Welcome to Edition 12 of the Please Haul My Freight newsletter. Here are some of the items in my notebook this week:

J.B. HUNT TALKS: Box turns are still a problem in J.B. Hunt’s intermodal division, the company said on its Jan. 18 earnings call. Darren Field, president of J.B. Hunt Intermodal, also commented on intermodal contract rates in the 2022 bid season:

“It's not likely that double-digit rate increases present themselves without significant cost pressure. I would consider it highly unusual for our rates to climb in the double digit range without corresponding cost challenges coming at the market.”

Compare that with CFO John Kuhlow on the same subject on Jan. 19, 2021:

“There are certainly key markets where it's substantially higher or it's absolutely in the double-digit area…High single to low double-digits remains a pretty good placeholder. But certainly, there are pockets of our network where I think it will be higher than that.”

Union Pacific won APL Logistics and Swift Intermodal business, which may increase UP’s domestic intermodal volume 4%-5%+ YoY in 2022. That may provide an opportunity to J.B. Hunt to fill the 6,000 new containers arriving in 2022. Field admitted as much:

“Certainly that presents an opportunity. Those lifts occurring on BNSF were aligned with BNSF…We have discussions with BNSF daily about our efforts to grow together, and we have a lot of focus in that area in ‘22.”

SCHNEIDER-UP: The Schneider decision to leave BNSF for UP in 2023 generates a few questions:

Is this an indictment of BNSF’s decision not to fully embrace precision scheduled railroading? Or is it as Schneider wrote in its 10-K an issue of the preferential contract between J.B. Hunt and Schneider?

What does BNSF do now? APL, Schneider, and Swift own a combined 40,000 containers, according to Jason Hilsenbeck of Loadmatch.com. Guess who owns 45,000 to 50,000 containers — Hub Group. We don’t know when Hub’s contract expires with UP. Plus BNSF and Hub went through a messy divorce more than a decade ago — “burned bridges” and “a major grudge“ are the terms I often hear.

Another option: BNSF grows with J.B. Hunt to replace about 650,000 loads from APL, Schneider, and Swift combined per year. If we assume J.B. Hunt maintains the 1.65 monthly box turn ratio in Q4 going forward, then it would take 32,828 containers to replace the lost BNSF business. Remember J.B. Hunt already ordered 12,000 containers, so it would need to purchase another 21,000. If we assume J.B. Hunt returns to the 1.88 box turn ratio of 2019, then it would take 28,812 containers and J.B. Hunt would need to purchase another 17,000. J.B. Hunt could easily order 17,000 to 21,000 container in 2022 and 2023. Did I lose you? If so, feel free to email me! Happy to explain my math.

What opportunities will this provide J.B. Hunt to snatch share from non-asset IMCs? Non-asset IMCs can provide a BNSF Railway option through COFC Logistics or Matson Logistics, but neither can replace the UMAX/EMP fleet.

UP-IMCS: Non-asset IMCs question UP’s commitment to them after winning APL, Schneider, and Swift business. Will UP favor IMCs which supply their own containers? Here is what Kenny Rocker, executive vice president of sales and marketing, said on UP’s earnings call Jan. 20:

“We're bringing on Knight-Swift this year, they're a strong industry leader. And then in the future, we'll bring on Schneider, we look at that as a great value to the BCOs. We believe that's going to give them a lot of optionality to grow. It's going to also give [UP] an opportunity to densify a lot of networks...

As we look at our own equipment, we're doubling down on investing there. So we invested in almost 6,000 chassis, we're bringing on GPS [technology]. So we feel like we got a great mixture to offer the both private asset players that are on our network, and also the ones that will be utilizing our equipment.”

Rocker’s point is that UP wouldn’t spend $80 to $100 million to buy 5,600 chassis, nor spend millions to equip UMAX and EMP containers with GPS for tracking and tracing if they were not fully committed to non-asset IMCs.

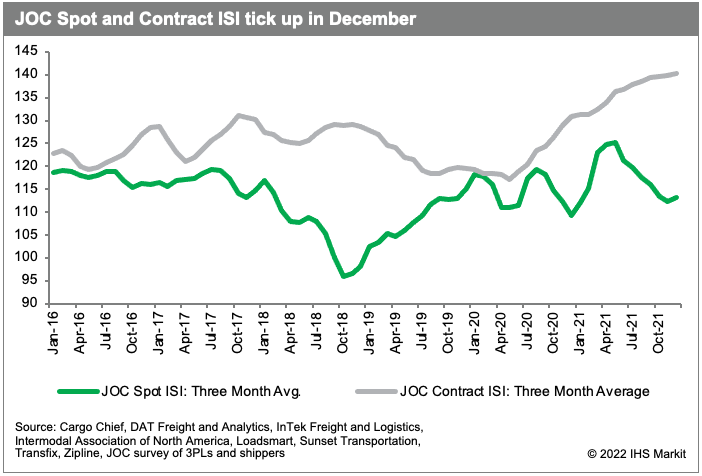

INTERMODAL SAVINGS INDEX: The JOC Intermodal Savings Index has been finalized for December 2021. This index tracks what an average shipper should save nationally using domestic intermodal compared with truckload, on a spot and contract basis. The base is 100, which signifies rates are identical.

The JOC Spot ISI rose 5 points to 116.2 (16.2% intermodal savings) after J.B. Hunt canceled their peak season surcharges in mid-December. The JOC Contract ISI rose another point to 141.1 (41.1% intermodal savings), a new record.

The JOC Intermodal Savings Index Q4 research report is due out in about two weeks, and the underlying data for our index is available to paying JOC subscribers upon request.

COWEN RAIL SURVEY: Jason Seidl of Cowen & Co., one of the top transportation Wall Street analysts, released his quarterly rail shipper survey. There are a couple items that caught my attention:

Of intermodal shippers, 48% said they do not plan to shift highway freight to intermodal rail while only 25% said they will do so. Seidl wrote:

“Despite rates in the trucking market at significantly higher levels y/y, it appears that a majority of shippers have not changed their school of thought surrounding modal shifts over the past quarter, which may be attributed to the congestion and declining on-time performance amongst the rails.”

Another chart I always watch is the intermodal rail savings:

CONTAINER THEFTS: As KCAL reported last week, Union Pacific has suffered a rash of thefts on intermodal trains near the UPS facility in Lincoln Heights. As far as I can tell, this is only impacting trains out of the LATC Intermodal Terminal, which is domestic intermodal. Criminals have pilfered FedEx, Hub Group, and UPS containers.

UP CEO Lance Fritz talked about it on an earnings call Jan. 20:

“Two years ago, members in a neighborhood would see a train not moving and might take advantage of trying to pop open a box and see what's inside. Today that's more organized. And we have our arms around it. We've increased our own police presence, [and] we're working with the LAPD in that area…and we're going to be enhancing security in the area. We're going to put physical security barriers in place. It's unfortunate, because they won't be they won't be necessarily pretty, but it will protect our property and more importantly, it'll protect our employees.”

This has also been a problem on BNSF Railway. One BNSF customer told me:

“We actually had 1-2 thefts a week on the BN in L.A., but we haven’t seen any over the last probably 3 weeks. Before that it was pretty consistent going back to April. Many times just breaking into the container and not stealing anything.”

BNSF has not written a letter like the UP sent to the Los Angeles District Attorney, according to Lena Kent, general director of public affairs, but BNSF has robust security protocols:

“It is important to note that we are doing our part to protect our customers’ freight from this organized crime network; however, it is essential that policymakers, district attorneys and judges ensure these criminals are held responsible and prosecuted. These are not victimless crimes, particularly when many of these packages include much-needed supplies.”

DUM SPIRO SPERO: Retailer Walmart began bringing in merchandise earlier this month into its massive 3 million square-foot distribution center in Ridgeville, South Carolina. Construction only took 18 months and the official grand opening is this spring.

PORT HUENEME-FEDEX: FedEx has chartered three vessels with 53-foot containers from Port Humen, China to Port Hueneme, California. The Genco Shipping vessels hold 300 containers per sailing. The Geico Pyrenees left Jan. 4 and is due to arrive in late January, according to Steve Ferreira of Ocean Audit. The second vessel leaves in February, and the third in March. FedEx took possession of roughly between 1,700 and 2,100 containers in 2021, according to PIERS, a sister product of the Journal of Commerce within IHS Markit.

IPI STRUGGLES: International intermodal, also known as IPI, continues to be down significantly. IPI volume plunged 19% year over year in December, and declined 16.2% in the fourth quarter, according to the Intermodal Association of North America. All intermodal volume fell 9.8% year over year in Q4.

Much, if not all, of this decline is West Coast IPI as ocean carriers refuse, cap, or price IPI so high that transloading to truck is cheaper.

Here is what one NVO told me:

“[An ocean carrier] cut it completely and said ‘you’ve got two TEU per week to Dallas,’ whereas we used to be able to book as many as we wanted. That began in August, September, and October. In the early part of December, the carrier said ‘we can open it up a little bit more, we can start to take a little bit more IPI,’ but the price differential hasn't changed, so there's been no incentive to do it.”

EXPORT HEADACHES: Norfolk Southern Railway is reducing international intermodal service from Cincinnati to the West Coast effective Feb. 13. It’s not just railroads, according to this LinkedIn post from Stephen Zambo with Ally Global Logistics, an NVO specializing in export business:

“Here is a great graphic to give you an idea of what we are seeing on a daily basis in regards to trucking lead times. Requesting a booking and subsequently trucking to move within a week is not going to happening in the majority of instances.”

SO MUCH CONGESTION: I read a report from 3PL Central, and while most of it is a pitch for why 3PLs are necessary and good, there was one part that caught my attention as numbers and statistics person:

AUTOMATED WAREHOUSES: Jennifer Smith of the Wall Street Journal had a good article on remote forklifts in warehouses.

ArcBest Corp. and logistics provider NFI Industries Inc. led a $42 million investment to back startup Phantom Auto Inc.’s remote vehicle operation software and plan to deploy thousands of remote-enabled forklifts over the next several years…

The goal isn’t to replace workers, NFI Chief Executive Sid Brown said, but to add capacity by having people work remotely, which he said would also help recruitment, including among people who like to play video games.

“We have thousands and thousands of forklift operators,” he said. “If we can solve 30% to 50% of our warehouse job functions by utilizing the remote forklifts, I think that’s a real win for us. And if I can position people in different time zones—maybe Asia or South America or Europe—you can get people to work that may do a second or third shift” that is harder to fill.

TRAC CHASSIS: TRAC Intermodal outlined its plan to address the chassis shortage in 2022. Both TRAC and DCLI will spend hundreds of millions of dollars to add new marine chassis to the fleet. Given the current prices, every $100 million spent on new chassis equals about 5,500-6,700 units, give or take a few hundred.

INFLATION: Just how much have prices gone up in 2021? Look at some of these inflation figures:

“The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in December on a seasonally adjusted basis... Over the last 12 months, the all-items index increased 7.0% before seasonal adjustment, the largest 12-month increase since the period ending June 1982. The all-items index, less food and energy, rose 5.5%, the largest 12-month change since the period ending February 1991.”

Any opinions in this notebook represent the author’s views, not the Journal of Commerce or IHS Markit. Any rumors in this notebook are just that: rumors. Unconfirmed. Not news stories.

Do you have an opinion on anything I wrote or a subject you’d like me to cover?

Email me ari.ashe@ihsmarkit.com to send your thoughts. You may also request our data behind JOC’s Intermodal Savings Index and JOC’s Shipper Truckload Spot Rate Index, available to paid JOC subscribers. Don’t have a JOC subscription? You can change that!