Welcome Please Haul My Freight: Edition 38. Here are some items in my notebook this week:

LOS ANGELES: One theme coming out of TPM23 was that truckload and intermodal contracts out of Los Angeles-Ontario are significantly underperforming the national market.

While truckload contracts are -14% nationally, truckload contracts out of Los Angeles-Ontario -22% YoY, according to DAT Freight and Analytics. Intermodal contracts nationally are -3% to -6%, but contracts on several Los Angeles lanes are -15% to -20%, according to the JOC Intermodal Savings Index.

Thus the JOC Contract Intermodal Savings Index is rising for 2,000+ lanes, while for 800-1,200 miles and 1,200-2,000 lanes the index is falling (see chart below).

There is also a divergence between asset-based intermodal providers and non-asset IMCs. On lanes such as Los Angeles to Chicago and Los Angeles to Elizabeth (NJ), the private container owners are offering contract rates that non-asset IMCs cannot compete with right now.

INTERMODAL VOLUME: There is no way to spin it — intermodal is struggling to get volume in 2023. Intermodal volume, international and domestic, is worse than even pre-pandemic 2020.

Perhaps no surprise then on the screenshot below from Nick Little, director of railway education at Michigan State University. I concur with these observations 100% having visited several rail ramps and marine terminals during TPM23.

Domestic containers/chassis are being stacked. Marine chassis are being stacked. Rail yards have dozens, if not hundreds, of open spots for wheel-mounted containers.

SERVICE: The positive is intermodal service is better. Not surprising. Fewer loads means service will be better. Just like a highway: there’s no traffic Sunday at 2 a.m., but it’s bumper-to-bumper traffic Monday at 5:30 p.m. or when there are multiple major sporting events happening near one another. No different.

Trains speeds are up. On-time performance is up.

Savvy shippers and IMCs know that the “rail service has been fixed, we did it!” is not an accurate narrative. It’s Sunday at 2 a.m. right now, not Monday rush hour.

INTERMODAL SCORECARDS: Who do you think is the best railroad at moving 53-foot containers? BNSF Railway? Union Pacific? CSX Transportation? Norfolk Southern? Maybe a Canadian rail?

What about the best intermodal provider? Is it J.B. Hunt? Hub Group? Schneider? Maybe STG Logistics, Swift Intermodal, or a non-asset IMC?

That’s what we want to know.

Coming soon: JOC’s Intermodal Service Scorecards.

We want to hear from IMCs and from intermodal shippers. Fill out our survey anonymously and tell us who are the best service providers in the industry and why?

It’s an Angie’s List for domestic intermodal!

Want to participate? Click on the photo below to contact me.

CP-CSX: Canadian Pacific and CSX Transportation began a pilot program last November sending CSXU 53-foot containers between western Canada and the US Southeast. I just learned about it earlier this week, but I am not surprised.

Union Pacific Railroad kicked CP out of the EMP program last October and signed an agreement with Canadian National. With that decision, CP ceased doing business with Norfolk Southern Railway.

CP was looking to replace the lost cross-border 53-foot business, which included about 2,100 EMP containers. It’s not surprising CP would reach out to NS’s competitor CSX to re-capture some of that lost business. The pilot program is small in scope, however.

CP and CSX will evaluate the results of the pilot program in a few months.

EAST PALESTINE: The National Transportation Safety Board said the railcar that derailed on February 3rd in East Palestine, Ohio, was owned by GATX Corp. and handed off among multiple railroads before the accident.

Braden Kayganich has some great posts of how people misunderstand the issues, including preventability, tank cars, and electronically-controlled pneumatic brakes. Also a good article from Bill Stephens on the rail safety.

What I don’t like is how politicized this situation has become. Pro-union spin. Pro-railroad spin. The Senate committee hearing was meaningless theater. I’d rather watch a reality TV program on Netflix.

I will praise the Norfolk Southern public relations team. It’s difficult and stressful for any PR person to manage a crisis. I know the PR team at Norfolk Southern. They are hard workers. They are also doing a good job managing a PR crisis.

ANOTHER ONE: Service disruptions tend to be a regular thing on the railroad. I’d keep my eye on this Norfolk Southern derailment, however, given the location and connection to the Meridian Speedway and UP-Shreveport interchange. Hopefully, it doesn’t become a major issue.

SILVER LINING: The National Retail Federation is hopeful of a rebound in import volume later this summer, saying “Import cargo volume at the nation’s major container ports is expected to begin slowly climbing again this month after February saw one of the lowest levels since the beginning of the pandemic.” Here are some forecasts from the Global Port Tracker. Let’s hope July looks as good as this forecast.

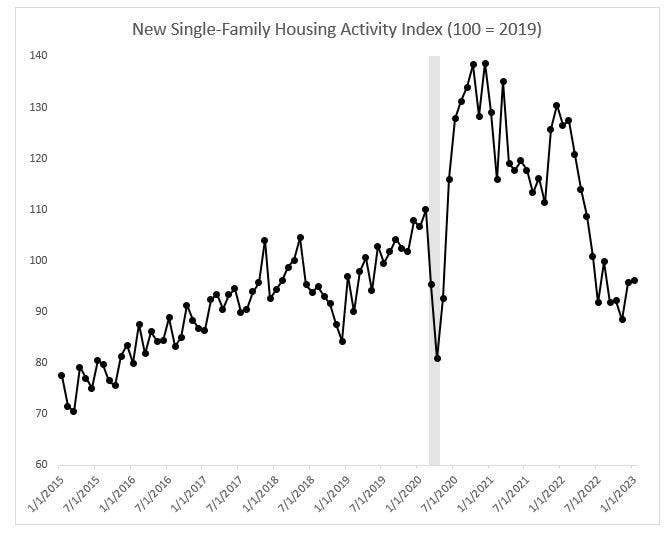

HOME SALES: Jason Miller of Michigan State University reiterated a point in a LinkedIn post that I heard from furniture shippers at TPM23 who were bearish in their outlook.

New single-family housing activity is a key sector that generates freight demand for trucking companies including loads of bricks, lumber, and shingles that move by flatbed carriers to large appliances and furniture that move by dry van carriers.

Furniture shippers told me until home construction picks up and home sales recover, furniture imports will remain depressed. Given the Federal Reserve has not shown signs of easing back on interest rate hikes, I’m not hopeful right now.

CHASSIS DISPUTE: An e-mail going around in Kansas City questioned why BNSF Railway is still policing chassis exiting its terminal given the decision in the ATA-OCEMA chassis case. Remember, a law judge issued a summary judgment saying ocean carriers were violating the US Shipping Act when mandating what chassis BCOs and truckers use on merchant haulage.

OCEMA has since appealed the ruling and the Federal Maritime Commission will stay the initial decision pending a review of the full case.

Bottom line: We’ve got a few more rounds in this duel.

STG HIRING: STG Logistics hired industry veteran Brian Nemeth as its new chief growth and strategy officer. In this role, Nemeth will be responsible for driving growth, revenue and competitive advantage. As you may remember, STG Logistics bought XPO’s intermodal division last year, including more than 10,000 domestic containers, which STG has added to since. Nemeth comes to STG from AlixPartners where he served for 12 years.

Any opinions in this blog represent the author’s views, not the Journal of Commerce or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to people with a JOC Gold-Tier subscription.

Not a Journal of Commerce subscriber? Click here to become one.

Great column. Keep up the fantastic work!