Welcome Please Haul My Freight: Edition 44. Here are some items in my notebook this week:

RIPPING UP THE RATES: Union Pacific Railroad and BNSF Railway wholesaler COFC Logistics have essentially ripped up the annual aggregate rates (contracts for low-volume shippers) midyear and lowered rates across the board amid weak domestic intermodal demand.

While I’m not going to reveal all the rates, here is a pivot chart that shows the averages across more than 200 lanes comparing the old UP agg rates with the new ones that were put into place June 16, 2023.

What does this tell us?

Los Angeles, Portland, Salt Lake City, and Seattle show us how weak domestic intermodal has been on the West Coast, which is down 18% out of the Pacific Northwest and 11.5% out of the Southwest — while down 6.9% nationally.

El Paso and Laredo tell me that UP wants to shore up its defenses against CPKC on Mexico cross-border business. Laredo is a definitely play against the CPKC’s Mexico Midwest Express.

CPKC INVESTOR DAY: Canadian Pacific Kansas City made several big announcements at its Investor Day this week. It has reached a deal with CSX and Genesee and Wyoming to build an alternate CSX option to compete with Norfolk Southern Railway’s Meridian Speedway.

The CPKC-CSX agreement is squarely designed to benefit Schneider National and also win automotive business that has historically be a stronghold of Union Pacific Railroad-Loup Logistics.

We also learned that CPKC and Schneider were talking as early as 2021, so Schneider was talking to CPKC while simultaneously striking a deal to leave BNSF for Union Pacific. Nevertheless, it seems like Union Pacific was unwilling to share the auto business with Schneider and thus the Schneider-CPKC partnership.

CPKC also revealed that Hapag Lloyd is the first partner marketing the Port of Lazaro Cardenas to customers, and that CPKC wants to operate a daily international intermodal train out of the port within the next few years.

Finally, CPKC revealed the Americold partnership includes warehouses built on terminal, allowing CPKC to pack reefer boxes beyond US highway weight limits because the loads will never touch US streets.

MEXICO: Remember we will be doing a session on cross-border intermodal at our Inland Distribution Conference on Sept. 27. We will have Jonathan Wahba and Michael Baumgardt to discuss the CPKC-Schneider, Johnny Curiel to talk about BNSF Railway-J.B. Hunt options, and Keith Crenshaw of Matson to discuss Union Pacific-Falcon Premium.

Click the photo to register and use code “AASUBSTACK20” for a special reader Substack discount!

STRIKE, STRIKE, STRIKE: The ILWU Canada given a 72-hour notice under Canadian Labor Code of a strike at the West Coast ports starting on July 1. Unlike its U.S. counterparts, the ILWU Canada was not prepared to have the negotiations drag on for more than a year. We’ll be watching as it impacts Vancouver and Prince Rupert.

Meanwhile, the Teamsters ordered UPS to provide its last, best, and final offer by June 30, setting the stage for a potential strike. Needlessly to say, it would create quite a disruption in parcel, LTL, and intermodal rail. UPS is one of the largest domestic intermodal shippers. Just ask CSX, Norfolk Southern or Union Pacific!

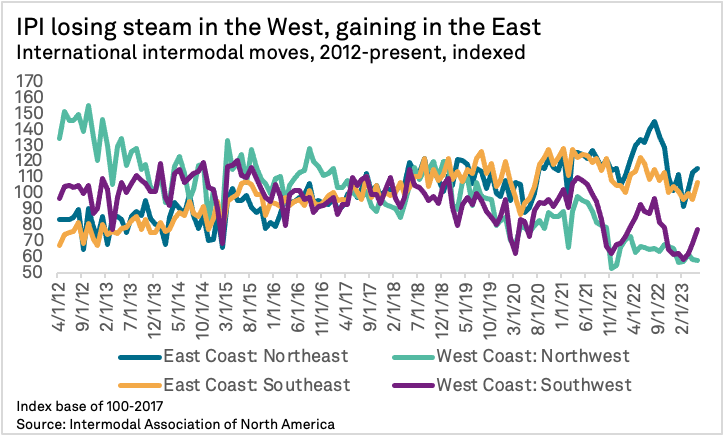

IPI TRENDS: While international intermodal is down more than 11.3% year over year between January and May, according to the Intermodal Association of North America, the regional breakdown shows the West Coast IPI has taken a share hit in recent years.

While the West Coast IPI index (teal and purple) has fallen since 2012, the East Coast IPI index (blue and orange) has risen since 2012.

The good news is the vessel reliability to US West Coast ports has hit a two-year high, as our Bill Mongelluzzo reported.

SAFE CARGO: In our last Substack, Musical Chairs, we shared how agricultural exporters are reporting containers seals are being broken on the train from Chicago to Southern California. Loup Logistics announced June 23 a pilot program to test bracing cables on boxes traveling on UP trains between Chicago and Los Angeles.

The problem is that you need a bolt cutter to break the cables, and not all receivers have them readily available.

BNSF Railway talked about its efforts on cargo theft at a symposium earlier this month, including additional policing, drone technology, and placing high-value cargo into the bottom well of a double-stack train.

Each solution, however, comes with its own set of drawbacks and inconveniences. The railroads are doing the right thing, there just isn’t an easy solution.

WHO’S THE BEST: When it comes down to transportation, it’s all about execution.

So how do you know if you’re getting the best service? That’s where the Journal of Commerce Intermodal Service Scorecard comes in handy.

It’s an Angi’s or Home Advisor for domestic intermodal. Like homeowners can review plumbers or roofers on Angi’s or Home Advisor, we have platform for shippers to anonymously score their intermodal service providers.

We tabulate the results to name the top-rated providers, just like one can find top-rated providers on Angi’s or Home Advisor.

Click the photo to message me for more details. All responses are 100% anonymous.

LOSING A CONTRACT: BNSF is changing terminal operators in Logistics Park Chicago, ending its agreement with Parsec and switching to ConGlobal.

According to a Parsec letter sent out June 22:

“This is regrettable as we have operated the facility professionally for almost 17 years with the most dedicated and committed personnel. While the closing of this chapter is unfortunate, I believe we can hold our heads high knowing we operated the facility with the focus to make it the best intermodal ramp in this country.”

I believe the handoff will take place on or around July 15, 2023. I’m also told the BNSF C-Suite did a site tour in Logistics Park Chicago this week, although I haven’t officially confirmed that with BNSF.

PORT OF WILMINGTON: The North Carolina State Ports Authority is undertaking an expansion project to its intermodal facility. The $22.6 million intermodal facility is expected to convert 250,000 container boxes from trucks to rail over the next decade. The project received a grant from the U.S. Department of Transportation and will help keep Wilmington competitive with ports like Charleston. It’ll break ground in January and open in 2025.

EMPTY MILES: Uber Freight has released a report stating that the trucking industry could be driving nearly double the number of empty miles than previously estimated. As per the article in Transport Topics, Uber Freight said between 20% and 35% of miles driven by trucks in the US annually are empty. Uber Freight utilized existing data rather than relying on surveys, estimating that truck drivers waste about 3.5 billion hours per year driving without freight.

ALL RISE: The US Supreme Court dealt a blow to Norfolk Southern, rejecting the NS bid to limit liability in states where it does minimal business. The case involved Robert Mallory, a retired worker who alleged exposure to carcinogens led to his colon cancer. Mallory filed a lawsuit in Pennsylvania, prompting Norfolk Southern to argue against the state's jurisdiction. The ruling has significant implications for forum shopping, a practice in which litigants choose favorable courts for their claims.

Any opinions in this blog represent the author’s views, not the Journal of Commerce or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com.

You may also request the data behind my Intermodal Savings Index and my Shipper Truckload Spot Rate Index, available to those with a Journal of Commerce Gold subscription. Click here to become a Gold member.