Welcome Please Haul My Freight: Edition 30. After a hiatus for the JOC Inland Distribution Conference, I am back and ready to write.

Here are items in my notebook this week:

SPOT MARKET TURN: Have we reached the bottom of the spot truckload van market? Perhaps. It’s too soon to tell yet. But the JOC Shipper Truckload Spot Rate Index, an analysis of data from Cargo Chief, DAT Freight and Analytics, digital broker Loadsmart, and a survey of 3PLs and shippers, shows an uptick from September. This is a normal seasonal trend in October (as the chart shows). The JOC Shipper Truckload Spot Rate Index, tracking shipper rates, is up $0.036 from September:

DAT CEO Claude Pumilia connects the spot truckload rates to the rail labor situation, citing a high-volume intermodal lane in Los Angeles to Chicago.

Two unions last week ratified their deals, but the Brotherhood of Maintenance of Way Employees Division of the Teamsters (BMWED) rejected its agreement.

Eyes are now on the vote from the Brotherhood of Locomotive Engineers and Trainmen (BLET) and SMART-TD, which will be announced the third week of November.

If the BLET and SMART-TD ratify, then BMWED members may reverse course, but if BLET and SMART-TD reject like BMWED, we can be in crisis mode again around Thanksgiving. The stakes are massive: sources tell me the International Longshore and Warehouse Union (ILWU) is watching the BLET and SMART-TD vote closely and taking cues on how they approach their contract with West Coast ports.

RAIL STRIKE: One large US shipper told me that he is reluctant to put more than the bare minimum on the rails until the labor situation is resolved:

“You have a potential port strike, you have a potential rail strike, you have fuel surcharges which you don't know which way it's going. And then you have no idea what the recession is going to do to our sales. Maybe the virus part of the pandemic is over, but we're almost living in an aftermath. We're in this this pandemic aftermath and the real question is, ‘What will the new norm be? I don't think we'll ever get back to the old norm, so what is the new norm?’ And I’m hedging my bets where I can until I have better clarity on some of these issues.”

Another shipper told me he’s not worried so much:

“No concerns yet. A major US Class I railroad source leveled with me that he would say if panic is warranted, and he told me that isn’t warranted yet, for sure. The unions risk losing what was negotiated at the last minute tentative agreement if they hold out.”

His point is well taken. The BLET, SMART-TD, and other unions got some extra concessions at the bargaining table last month above and beyond what was in the Presidential Emergency Board recommendations. If the rank-and-file reject, Congress can mandate the PEB recommendations as the final agreement, which would be a loss for the unions. More good articles on the rail situation from Axios and Marketwatch.

ATA NUMBERS: The American Trucking Associations Truck Tonnage was up in September. Remember ATA’s index is heavily weighed toward contract freight, not spot market loads.

INTERMODAL RATES: There are a lot of pressures on the US railroads ahead of 2023 contracts. Given truckload spot rates are about 7% cheaper than truckload contracts, based on my internal data, it’s likely motor carriers will have to deliver concessions on contracts in 2023 regardless of inflation. If truckload rates decline, then railroads will have to be strategic about how they price intermodal contracts.

The spot market rate gap (see chart below) has fallen below $0.20 per mile nationally in recent months, a dangerously small gap that causing conversion back to trucking. While the contract rate gap isn’t in dangerous territory yet — below $0.40 per mile — it could get there.

So what’s the answer? Should US railroads keep intermodal contracts in 2023 flat? There’s one problem with that: the concessions to the rail unions carry some major pay increases and other benefits. The US railroads could absorb these new costs without a rate increase to intermodal shippers, but their operating ratios would likely suffer and Wall Street investors are unforgiving in this bear market.

MARK YOUR CALENDAR: The JOC Intermodal Savings Index Third Quarter Report will be released in the next seven to 14 days. For those unfamiliar, this is a research report with proprietary JOC data measuring how much money an average shipper saves using domestic intermodal versus long-haul trucking across the US.

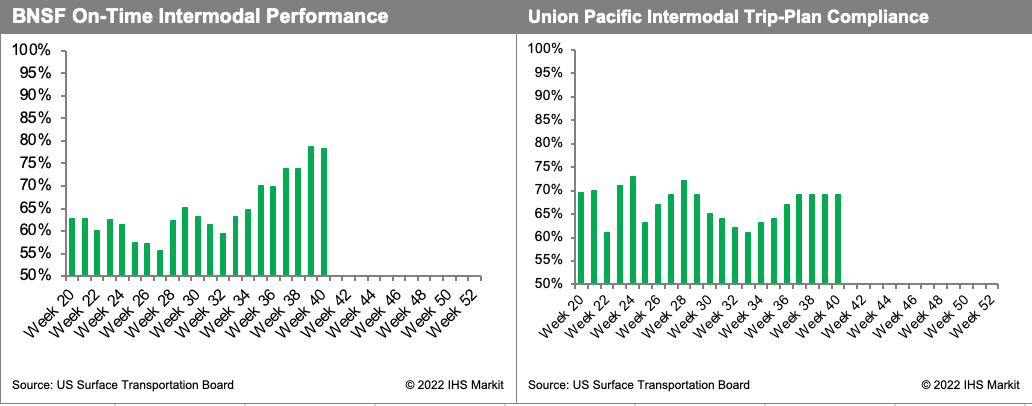

INTERMODAL SERVICE: Another topic discussed in the JOC Intermodal Savings Index is domestic intermodal service. Here is a chart that will be in the report, which shows intermodal service is better today than it was three months ago.

Generally the feeling is intermodal service is “less bad” than it was three months ago, a step in the right direction, but it’s still not where it needs to be.

BNSF and Union Pacific using different methodologies to capture performance, but in general IMCs want transcontinental trains to be 85% on time, and eastern US trains 95%+ on time to satisfy shippers.

Dustin Ohlman, vice president of intermodal with Swift Transportation, reminded us at the 2022 JOC Inland Distribution Conference that service is as important as price:

“It’s become very apparent that we can't just drop price and assume volume will come back. Price is a component of that, but it's not the most important component. If it was, then we would have seen significant jumps in rail volume over the last two years when the gap between intermodal and truck was higher than ever. Customers didn't flock to intermodal, not because of price but because of service.

So it's great that spot prices are going down, and the railroads are trying to incentivize customers back, but until there's service that customers can trust, lowering rates can only so do much.”

JOC INLAND22: It was a great event at JOC Inland ‘22 in Chicago last month. Mark your calendars for Sept. 25 to Sept. 27, 2023 for JOC Inland ‘23 in Chicago. For those who missed it, here are some items that stood out to me:

UP’s Kari Kirchhoefer on the 5,600 chassis order:

A: “We expect by the end of October that we'll have all 5,600 in place. So the good news for someone who's trying to move an intermodal movement shipment is we have containers and chassis ready.

Q: Are there any more chassis orders for UP in 2023?

A: The good news is we're just now getting them in, but the bad news is it looks like the market could soften. So for right now, I don't anticipate that we're going to need additional infrastructure from a chassis perspective.”

Kirchhoefer on whether UP will abandon the EMP-UMAX program:

“It seems very hard for me to see it in a world where we would have that happen, when besides just domestic intermodal, I have a significant base of auto parts and parcel guys that move in our EMP UMAX fleet. So I don't see any future that doesn't have a portion of our railroad still running with non-asset based partners.”

Michael Baumgardt said Schneider’s service issues in Q2 was not a signal of a deteriorating relationship with BNSF Railway:

“There might be some conflation of issues. There's been well known things that have been worked through in the West. I'll tell you what, though, what I'm hearing from customers is excitement about the transition. As we made this announcement, in January, we made a decision that we're really going to go and try to grow on the non overlapping lanes that the UP operates on. And 15% of our western business was on the Union Pacific just in a few months.

There are a few reasons why we made the decision to announce early. One, we think it's the right thing to be transparent with the BNSF. That's important to us. The other thing is we thought it was really important to have that time for planning such a transition like this. We've been working with the Union Pacific for the last nine months. And I am confident we have got everything wired, from commercial to technology to operations, and I'm feeling really good about it. ”

We also learned DCLI’s purchase of 40,000 domestic chassis is likely to be fulfilled late next summer.

IMPORT SLIDE: There is no doubt the spot market rates from the Asia to the US West Coast have fallen to pre-pandemic levels. While the Chicken Little fear-mongering was about “volume” reverting to pre-pandemic levels, I would be the first to acknowledge “rates” have PLUNGED, rates have FALLEN OFF A CLIFF.

But we have to separate stories: rates and volume. Don’t confuse the two.

Yes, Asian imports to the US plunged between August and September, although I think that’s an unfair comparison as volume into ports tend to always peak in July-August.

But I also think we need the proper perspective. All US imports were down less than 1% last month versus September 2021 and were up to the US East Coast. While fourth quarter volume probably will be lower than a year ago, the Chicken Little fear that volume reverts to pre-pandemic levels is highly unlikely on the East Coast (see PIERS data below):

RESILIENT SHOPPING: Despite inflation continue unabated, the latest data shows US retail sales are holding up in the face of stiff resistance

More from Reuters:

"Consumer staying power may be waning, but it's showing few signs of breaking," said Tim Quinlan, a senior economist at Wells Fargo in Charlotte, North Carolina. "Overall spending will continue to moderate as inflation persists and tighter monetary policy begins to weigh more meaningfully on consumption.”

"The (retail sales) data don't show the kind of overheating that would necessitate more aggressive rate hikes, nor the kind of rapidly deteriorating consumer spending that would encourage a pause," said Will Compernolle, a senior economist at FHN Financial in New York.

WHEELIN’ AND DEALIN’: Bison Transport is acquiring Pottle Transportation, less than a year after the Canadian carrier acquired Hartt Transportation. All three companies are certainly familiar with each other as active members of American Trucking Associations and the Truckload Carriers Association.

On the drayage side, Mediterranean Shipping Co. (MSC) acquired C&K Holdings (C&K Trucking and AV Holdings) in late August, a deal we knew about but wasn’t ever publicly announced.

KAG Logistics, a subsidiary of Kenan Advantage Group, acquired Connectrans Logistics Inc., based outside Toronto.

Digital broker Transfix abandoned plans to become a publicly-traded company through a special purpose acquisition company (SPAC), a result of the bear market.

DATA COLLECTION: A jury in Illinois ordered BNSF Railway to pay $228 million to a class of truck drivers for collecting the fingerprints without consent in violation of the Illinois Biometric Information Privacy Act. CNN had a good article about the Illinois law and how companies in many other industries are on notice with this law.

Any opinions in this blog represent the author’s views, not the Journal of Commerce, IHS Markit, or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to JOC subscribers with the proper subscription tier.

Not a JOC subscriber? Click here to become one.