Welcome Please Haul My Freight: Edition 24. Here are items in my notebook this week:

BNSF CONGESTION: Congestion is a major problem at BNSF Logistics Park Chicago. We profiled LPC in a recent story with BNSF’s Brandon Unterbrink and Scott Hernandez. I recommend the story, and a post on LinkedIn from John Roetter.

Truckers spent 80 minutes on average in LPC last month, according to the Illinois Trucking Association, compared with 53 minutes in May 2021, and 30 minutes in May 2020. Remember the data includes domestic moves in LPC such as J.B. Hunt loads.

BNSF’s Scott Hernandez:

“Part of the reason we're seeing an increase in trucker dwell is because of we want to keep the West Coast fluid. The best way to do that is to get more boxes off the railcar, and the only place we can go when there aren't chassis is into a stack. But as soon as we go into a stack, those moves take longer from the trucker perspective.

We know there are challenges on Mondays and Tuesdays because the pickup volume on the weekends is extremely low. So all that builds, builds and builds, we actually get to the point on Monday where we can't unload any more volume because that location is completely full. So our production rates, let's say Tuesday through Saturday are higher, then we actually fall down on Sunday, Monday because there's nowhere else to put boxes in the terminal until people come and start pulling stuff out.

But the result of us trying to keep the West Coast fluid is that we’ve got to dig more, especially on Monday, causing an increase in the trucker dwell. And so that's a really tough balance for us: the trucker impact and the West Coast needing to get stuff off the dock to stay fluid.”

Unterbrink explained the decision to cherry pick, as opposed to Union Pacific’s “no cherry picking”. It’s probably unfair for importers, NVOCCs, or truckers to expect cherry picking in less than an hour right now:

“For me, it's as simple as that is a customer's freight in that box that they have a demand and need for and for us to allow them being able to run their business. We just feel like that's the better play.”

BNSF is also struggling with truck turn times in Memphis and Kansas City.

UP WARNING: Union Pacific reminded customers about its “no cherry picking” policy with a warning on May 25 that it was stacking ocean containers. It was a warning shot as UP ramps have gotten worse in the last two weeks.

From one Memphis trucking source:

“The Memphis market is in turmoil. Severe chassis shortage at all ramps. UP now asking for chassis to mount loads (normally a mounted facility) having drivers dwell 2-4hrs. BNSF continues to have long, 2-4hr dwell. CSX & NS 1.5-2.5 hr dwell. Cargo is stacking up within ramps. RR are digging to retrieve boxes creating additional dwell.”

From a second Memphis source:

“The UP congestion is now is in full swing in Memphis. The yard is not allowing any trucker to remount the wheels they are bringing in if under a load or empty. So for example, a trucker is bringing in an empty, after dropping his empty, the driver must bobtail back across the river to find a bare chassis, then back across the river to the UP to pickup their next load. No bare chassis are available in UP Marion.”

PEAK SEASON: Don’t expect a let up in the pressure on the international supply chain this peak season, as The Journal of Commerce executive editor Peter Tirschwell wrote. So how does that square with what Kurt McElroy of Kerry Apex told Peter?

“We’re hearing significant amount of BCOs [beneficial cargo owners] cutting back orders, and certainly with highly publicized shortcomings with major retailers... it sends a chill into the retail forecasts for volume expectations.”

Here is what one shipper told me:

“Last year when demand was super strong, there were depleted inventories. And so not only were buyers buying for demand, they were buying to try to both meet demand and replenish the inventory. So you double overbought, right? You didn't say I'm comfortable running with the leaner inventory, you said, I gotta get my inventory position back strong. For 24 months, you haven't been able to replenish those inventories, because of how strong demand has been…

It doesn't take long for demand to soften for those inventories to rebuild, and then some, but you're buying six months out, right, you're buying this stuff pretty far in the future. So what we're seeing is the catch up coupled with the slowing down the out-the-door rate, and creating unproductive inventory.”

I asked him to further explain the unproductive inventory:

“More people are tied up with the wrong inventory in their yards, their buildings are full. No one wants to pay rail detention or box detention. But no one's got the space for it…

Let’s say my mix is 65% current freight and 35% future freight. My network design is 65% current, but very rapidly the future freight starts building in my yard. So very rapidly my yard is converting from 65%-35% to 50%-50%, and then 90%-10% future freight. And so I’m going from hand to mouth on all the inventory to being unable to touch the mountain of stuff I have on the backside of the yard.”

Macy’s CEO talked more about this in a Wall Street Journal article. Very good story.

HIGHER FEES: Norfolk Southern Railway is raising fees.

NS charges a flip fee in its wheeled terminals when it runs out of pool chassis and puts containers into stacks. A flip fee is charged when NS lifts a box out of the stack and places it on a private chassis. BNSF does not charge a flip fee in these situations. UP doesn’t allow flip (“cherry picking”) when containers are put into stacks.

SCHNEIDER: Union Pacific and Schneider recently gave joint presentations for intermodal shippers about the benefits of their new partnership. More in our story, but what caught my attention was the number of new steel wheel interchanges:

But Mike Sperry, a drayage provider in northern California, is not convinced UP can keep up with the flood of containers and increased lifts in California:

“UP Lathrop is over congested and routing loads into UP Oakland. Not sure how UP convinced [Schneider] that they could handle this increase.”

UP’s domestic intermodal service has sputtered in NorCal and Seattle-Tacoma in recent weeks. Many shippers, IMCs, and truckers are suspicious that UP can handle Hub Group, Schneider, STG Logistics, Swift, and non-asset IMCs simultaneously.

JOC SHIPPER TL RATES: Our broker-to-shipper van truckload rates have officially gone negative year-over-year in the JOC Shipper Truckload Spot Rate Index and the JOC Intermodal Savings Index, according to preliminary May data.

The spot market penalty also flipped negative, indicating that door-to-door van rates are cheaper on spot markets than under contract. That makes sense as owner operators do not have the leverage to pass huge diesel costs onto C.H. Robinson, Coyote, TQL, and other truckload brokers. Motor carriers, however, like Knight-Swift, J.B. Hunt, and Werner have fuel surcharges resetting every week under their contracts.

TRUCKLOAD CONTRACTS: While some shippers have negotiated reductions in linehaul rates, others have not seen the spot market impact its contract rates:

Here is what one shipper told me:

“We've gone back with targeted specific lanes to do reductions and we've been successful in negotiating that. But what I will tell you is that any benefit that I'm seeing in rate negotiations is offset by fuel…I put together a complete fuel surcharge slide that shows the number of miles we traveled, and what we had in the budget. The budget was 39 cents per mile because that's what it was back in October of last year, and now it's 70 cents a mile.”

Another shipper told me its contract rates were up about 3% to 5% YoY, excluding fuel. He said that it’s very difficult for any shipper to negotiate rate reductions because the competition to find drivers is still intense, and equipment costs continue to soar as the price of raw materials to build trucks and trailers remain elevated.

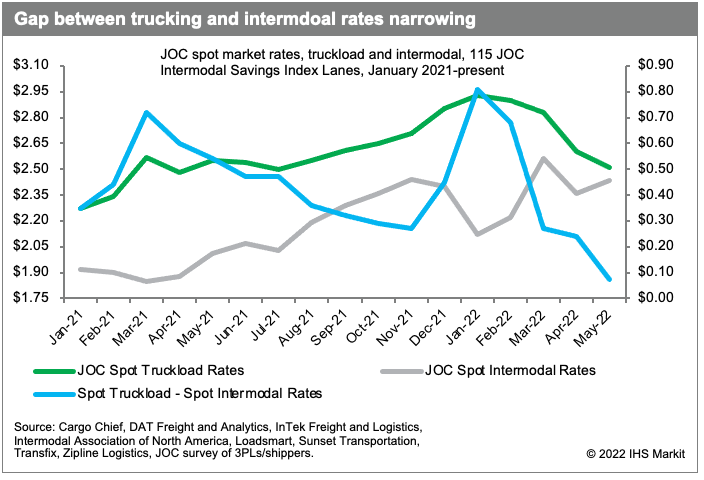

INTERMODAL SAVINGS: While a majority of domestic intermodal loads are moved under contract, there is spot market freight going on trucks today because there aren’t enough savings on rail. The JOC Intermodal Savings Index (ISI) preliminary data for May shows the gap fell to 7 cents per mile. Our JOC Spot ISI for May is likely to be below 110, or less than 10 percent savings nationally.

While high fuel prices are a net positive for contract intermodal, it’s a net negative for spot intermodal. Owner operators don’t have the leverage today to pass through fuel costs to brokers, but railroads are assessing fuel surcharges of 52% to 55%.

OCEAN RATES: More shippers are able to find spot capacity on vessels and secure rates that are cheaper than under contract. Here is what one shipper told me:

“Booking space has become a lot easier these days, we're getting all the space that we need. Matter of fact, as the spot market came down, we've been able to even book on cheaper rates than on our contractual rates. It's kind of seems like it's the calm before the storm. But I don't know, we'll see.”

SAVANNAH: The vessels are anchoring again outside Savannah for the first time since last fall. Griff Lynch, CEO of the Georgia Ports Authority, said a number of triple calls and extra loaders came simultaneously to the port closing Berth 2 for one week. A triple call — believe it or not — is when three vessels on the same service call within the same week, as opposed to spread out over three weeks.

“The difference I would say between what happened seven or eight months ago and today is that we have more yard space in the yard. We are not metering vessels. And I wouldn't say we have an infinite amount of space, but we're not at a point where we're our backs are against the wall.”

We will monitor the situation in Savannah.

WHAT A WONDERFUL PHRASE: A new Sea Lead service made its Charleston debut last month with the arrival of the Hakuna Matata at the Hugh K. Leatherman Terminal, as The Journal of Commerce associate editor Teri Errico Griffis reported. While Hapag Lloyd is the only major international ocean carrier calling Leatherman, smaller carriers and a few charters are also using Leatherman.

IT’S THE SIZE THAT COUNTS: The MSC Cape Sounio called Port Everglades on June 2 and became the largest containership to visit the port at 11,037 TEU.

USDOT GRANTS: The Port of Baltimore has received a $15.6 million federal grant for new on-dock railroad tracks and lifting equipment, which will help when the Howard Street Tunnel and other CSX double stacking work is completed in 2025.

Another $6.2 million will go toward upgrading tracks connecting Savannah to the Cordele Inland Port, operated by shortline railroad Cordele Intermodal Services.

XPO SPINOFF: XPO filed a Form 10 registration statement with the US Securities and Exchange Commission last week for the spinoff of its brokered transportation platform. The company expects the spinoff to complete in the fourth quarter of 2022.

JOC INLAND: If you enjoy Please Haul My Freight, register to attend the JOC Inland Distribution Conference at The Westin Chicago River North in September. Most of the content above will be on our agenda in Chicago. Hope to see you there.

Any opinions in this blog represent the author’s views, not the Journal of Commerce, IHS Markit, or S&P Global. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion or a subject you’d like me to cover? Email me ari.ashe@spglobal.com to send your thoughts.

You may also request the data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paying JOC subscribers. Not a subscriber? Click here to become one.