference in Chicago Sept. 25-27. Perhaps this topic comes up!

INTERMODAL REVENUE: One data figure that I try to estimate every quarter is total revenue in domestic intermodal (containerized). By combining data from earnings reporters and the Intermodal Association of North America, I can project out a ballpark figure on how much revenue domestic containerized traffic generates in North America.

I believe domestic containers generated about $6 billion in revenue in the second quarter, down from $6.4 billion in the first quarter. Domestic container revenue is down 18.3% to 19.3% year over year, based on the analysis.

I’ve also indexed the data to 2019 levels.

If’ you compare this chart to the Intermodal Rail Producer Price Index, it’s remarkably similar. So what does this mean for intermodal contracts going into 2024?

As one intermodal executive told me:

“I would be happy with flat year over year, as far as rate goes with our customers. We were taking concessions right now. But once the market turns there's not going to be a hesitation in our part to go back to our customers and go for rate increases. I mean, some of the concessions, especially with the much larger BCOs out there have been really brutal.”

We’ll dive deep into intermodal pricing today and what to expect in 2024 RFPs during our Inland Distribution Conference Sept. 24-27 in Chicago:

The best questions for these sessions come from the shippers. If you’ve got a truckload or intermodal question that you’d like me to ask, don’t hesitate to reach out.

Also, if you’re a shipper who uses domestic intermodal, then we’d like you to participate in an anonymous survey launching Sept. 1 to let us know who are the best IMCs in the industry and why.

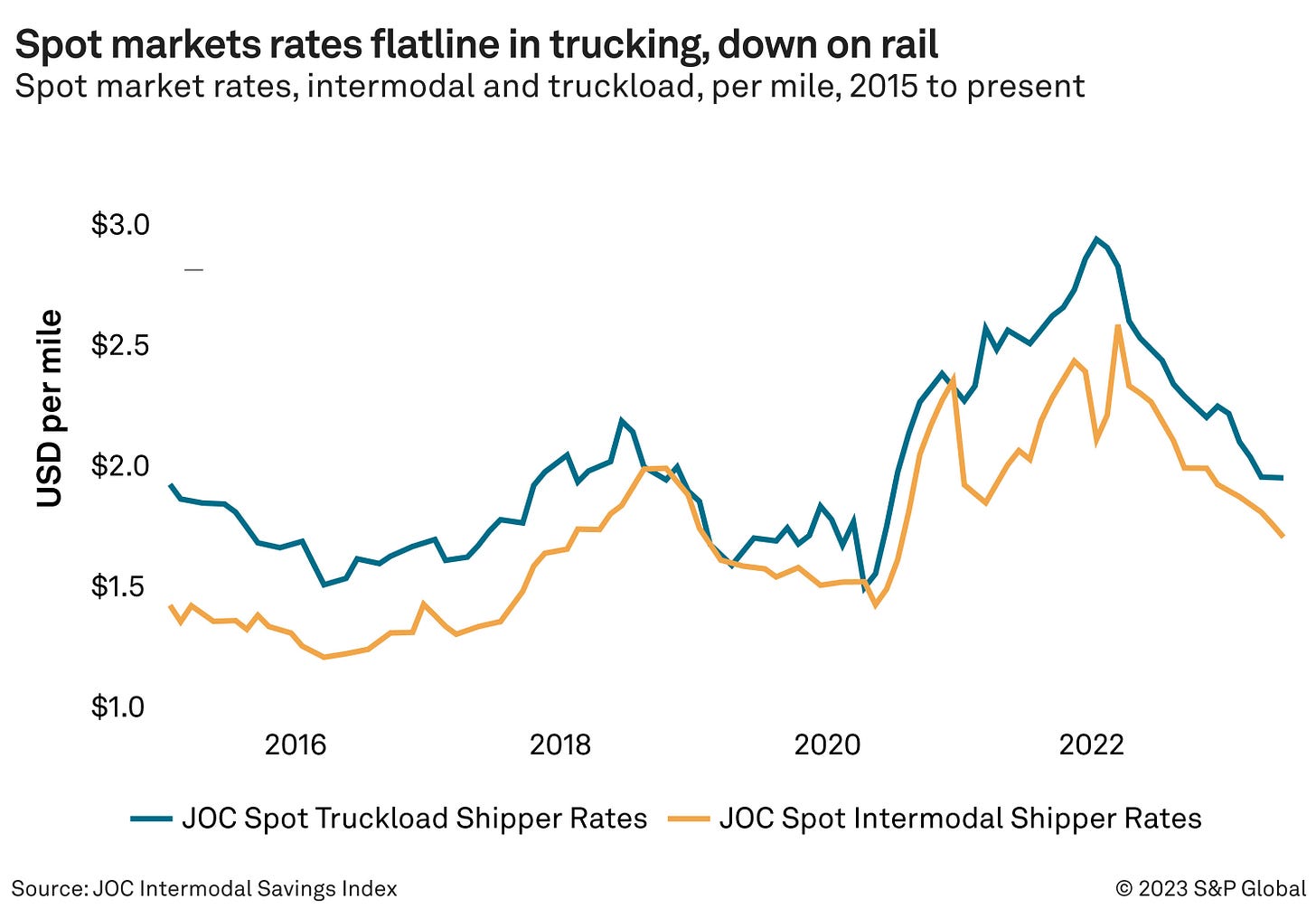

INTERMODAL SAVINGS: I wanted to share one chart that is giving me some optimism about intermodal savings, ahead of the Journal of Commerce Intermodal Savings Index report out later this week.

I’m encourage for the intermodal industry to see that blue line of truckload rates flatlining while the intermodal number went down.

I anticipate an increase in intermodal savings in the third quarter as the fall of truckload rates bottom out. Rising fuel surcharges should also help the index because it is weighted toward longer lengths of haul, in which fuel surcharges hurt trucking more than intermodal rail.

Fuel hurts intermodal on the shorter hauls — i.e., Atlanta-Chicago-Elizabeth NJ triangle, the Los Angeles-Denver-Seattle triangle, and perhaps that Southern Texas-Chicago corridor.

The average intermodal contract saved shippers about 25% in the second quarter, and spot transaction saved between 12% and 13%.

What was the story of the second quarter? Perhaps it’s best described this photo from John Roetter spotted in Elwood-Joliet recently showing scores of J.B. Hunt empty containers stacked.

GREEN TRANSPORTATION: What is the future of hydrogen to power trains as a green alternative to diesel? Intermodal has an advantage to trucking on its environmental impact, but trains run on diesel still. While CSX and CPKC are exploring this technology, this article is an interesting read in how the early returns in Europe are not promising on hydrogen.

INTERNATIONAL INTERMODAL: In my check-ins with the drayage and NVO communities on how IPI (international intermodal), it’s pretty quiet except for two locations: Norfolk Southern’s Austell (Atlanta) and Rossville (Memphis) ramps.

From one Memphis source:

“Our average turn time right now is 1-2 hours with one out of 50 or so moves turns into a 4-hour delay. When this first transitioned over, most transactions were taking 4 hours or more. Right now the delay is trucks showing up at same time.”

From an Atlanta source:

“I would say on half of our moves it's taking 50% longer. But, July actually improved a little bit over June. I'm looking at our bill out, and we billed less in rail detention charges to our customers in July than we did in June”

There are some lessons to be learned in how the Memphis rollout because a planned July rollout of the same appointment system in Atlanta has been pushed back three months, according to Norfolk Southern.

CALIFORNIA COOLDOWN: With the West Coast losing market share to the East Coast, plus a slowdown in import activity, the warehouses in Southern California are not in as high demand as they were in recent years, according to a Wall Street Journal article.

The warehouse vacancy rate in a logistics-heavy region called the Inland Empire jumped to 3.8% in the second quarter from 1.2% a year earlier, according to real-estate services firm Savills. That is still below the nationwide vacancy rate of 4.8% but a sharp reversal from a yearslong contraction that left one of the country’s busiest warehousing markets effectively full.

TRANSLOADING: Sid Brown, CEO of NFI Industries, posted this message on LinkedIn:

Our Real Estate team is wrapping up the construction of two brand-new state-of-the-art transload facilities in Virginia and Georgia. These facilities are now available for shippers interested in streamlining their operations from the port.

The Port Wenworth facility is the transload facility adjacent to the Port of Savannah, which it’ll operate in coordination and cooperation of the Georgia Ports Authority.

The transload facility in Savannah is going live in early September, if not sooner.

Any opinions in this blog represent the author’s views, not the Journal of Commerce or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com.

You may also request the data behind my Intermodal Savings Index and my Shipper Truckload Spot Rate Index, available to those with a Journal of Commerce Gold subscription. Click here to become a Gold member.