Welcome Please Haul My Freight: Edition 36. Here are some items in my notebook as I hop on a plane for TPM23 next week:

INTERMODAL VOLUME: There is really no good way to sugarcoat the intermodal numbers. The Intermodal Association of North America reported domestic container volume was the lowest January since 2020. Domestic container volume was down 4.2% on a rolling three-month basis year over year. Throw in the weak trailer-on-flatcar business, and the number is down 7.2%. International intermodal fell 2.2% during the period.

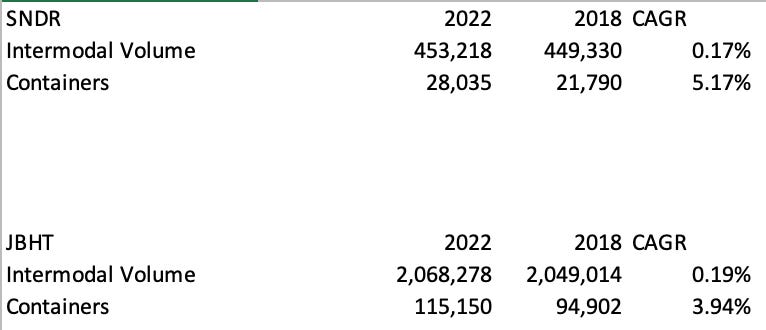

Normally I’d look at the numbers and say, “Well the big players like J.B Hunt and Schneider show intermodal has a bright future,” but is it so bright?

Here are links to the Schneider data (2022, 2018) and J.B. Hunt (2022, 2018).

OK why are these so bad? The answer is box turns. The average J.B. Hunt and Schneider container is doing a fraction of what it did in 2018. So the higher equipment CAGR is feeding how inefficient the supply chain has become since 2018.

I estimate the US box turn ratio in January was 1.47. In 2018 that number was 2.00 to 2.20. Shippers have taken much longer to unload containers in the last 24 months. Railroad service was subpar in 2021 and 2022, which also hurts box turns.

But now the box turn ratio is poor because containers are stacked, not because of shipper detention or poor rail service. Too many containers, too little demand.

INTERMODAL CONTRACTS: In following up with several shippers in recent weeks, I’m starting to hear a few themes on domestic intermodal bid season:

Intermodal providers, in general, are letting the short-haul lanes go to trucking. It seems like the railroads and/or asset-IMCs won’t chase truck rates on lanes like Atlanta to Elizabeth, NJ, Charlotte to Chicago, Chicago to Dallas, Los Angeles to Denver, or Los Angeles to Seattle. The thinking “Shippers who take truck will come back to rail eventually on these lanes” may be a factor here.

Lanes in and out of the Southeast are getting very truck competitive too.

The larger asset IMCs are very much fighting and clawing for the long-hauls, especially out of Los Angeles. I’ve heard and seen intermodal contract quotes that are jaw-dropping from a certain unnamed big intermodal provider for Los Angeles to Chicago and Los Angeles to Dallas.

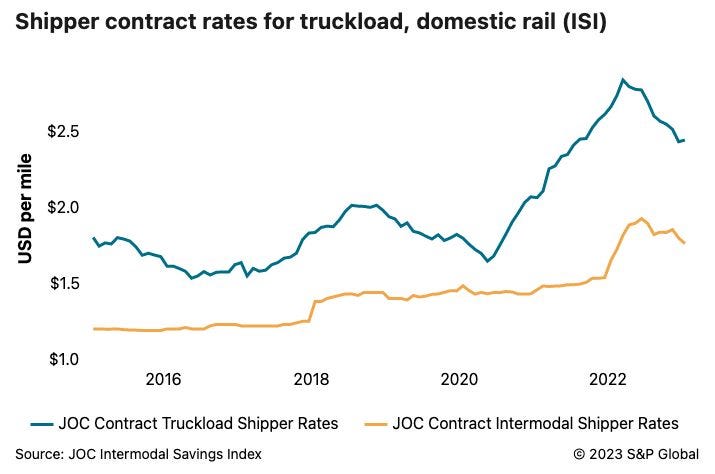

Here is the latest showing the race to the bottom between intermodal and trucking:

INTERMODAL SCORECARDS: The JOC Intermodal Savings Index fuels the observations above. Our proprietary data and analysis are unmatched on the issue of how much money an average intermodal shipper saves using rail. Our next big project — domestic intermodal service.

Shippers: Companies like Hub Group, J.B. Hunt, and Schneider National perform a service. Like you can rate service providers with Angie’s List, Consumer Checkbook, or the Better Business Bureau, we have created a survey to grade your IMCs.

IMCs: Railroads also provide a service, so we want you to grade their performance.

All survey respondents will be anonymous but will receive detailed scorecards identifying the “best of the best” service providers.

Click the photo or e-mail me for details on how you can participate.

GLOBAL 4: I reported earlier this week that Union Pacific Railroad is beginning the process of becoming a hybrid operation in UP Global IV in Joliet, Illinois. All imports from California ports and most exports will be put into stacks running like CSX 59th Street or Norfolk Southern Landers. Imports from the Pacific Northwest and domestic loads will remain “wheel-mounted” in parking spots.

This makes sense on many levels.

The UP “no cherry-picking” policy was irksome, at best, to BCOs, ocean carriers, and truckers. Eventually, the Federal Maritime Commission would have also chimed in on whether UP’s storage fees (“demurrage”) were a violation of the US Shipping Act when the container is covered under a carrier haulage agreement. The FMC judge’s decision on chassis (ATA v. OCEMA) would have also presented logistical challenges to keeping G4 a purely wheeled operation.

UP took it a step further Friday, announcing what is effectively the end of the “no cherry-picking” policy across the board.

Yes, truck turn times are longer in grounded terminals. But making the container available matters, even if takes hours in line.

POLITICS-OHIO: Ok, so here is the section where I delve into opinion. I enjoy being a business reporter. I don’t want to be a political reporter. I never want to be a political reporter. This Norfolk Southern Railway derailment is a classic example.

Horrible accident. I feel terrible for the residents of East Palestine, Ohio.

Now both sides — the Left and the Right — use this as an opportunity to trot out all the old debates as if they are new. As if it’s a game where now this crisis opens a window to gain traction on issues that have stalled in Washington for years.

Here are some examples:

1) USDOT calling for paid sick leave: Now I’m happy this issue was resolved after all the animosity last fall. Railroads said they would bargain on the issue locally after the national deal was closed. They have. CSX, Norfolk Southern, and Union Pacific have all announced deals to provide short-term sick pay. It has nothing to do with East Palestine, however.

2) Corporate greed: I’ve heard Senator Bernie Sanders and other prominent Democrats bang the drum. Corporate greed. Stock buybacks. Billion-dollar companies not paying workers their fair share. I got it the first 1,000 times. Even if Senator Sanders is 100% right, it’s a broken record. Yes, Democrats are the party of pro-worker and anti-big corporations. Republicans are pro-corporations and anti-unions. Welcome to 1995.

3) Train crews: Again welcome to 1995. Unions want regulations to mandate two-person or three-person crews. Railroads want one-person crews. Thus Democrats and unions are taking East Palestine as an opportunity to trot out the issue again.

Republicans do it too. All politicians and interest groups do it, but it’s too much for me. So what should we focus on? What we know and don’t know.

Let’s discuss the defect detectors.

Do railroads need to change their policies on when to stop a train based on readings from a wayside defect detector? Perhaps lower the threshold for overheating before stopping the train. What are the standards other railroads use? Why 115 degrees?

These are the questions I want to hear answered.

Any opinions in this blog represent the author’s views, not the Journal of Commerce or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to JOC subscribers with the proper subscription tier.

Not a Journal of Commerce subscriber? Click here to become one.

.